ZINGER KEY POINTS

- French stock market faces worst weekly performance since February 2022 due to snap election uncertainties.

- Major banking stocks plummet: BNP Paribas down 13% for the week, Societe Generale down 16%.

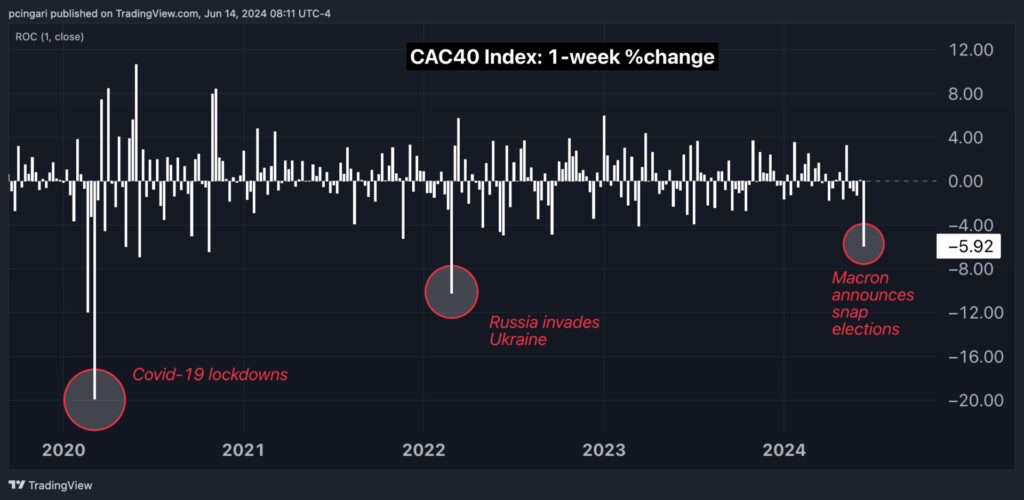

The French stock market is on track to register its worst weekly performance since late February 2022.

Following the announcement of snap elections last Sunday, the Paris CAC 40 index fell by 2.4% at 8:10 a.m. ET, heading into the final hours of the European session.

On a weekly basis, the decline extends to 6%, marking the worst performance since late February 2022, when Russia’s invasion of Ukraine triggered a drop of over 10% for the CAC 40.

Chart: France Equities Tumble The Most Since Russian Invasion Of Ukraine

Risks Of Broader Contagion

The main declines this week are among banking stocks, hit by the wave of sell-offs due to political uncertainties. France’s largest financial institution, BNP Paribas, fell over 13%, while Societe Generale is down by over 16% this week.

An exchange-traded fund tracking broader European financial institutions is down by 7% for the week, indicating that France’s political risks are spreading throughout the region.

The euro fell by 0.5% on Friday and by over 1% for the week, eyeing its worst weekly performance in over two months.

“The risk premium in European assets could build further,” Chris Turner, global head of markets at ING analyst, wrote on a note Friday.

Why Are French And European Assets Tumbling This Much?

The decisive victory of Marine Le Pen’s far-right National Rally party in last Sunday’s European Parliament elections led President Emmanuel Macron to dissolve the French National Assembly and call for new parliamentary elections. France will vote in the first round in two weeks, followed by a runoff on July 7.

With a budget deficit already particularly high at around 6%, investors fear the risk of French fiscal accounts deteriorating further if Le Pen’s party secures a majority in the national parliament.

According to ING, “Frexit” is no longer seen as a risk, but markets are jittery ahead of the snap parliamentary election.

In addition to far-right-wing fears, French left-wing parties are forming a coalition to run a single candidate per district, which could further erode support for President Macron’s party.

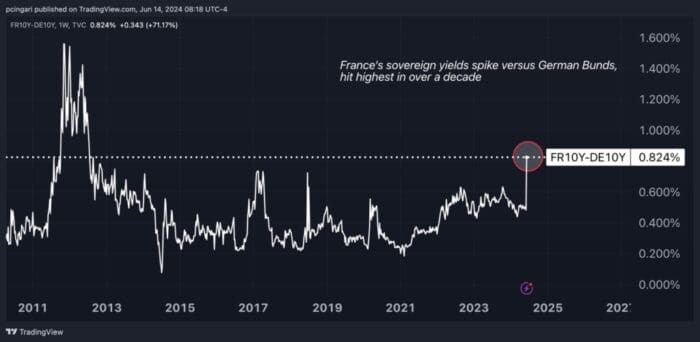

The yields on French 10-year government bonds have been trending upward, and the spread with the German Bund has shot up to 83 basis points, the highest level since July 2012.

—

Originally Posted June 14, 2024 – French Stocks Set For Worst Week Since Russia’s War In Ukraine, Yields Versus Bund Hit 12-Year Highs On Snap Election Jitters

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!