By Ryan Redfern, CMT, ChFC

1/ Check in on Seasonality

2/ Do the Market Sectors Agree?

3/ RRG – Watching the “Ducks”

4/ NAAIM Exposure Index

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Check in on Seasonality

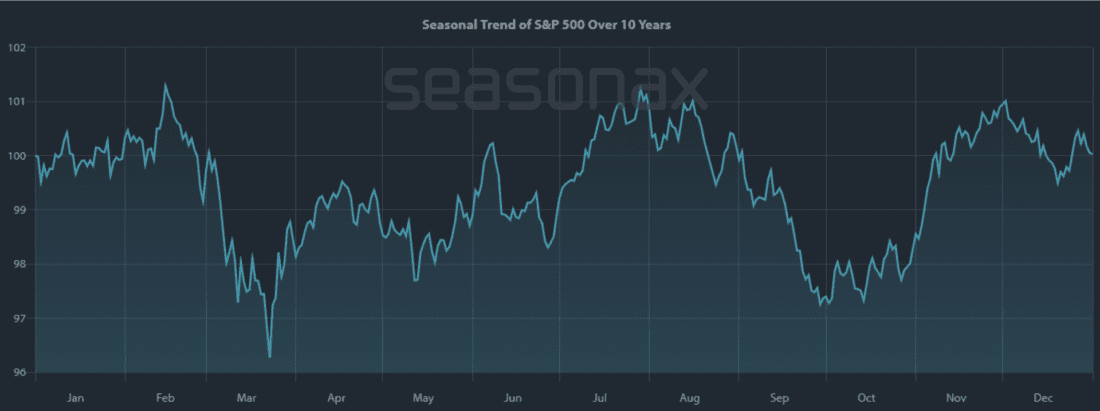

While history doesn’t always repeat itself, it does sometimes rhyme, as the saying goes. So it can be instructive to take a look at what the S&P500 usually does in the week (or weeks) ahead. For the week of Oct 14th to 18th, according to Seasonax, the Index has been positive 80% of the time. Those aren’t bad odds. Usually, that bounce happens after a sell-off during the previous week. I’ll take that as a favorable seasonal tailwind.

Seasonality looks at the average movement of an index, stock, etc. on a given day over the last X number of periods. For this example, I’m looking at the last 10 years of the S&P500 Index.

I’ve found when seasonality and trend agree, good things tend to happen.

Courtesy of Seasonax

2/

Do the Market Sectors Agree?

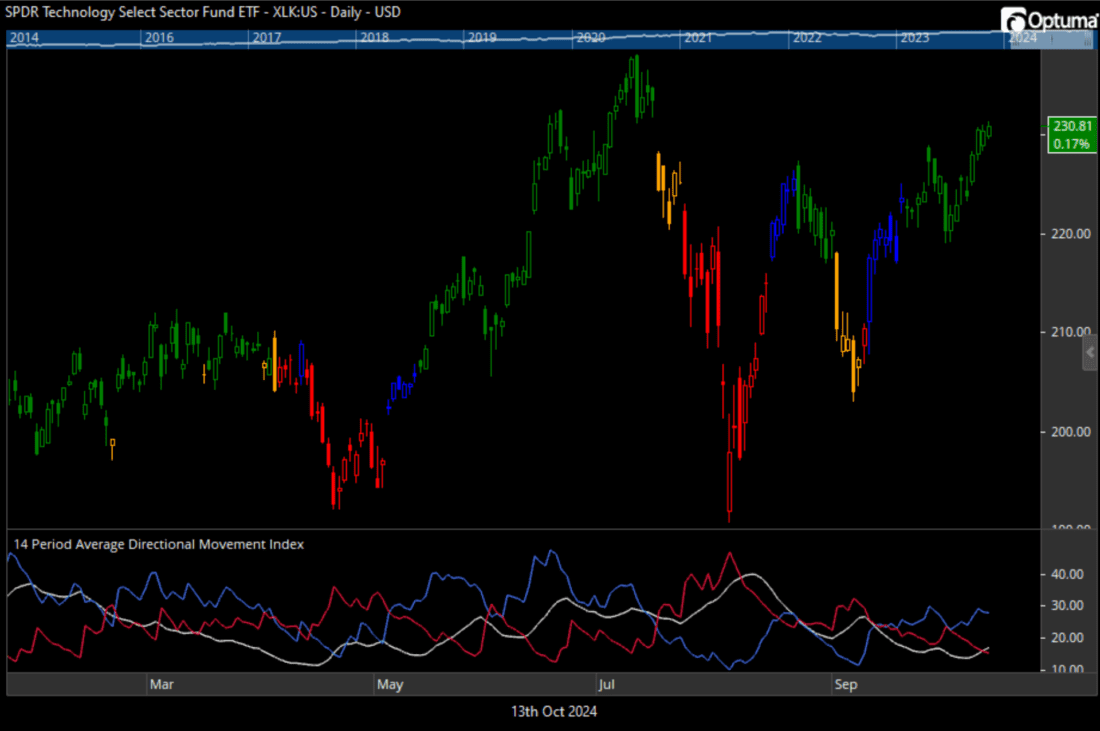

Now let’s look at the current trend of the market. What are the eleven S&P500 sectors telling us right now? For this information, I’m simply looking at the Average Directional Movement Index (ADX or sometimes DMI depending on the charting platform) using the standard 14 period settings. I like to think of this as looking at who is in control of each part of the market – is it the buyers or the sellers?

On the positive/buyers side, we have 7: (XLB, XLC, XLE, XLF, XLI, XLK, XLY). These are largely made up of the sectors you would think of as market leaders – Technology, Communication Services, and Consumer Discretionary.

On the negative/sellers side, we have 4: (XLP, XLRE, XLU, XLV). These are largely made up of the traditional defensive sectors – Consumer Staples, Healthcare, and Utilities.

So far, it appears the buyers are in control in the current environment (7 to 4) with the expected market leaders showing more strength than the defensive names.

For the chart, we’re looking one of the leaders: XLK – Technology Sector. The Average Directional Movement Index looks good, and as a bonus, the white ADX line is rising. And looking at the other 6 sectors on the positive side (not shown), I’m seeing similar situations.

I’m liking this set-up so far.

Courtesy of Optuma

3/

RRG – Watching the “Ducks”

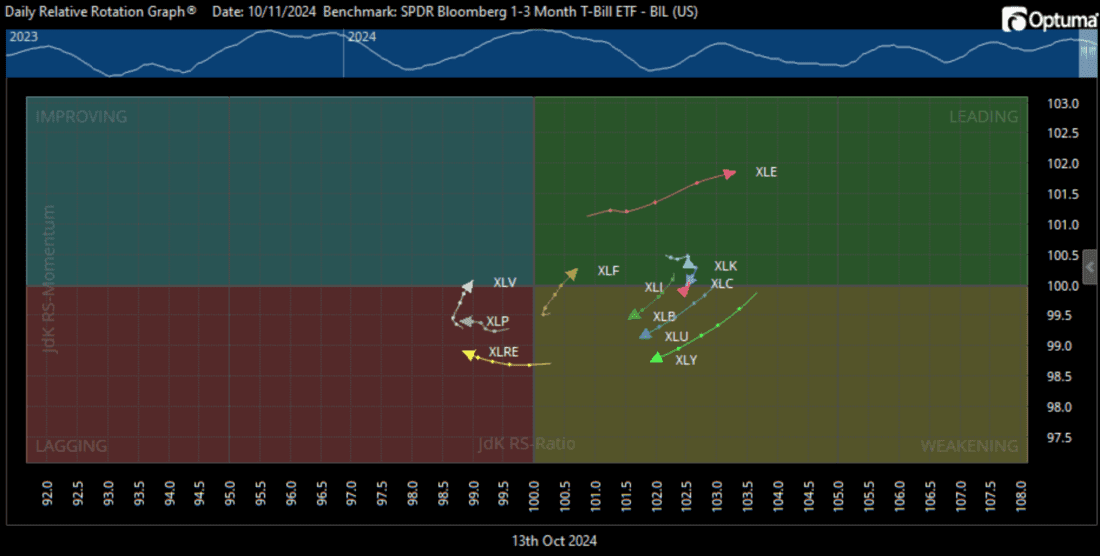

RRG – Watching the ducks going around the pond

Now that we know which sectors are showing strength and which are showing weakness, I want to get some context as to where each sector might be heading next. RRG (Relative Rotation Graphs) created by Julius de Kempenaer is a way to look at both Relative Strength and Momentum of multiple issues (stocks, ETFs, etc.) at the same time relative to a benchmark.

As the market sectors ebb and flow with strength and weakness, they tend to circle the “pond” in a clockwise rotation around the graph. So over time, you start to be able to determine where each sector “duck” might swim to next.

For now I’m looking at the eleven S&P500 sectors compared to the Treasury Bill ETF (BIL), sometimes referred to as the “risk free rate.” I want to see what is currently stronger (or weaker) than just holding T-Bills.

Here, the stronger sectors are XLV (Healthcare), XLF (Financials), and XLC (Communication). You can see them all turning up and to the right (some refer to it as Northeast). And XLE (Energy) is just running off all by itself.

On the weaker side, we have XLB (Materials), XLU (Utilities), and XLY (Consumer Discretionary). You can see them all heading down and to the left (Southwest).

I try to post this chart every Friday on https://x.com/RyanRedfernCMT if you want to keep following the “ducks” and see what they are up to.

Courtesy of Optuma

4/

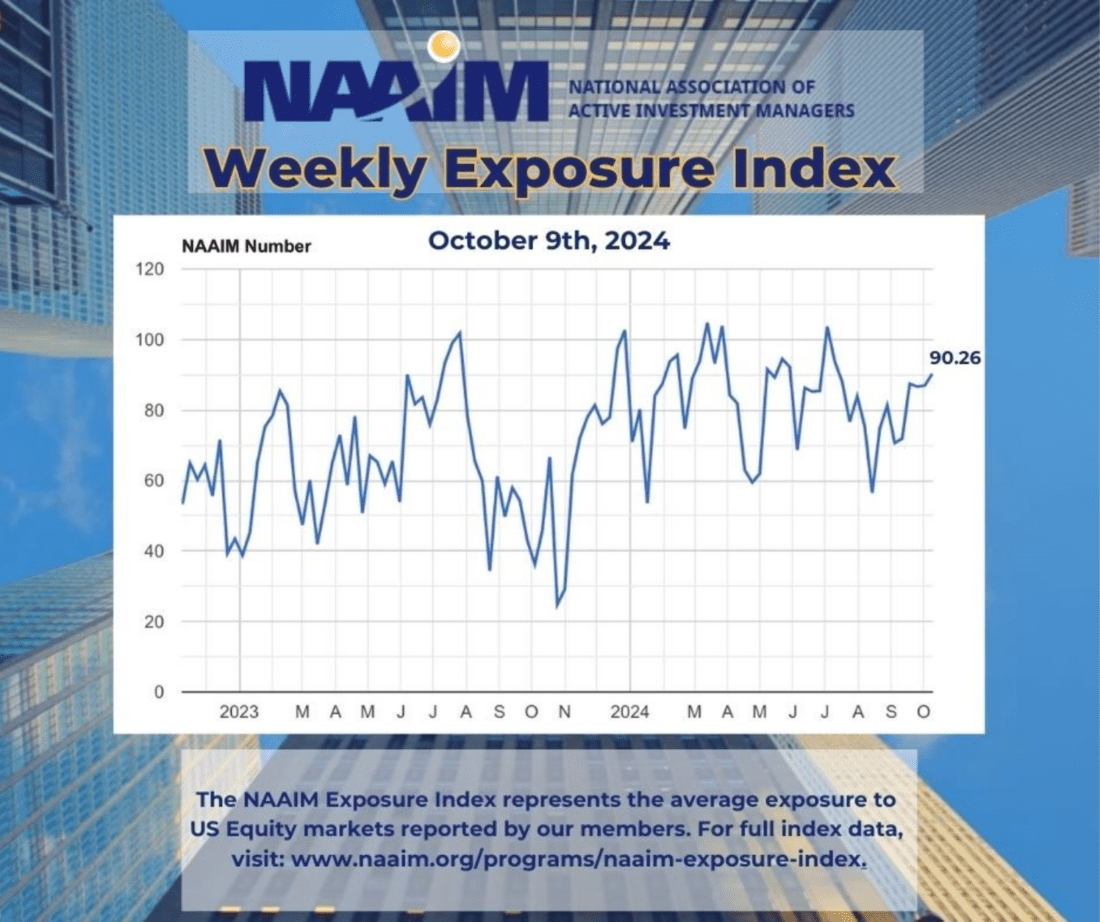

NAAIM Exposure Index

I’ve been a long-time contributor to the NAAIM Exposure Index and find it useful to compare my view of the market to other professionals. It indicates to me how much relative conviction I have and how much money is allocated to the market at a given time. It can also be useful as a contrarian indicator in some instances. Rob Hanna at Quantifiable Edges has done some excellent work on this contrarian angle. I’ve used the Exposure Index that way as well, all while being a contributor.

The number I report is based on a cumulation of Seasonality, Directional Momentum, and Relative Rotation all discussed above. But it can change quickly between the weekly reporting.

On October 8th, when we reported our allocation number to this index, we were only at 30. All while the rest of the index had been remaining high above 90. However, by the time this data came out, we had already gone to 110 – exceeding the consensus.

—

Originally posted 14th October 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!