Energy sector fundamentals point to an attractive IBKR ForecastTrader combination opportunity regarding US oil production. In my view, the “No” answer to the Contract asking, “Will US Oil Production exceed 13,800 thousand barrels per day for January 2025” and the “Yes” answer to the Contract asking the same question but with a 13,000 thousand threshold are likely to be correct. The first contract with the “No” answer is priced at $0.81 and the second contract with the “Yes” answer is priced at $0.83, representing a total cost of $1.64. If oil production follows its 11-month range, both would be correct, delivering $2 to the investor for the Forecast Contract combination.

Source: ForecastEx

Note: Prices are highest bids as of the morning of March 27, 2025.

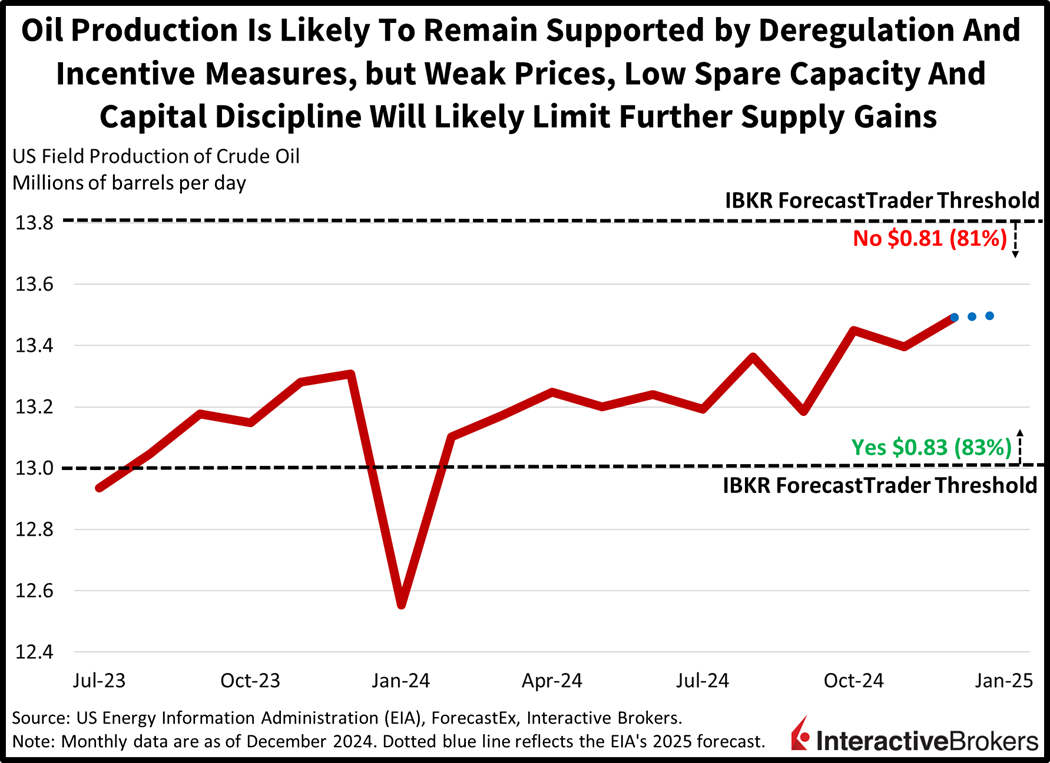

Let me explain why I think both will be accurate: As shown below, domestic oil production, which is at record high levels, has exceeded 13 million barrels per day (13,000 thousand BPD) in all but two of the past 18 months but it has yet to exceed December’s peak of 13.49 million. Against that backdrop, President Trump is seeking to boost activities by rolling back regulations and opening additional land for oil drilling, a strategy that will likely bolster output incrementally over the long haul. Conversely, with WTI crude at just $69 per barrel, motivating many expansionary projects in the short term is a tall bar, as increased supply may lower prices and compress margins while large producers have shifted to an approach of returning cash flows to shareholders via stock buybacks and dividends rather than reinvesting profits towards capital expenditures. Meanwhile, sector executives may believe that regulatory relief is only temporary as future administrations could re-impose restrictions. The industry also faces a considerable labor shortage and limited spare capacity, considering that volumes are at a record. With those points in mind, it’s probable that oil production will increase, but in my view, it’s unreasonable to expect the January average to exceed 13.8 million BPD. Furthermore, the Energy Information Administration estimates production will average 13.5 million BPD this year. In conclusion, I like the two contracts mentioned above which I believe feature an attractive risk/return opportunity and settle this Monday, March 31.

To learn more about ForecastEx, view our Traders’ Academy video here

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

There is no reason to increase supply. To lower prices, it would make more sense to cut taxes on gasoline. I’d rather not worsen deficits nor encourage more fuel consumption.

Well, at this point oil is not concern. Trump’s policies are sinking the economy and international diplomacy to a point of no return. Where are all those people that said Trump was “pro-business”? Now we cannot find anyone. The US went from TINA to a sort of toxic, nazi, imperialist state that will have deep and long term negative consequences. I am shorting everything, especially Tesla. You still have time.