The economic data calendar in the November 18 week is a light one. The focus of the week will probably be on the housing numbers which include the NAHB/Wells Fargo housing market index at 10:00 ET on Monday, data on housing starts and building permits issued at 8:30 ET on Tuesday, and the NAR report on sales of existing homes at 10:00 ET on Thursday.

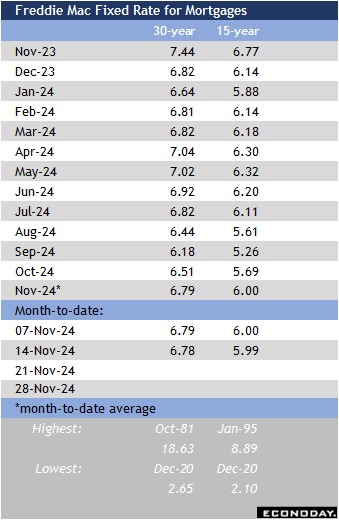

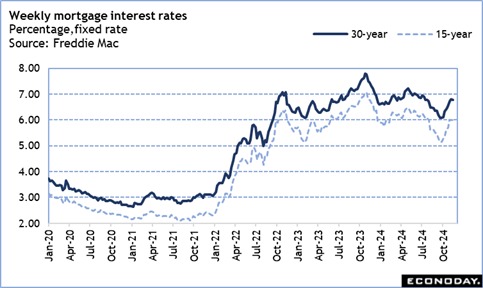

The main driver behind the data will be the direction of mortgage rates. The weekly Freddie Mac rate for a 30-year fixed rate mortgage has risen from the recent low of 6.08 percent in the September 26 week up to 6.79 percent and 6.78 percent in the November 7 and 14 weeks, respectively. A big question for the housing market is if potential homebuyers who have been hoping for another dip in rates will decide that is not in the works. There’s a hint that this is the case in the latest MBA weekly numbers on purchase applications. If so, there will be less reason to delay purchasing a home.

Nonetheless, the NAHB/Wells Fargo housing market index for November could fade from the reading of 43 in October. With more inventory of existing units, homebuyers have more selection and less sense of urgency in getting a contract signed. There’s also less prospect that the FOMC is going to pick up the pace in reducing rates, especially with concerns that inflation is going to rise again, or at least not improve further.

Permits issued for new homes in October may include some disaster recovery efforts. There were numerous properties in the Southeast that were so badly damaged they will have to be rebuilt from the ground up after being demolished. It is probably too soon to see actual housing starts if homeowners are waiting for insurance claims to settle, but some may be moving ahead.

The NAR sales of existing homes in October probably got a boost from contracts signed in September when a brief drop in mortgage rates encouraged buyers to take advantage of greater affordability. However, rates have gone up again since then and cool the housing market once again.

—

Originally Posted November 15, 2024 – High points for economic data scheduled for November 18 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!