Backtesting and Enhancing the Bloodbath Indicator

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

Backtesting and Enhancing the Bloodbath Indicator

Legendary traders Larry Williams and Ralph Vince’s 2024 Dow Award-winning paper introduced a novel investment strategy designed to circumvent market downturns. This article evaluates the “bloodbath sidestepping” 4% rule’s efficacy in the US stock market and proposes an enhancement framework. Additionally, the strategy is tested across a basket of global equity indices, demonstrating its robustness and potential for universal application.

Introduction:

In their seminal work, Larry and Ralph advocate for a strategic approach to market participation, suggesting investors remain in cash when over 4% of NYSE stocks reach 52-week lows, and re-enter the market once this metric falls below the threshold. This article examines the historical performance of this strategy using Bloomberg’s backtesting platform and proposes refinements to enhance its effectiveness.

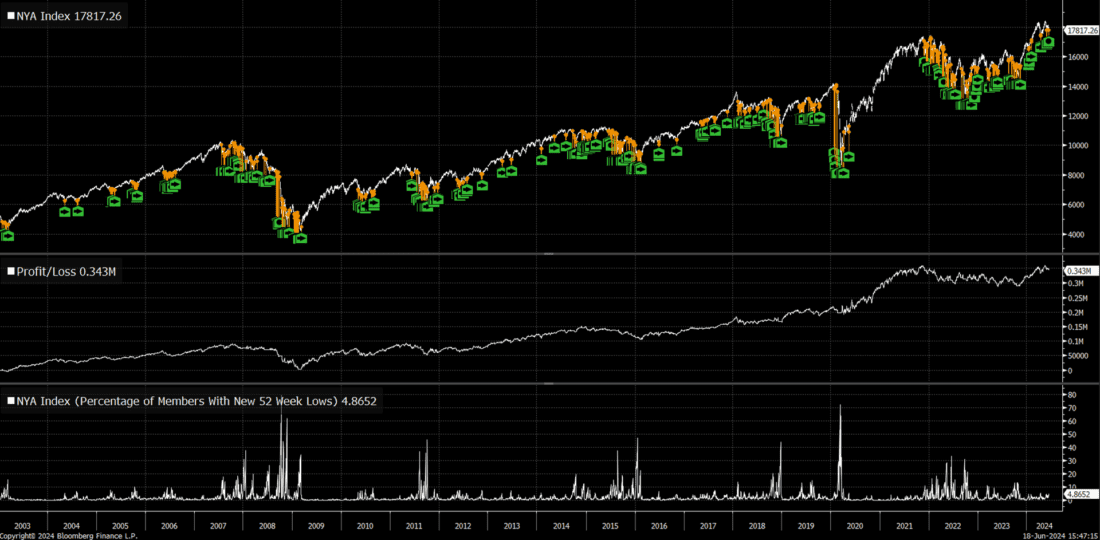

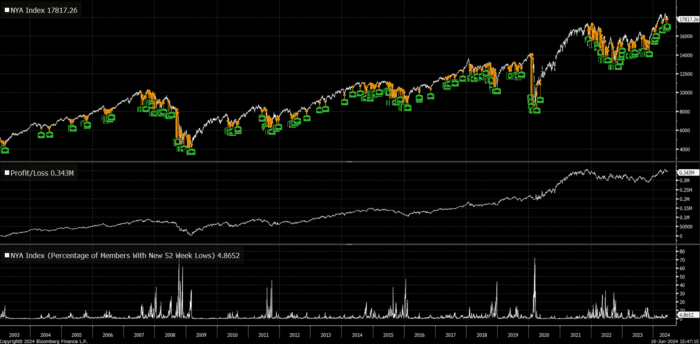

The Benchmark Strategy:

Our analysis begins by integrating the NYSE market breadth data, specifically the percentage of members hitting new 52-week lows, as a backtesting variable. The initial strategy dictates entering long positions when fewer than 4% of NYSE stocks achieve new yearly lows and closing these positions once the indicator exceeds 4%.

Backtested on the daily chart of NYSE composite index from January 1st, 2003 to June 14th, 2024, this strategy yielded a 343.1% return with a maximum drawdown of 45.5%, outperforming a simple buy-and-hold approach (246% return and 59% drawdown).

The benchmark strategy made a total of 229 trades, of which only 95 were profitable (41.5% winning ratio). The win-loss ratio is 2.4:1.

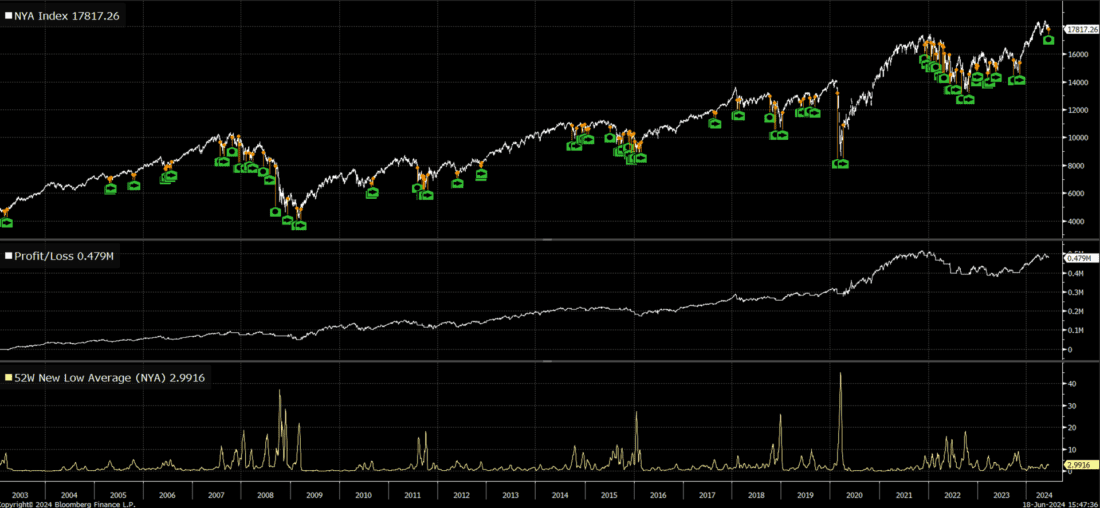

Strategy Enhancement:

Recognizing the prevalence of “numerous, short-lived, false signals”, we introduce a smoothing technique employing a simple moving average on the raw indicator, with an initial parameter of 10. The revised trading rule utilizes the moving average to refine entry and exit points, resulting in a 479% total return and a reduced maximum drawdown to 22.7%. This enhancement significantly increases the win rate to 53% and also improves the win/loss ratio to 2.7:1.

Optimization Analysis:

Further investigation into the smoothing factor’s impact reveals an optimal range for the moving average period between 9 and 11. This finding suggests a plateau in total profit within this parameter range, indicating a balance between responsiveness and stability.

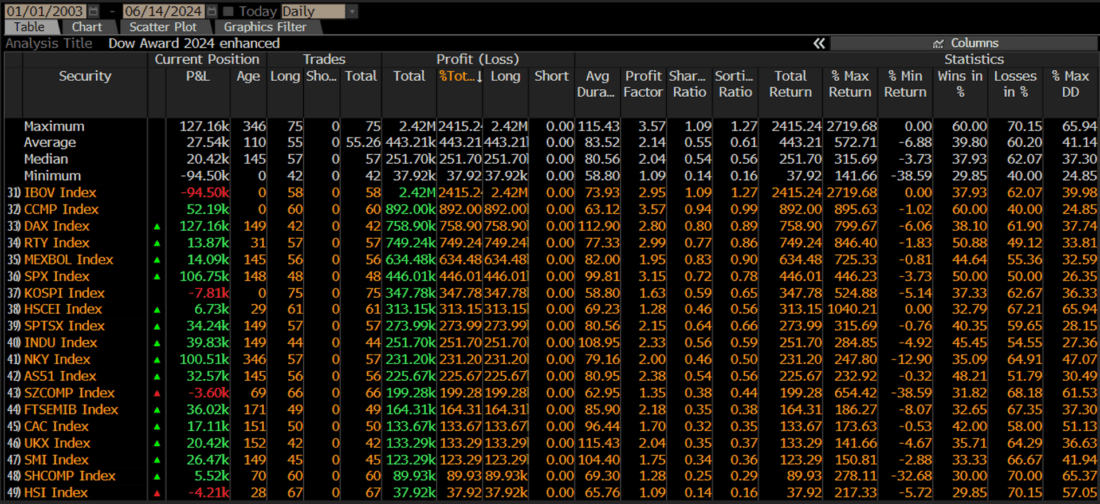

Global Portfolio Backtesting:

Expanding the strategy’s scope, we construct a diverse basket of global equity indices and apply the enhanced trading rule. The results confirm the strategy’s profitability across various regions, with an average total return of 443.2%, underscoring its universal applicability.

Conclusion:

The 4% bloodbath sidestepping rule has proven its merit over time and across different market conditions. The enhancements proposed in this article further solidify its position as a valuable tool in the investor’s arsenal. The insights provided by Larry Williams and Ralph Vince are a testament to their legendary status in the field of trading.

—-

Originally posted 15th August 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!