Key takeaways:

- Since the March trough the S&P 500 Index has gained around 14% and ten-year Treasury yields have risen roughly 0.50%.

- As market conditions have improved, inter-asset correlations have also shifted.

Russ Koesterich, CFA, JD, Managing Director and Portfolio Manager of the Global Allocation team discusses the outlook for stock/bond correlations going forward.

As fears of another banking crisis fade, both stock and bond yields have moved higher. Since the March trough the S&P 500 Index has gained around 14% and ten-year Treasury yields have risen roughly 0.50%.

As market conditions have improved, inter-asset correlations have also shifted. Bonds proved an effective hedge in the aftermath of the initial bank failures in early March but less so recently. Going forward, I would expect stock/bond correlations to continue to be less stable than the post-Global Financial Crisis norm.

Shifting investment narratives

Investor concerns are evident in the way stocks and bonds co-move. Recent shifts suggest a renewed faith in a benign economic outcome. Since early May, daily stock/bond correlations have been approximately zero. In contrast, back in March and April correlations were decidedly negative, arguably reflecting greater fears of more bank failures and a recession.

As I’ve discussed in previous blogs, how stocks and bonds co-move is influenced by several factors, including inflation and financial conditions. And while inflation is coming down, it remains too high and too volatile. Core inflation is slowly decelerating but remains comfortably above 5%. Not only has inflation remained elevated but it is still much more volatile than the multi-decade average. The three-year standard deviation of core inflation is roughly four times the pre-pandemic average. Higher inflation volatility, which undermines investor confidence in bonds, has been associated with higher stock/bond correlations.

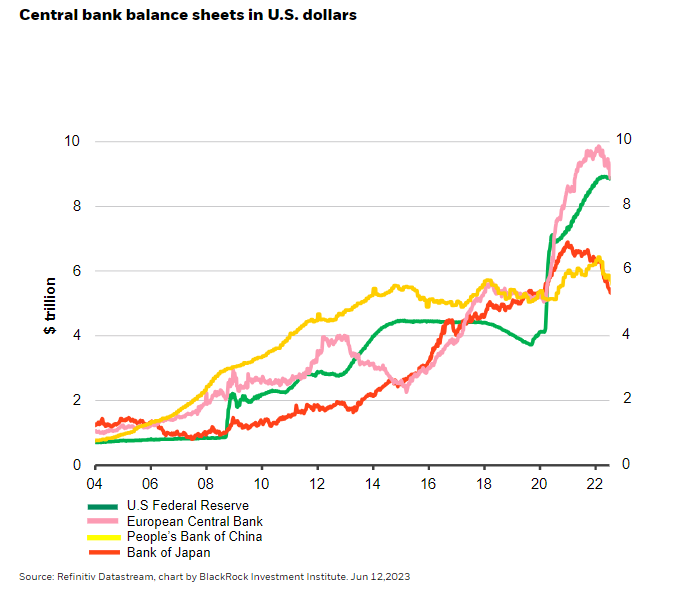

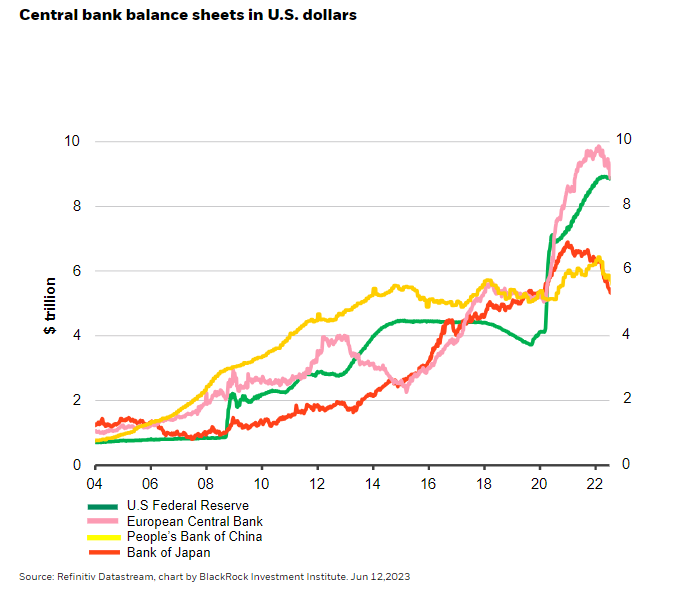

The second problem for those looking to use bonds as a hedge: The Federal Reserve is once again shrinking its balance sheet. After peaking at $9 trillion last spring, the Fed’s balance sheet began a slow decline, reaching a nadir of around $8.3 trillion in early March. However, following the banking stress the balance sheet expanded by around $400 billion on the back of emergency provisions. As the situation stabilized and emergency provisions became less necessary, the Fed’s balance sheet resumed its decline, along with those of most other central banks (see Chart 1).

Source: Refinitiv Datastream, chart by BlackRock Investment Institute. Jun 12,2023

Historically, changes in the Fed’s balance sheet, along with broader financial conditions, have co-moved with stock/bond correlations. If the worst of the banking crisis is behind us and the Fed’s balance sheet continues to shrink, bonds may prove a less effective hedge going forward.

Outside of extreme events in the banking system, the outlook for bonds as a hedge will be determined by one of two economic scenarios. If inflation is decelerating and the Fed is on hold, investors should have more confidence in bonds as a hedge. However, if recent economic resilience continues, core inflation remains elevated, and the Fed is forced to continue hiking, bonds may provide some diversification but prove a less reliable hedge. My base case is a slowing but still resilient economy. This suggests staying tactical with your bond allocation and diversifying your hedges.

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock’s Global Allocation Fund and the lead portfolio manager on the GA Selects model portfolio strategies.

—

Originally Posted June 22, 2023 – Economic resilience complicates hedging with bonds

To obtain more information on the fund(s) including the Morningstar time period ratings and standardized average annual total returns as of the most recent calendar quarter and current month-end, please click on the fund tile.

The Morningstar Rating for funds, or “star rating,” is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

© 2023 BlackRock, Inc. All rights reserved.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 2023 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

The BlackRock Model Portfolios are provided for illustrative and educational purposes only, do not constitute research, investment advice or a fiduciary investment recommendation from BlackRock to any client of a third party financial advisor (each, a “Financial Advisor”), and are intended for use only by such Financial Advisor as a resource to help build a portfolio or as an input in the development of investment advice from such Financial Advisor to its own clients and shall not be the sole or primary basis for such Financial Advisor’s recommendation and/or decision. Such Financial Advisors are responsible for making their own independent fiduciary judgment as to how to use the BlackRock Model Portfolios and/or whether to implement any trades for their clients. BlackRock does not have investment discretion over, or place trade orders for, any portfolios or accounts derived from the BlackRock Model Portfolios. BlackRock is not responsible for determining the appropriateness or suitability of the BlackRock Model Portfolios or any of the securities included therein for any client of a Financial Advisor. Information and other marketing materials provided by BlackRock concerning the BlackRock Model Portfolios –including holdings, performance, and other characteristics –may vary materially from any portfolios or accounts derived from the BlackRock Model Portfolios. Any performance shown for the BlackRock Model Portfolios does not include brokerage fees, commissions, or any overlay fee for portfolio management, which would further reduce returns. There is no guarantee that any investment strategy will be successful or achieve any particular level of results. The BlackRock Model Portfolios themselves are not funds. The BlackRock Model Portfolios, allocations, and data are subject to change.

For financial professionals: BlackRock’s role is limited to providing you or your firm (collectively, the “Advisor”) with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of the Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for a client’s account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein for any of the Advisor’s clients. BlackRock does not place trade orders for any of the Advisor’s clients’ account(s). Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics–may not be indicative of a client’s actual experience from an account managed in accordance with the strategy.

For investors: BlackRock’s role is limited to providing your Advisor with non-discretionary investment advice in the form of model portfolios in connection with its management of its clients’ accounts. The implementation of, or reliance on, a Managed Portfolio Strategy is left to the discretion of your Advisor. BlackRock is not responsible for determining the securities to be purchased, held and sold for your account(s), nor is BlackRock responsible for determining the suitability or appropriateness of a Managed Portfolio Strategy or any securities included therein. BlackRock does not place trade orders for any Managed Portfolio Strategy account. Information and other marketing materials provided to you by BlackRock concerning a Managed Portfolio Strategy—including holdings, performance and other characteristics—may not be indicative of a client’s actual experience from an account managed in accordance with the strategy. This material is subject to change.

Prepared by BlackRock Investments, Inc. LLC. Member FINRA

©2023 BlackRock, Inc or its affiliates. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

USRRMH0623U/S-2964925

Disclosure: BlackRock

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!