By: Garrett Strum and Jim Cielinski, CFA

As concern mounts over the looming US debt ceiling, Global Head of Fixed Income Jim Cielinski and Portfolio Manager Garrett Strum discuss the implications for financial markets.

Key takeaways:

- Without an act of Congress, the U.S. Treasury will lose its ability to borrow and will run out of money in the coming weeks.

- The risk of an outright default on Treasury debt is extremely remote, but it would have pronounced effects on markets were it to occur. However, those consequences would likely fade quickly as a resolution would be swift.

- While volatility may be pervasive through the final hours of this battle, common sense – if not good governance – should ultimately prevail.

Concern is mounting in financial markets about the looming debt ceiling. The United States has now met its statutory debt limit of $31.4 trillion. Without an act of Congress, the U.S. Treasury will lose its ability to borrow and will run out of money in the coming weeks. Default on U.S. Treasury bonds or bills, the very definition of a risk-free asset, is almost unthinkable. The ramifications would be far and wide and would likely upend risky assets of all types.

This risk of an actual default is extremely remote. As a tail risk, however, small changes in the narrative can move markets. An increase in default probability from 0.2% to 5.0%, for example, would send shock waves through many parts of the market.

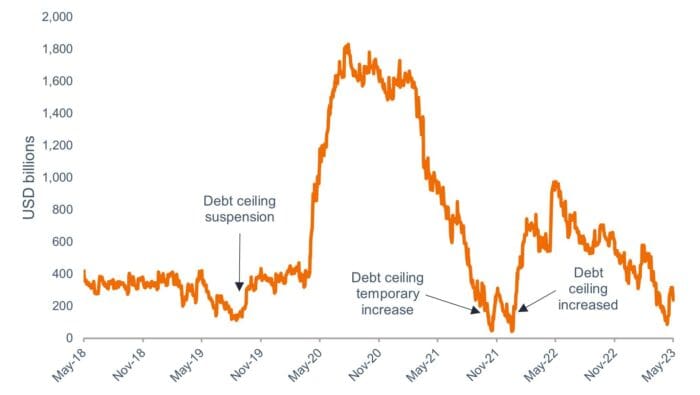

We expect the playbook from previous debt ceiling battles to play out here: Negotiations will go to the wire, but the crisis will be averted at the last moment, if only through one or more temporary agreements. There is no incentive for either side to blink too early. The narrowly split House and Senate provide the ingredients for this to be one of the more brutal fights since 2011, which led to a downgrade of the U.S. debt rating. As shown in Figure 1, political jostling around the U.S. debt ceiling has become commonplace.

Figure 1: Here we go again … U.S. Treasury’s cash balance at the Federal Reserve

Source: FiscalData.Treasury.gov, as of 3 May 2023.

And the drama is playing out as expected. The Biden administration wants a clean debt bill. The Republican-controlled House wants a series of spending cuts tied to the bill, permitting additional borrowing only if accompanied by the removal of student-loan forgiveness, lower defense spending, elimination of some “green” tax credits, and other curtailments. The House has passed such a bill, but there is zero chance it will be passed by the Senate and signed by the President.

What paths are available?

There has been a focus on the “X-Date,” the day where the Treasury exhausts its cash reserves and can no longer honor its obligations. Most estimates suggest this may happen in July or August, although it could be earlier, as indicated by Janet Yellen’s most recent forecast signaling the potential for an early June date. As shown in Figure 2, the potential X-Date window spans a relatively wide short-term maturity window, and investors are demanding a sizeable yield premium to hold securities maturing just after the anticipated X-Date.

Figure 2: Treasury bill yield curve

Source: Bloomberg, Janus Henderson Investors, as of 3 May 2023.

Resolution will depend heavily on who is taking the blame for the chaos. The public will view default as a byproduct of incompetence. The first rule of politics is that it’s fine if the opposition looks incompetent – but not if it’s you! Thus, the battle in the coming days will center on ensuring the other side takes the blame.

Several outcomes may unfold as we approach the X-Date. One, both parties may simply agree to a short-term extension of the borrowing limit, kicking the can down the road as was done in October of 2021. Two, either party may blink and seek compromise, although such a path would be difficult as House Speaker McCarthy would struggle to get the more extreme elements of his party to agree. Democrats would find a compromise slightly more plausible, but it would be perceived as a sign of weakness.

Importantly, even with a breach of the X-Date, a default on debt can and will be forestalled. The Treasury might attempt to prioritize interest and principal repayments, although this is viewed as operationally difficult. Other obligations – such as pensions and federal payrolls – could be suspended. A full-scale government shutdown would likely ensue, and the public would quickly turn on Congress.

The worst case

What about an actual default? If all else fails, the Treasury might miss some maturity and coupon payments, and market chaos would unfold. This would likely be short-lived, however, as the volatility would prompt a resolution within days, and likely before any technical “default cure” periods expired (i.e., fewer than three days). Even in these cases, debt holders would be highly confident of being “made whole.” No losses would be realized, even though the road would be very bumpy. The Federal Reserve would have a range of untested strategies at its disposal, such as repurchasing defaulted bonds at full value, mammoth short-term repo facilities, and the acceptance of defaulted securities in its money market liquidity facilities. And it would use all of them – probably even a few that are not yet vetted.

Conclusion

An outright default on Treasury debt remains less than a 1% probability. As an important tail risk, it would have pronounced effects on markets were it to occur, but those consequences would likely fade quickly as a resolution would be swift. This explains why early signs of volatility have been confined to short-term markets, where money market investors are loathe to hold delayed or defaulted maturities; Treasury bill yields have been elevated in the June-to-August maturity range, with largely benign movements elsewhere.

We have learned much over the past several debt-ceiling battles. Volatility may be pervasive through the final hours of this reckless game of chicken, but common sense – if not good governance – should ultimately prevail.

Definitions

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Repurchase (repo) facility an entity that enables eligible firms, who are mainly large banks, to quickly convert their Treasuries into short-term cash loans.

Yield: The level of income on a security, typically expressed as a percentage rate.

Yield curve is a graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer-maturity bond yields are higher than shorter-dated or front-end bond yields. For an inverted yield curve, the reverse is true.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.

—

Originally Posted May 8, 2023 – The debt ceiling battle: When politics and debt don’t mix

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!