ZINGER KEY POINTS

- Israel’s military urges the evacuation of Gaza’s northern region as a ground operation is imminent.

- Global concerns rise as over 1 million Palestinians are warned to leave Gaza City, prompting UN worries.

Stay updated on Israel’s imminent ground operation in Gaza, its global repercussions, and the escalating tensions in the Middle East. Benzinga brings you the latest.

The situation in Gaza Strip is reaching a boiling point as the Israeli Defense Forces (IDF) have issued an evacuation mandate for the northern sector of the city, foreseeing an imminent ground operation aimed at striking at the core of Hamas.

The evacuation from Gaza could affect more than 1 million Palestinians, and the United Nations, in response, has sounded a dire warning, predicting catastrophic civilian displacement on an unprecedented scale.

The UN has underscored the impracticality of relocating such a massive population within Gaza, emphasizing the inevitable humanitarian fallout.

Israel’s Evacuation Order Sparks Reactions

The mounting tensions in the region have provoked leaders across the Middle East to voice their concerns. As the Times of Israel reported Friday, Jordan’s King Abdullah II has urgently reached out to U.S. Secretary of State Antony Blinken, seeking international intervention to avert the displacement of Palestinians.

Palestinian Authority President Mahmoud Abbas has categorically rejected the evacuation order. Abbas’s stance stems from his belief that this forced displacement would be akin to a “second Nakba,” a reference to the tragic exodus in Palestinian history occurred in 1948. On the ground, Hamas seems to be preventing residents of the northern strip from adhering to the evacuation orders, The Times of Israel reports.

Internationally, Russian President Vladimir Putin has castigated Israel’s impending ground offensive in Gaza, labeling the potential civilian casualties as “unacceptable.”

Adding a layer of uncertainty to the region’s volatile situation, Lebanon’s Iran-backed Hezbollah movement has declared its readiness to join forces with Hamas when the time is deemed right. Hezbollah deputy chief Naim Qassem made this declaration during a pro-Palestinian rally in Beirut’s southern suburbs, signaling a potential escalation of hostilities in the region.

Second Round Of US Ammunitions Arrive Friday

Meanwhile, Israel’s Defense Minister Yoav Gallant has announced the arrival of a second U.S. aircraft carrying munitions for the IDF, signaling unwavering U.S. support.

Speaking alongside U.S. Secretary of Defense Lloyd Austin in Tel Aviv, Gallant underscored the strength of the Israel-U.S. alliance. Austin has asserted that Hamas poses a more significant threat than ISIS in several aspects.

Financial Markets React to Geopolitical Jitters

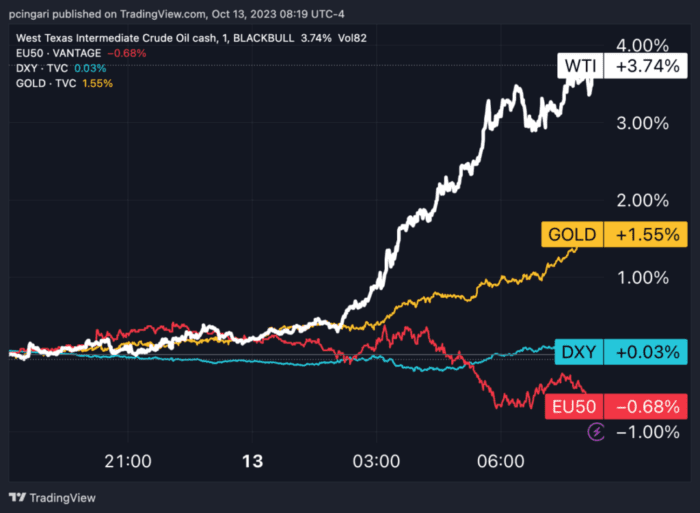

Mounting indications that Israel is preparing for a ground invasion of Gaza sent risk aversion surging across markets on Friday, as investors sought refuge in safe havens.

Treasuries experienced a rally, with yields retracting from the spike seen on Thursday. The 10-year yield, along with the 30-year yield, both dropped by 9 basis points. In Europe, long-term yields followed suit, with the German 10-year Bund also declining by 9 basis points.

Gold, as tracked by the SPDR Gold Trust, saw a notable uptick of 1.6% just ahead of the New York market opening, on track for its strongest daily gain since May.

Conversely, stock markets and U.S. equity futures faced downward pressure. The Euro STOXX 50 index recorded a 0.7% decline, while futures linked to the S&P 500 showed a 0.1% decrease.

The U.S. dollar index (DXY), as tracked by the Invesco DB USD Index Bullish Fund ETF, held steady, while the Japanese yen outperformed other currencies.

The Israeli shekel (ILS) fell 0.6% against the dollar, on track for its fifth straight session of losses.

Amid the turmoil in the Middle East, oil emerged as the primary beneficiary. The West Texas Intermediate (WTI) crude oil price surged by over 3.5%, surpassing the $85 per barrel mark.

Price Actions in Global Markets Ahead of Wall Street Opening on Friday

—

Originally Posted October 13, 2023 – Israel Orders North Gaza Evacuation, US Labels Hamas Worse Than ISIS; Oil Surges

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!