Last week we were bullish towards gold, silver, and Treasuries, and this week we are reversing our views towards those markets in the wake of their recent, excessive gains. The perceived Fed pivot combined with similar pivots by other central banks does create a bullish environment, and with the shift in policy after one of the most aggressive rate hike cycles in history, the markets likely need more than just a few sessions to price in the new regime.

However, many markets have overestimated the potential weakness in the US economy. US economic activity has shown significant resiliency throughout the post pandemic era. Inflation is easing, and Fed policy is likely to become a tailwind instead of a headwind. One could argue that recent US scheduled data has been more mixed than weak, with inflation readings consistently moderate. We are not arguing against gold and silver entering an uptrend pattern, but we see action in the dollar and Treasuries becoming less supportive to the metals and possibly undermining them.

Precious Metals

Much of the gains in gold and silver off the October lows were directly tied to hopes for significant losses in the dollar, with the surprisingly large decline in US Treasury rates an added bonus. However, recent economic data suggests the US economy is not as weak as the European economy. And if the US economy continues to exhibit a softening pattern, we would expect to see a wave of recession forecasts for the euro zone. We also think that the slide in the dollar has run its course and that the trade is wrong to think the US Fed will cut rates before other central banks do.

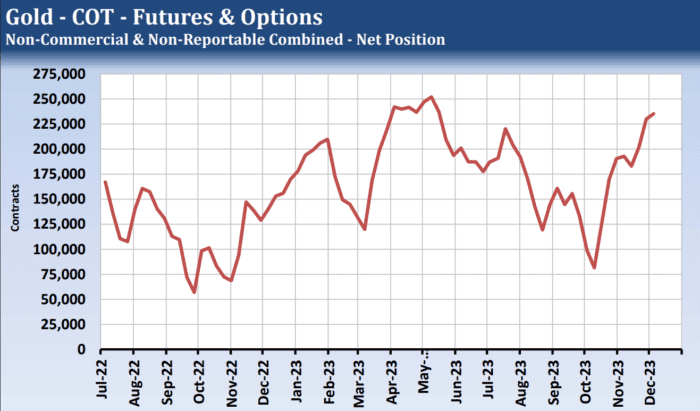

Technical conditions in gold and silver are also flashing red, with both markets maintaining relatively large spec and fund net long positions. Today’s Commitments of Traders report showed these traders were net long 214,838 contracts of gold as of December 12, which is not too far from the 2023 high of 251,980. These traders were also net long 45,530 contracts of silver versus the 2023 high of 55,847.

Another potential problem for the bull camp is the mismatch of timing for a US rate cut. Daily trade sentiment seems to be embracing a US cut in the first quarter, but that was not backed up by Fed dialogue or the CME FedWatch Tool. The FedWatch Tool gives only a 62% chance for the US Fed to cut rates at the end of March.

We suggest traders take a contrarian approach to gold and silver, looking to position for a technical and fundamental correction. Because of the magnitude of recent gains, we suggest traders limit risk by entering bear put spreads as opposed to selling futures outright.

Treasuries

The Treasury markets have also overplayed the paradigm shift by the Fed, with Bond prices up 17 points and 10-Year Notes up 7 points since October. However, both markets have held significant spec and fund net short positions going back to August 2021, and at times the combined net short has been more than 1 million contracts. This suggests that a portion of the recent gains have likely been stop loss buying, and this action has likely resulted in implied Treasury yields falling too far. The US economy continues to show resiliency, and the sharp declines in interest rates and fuel prices and the weakening dollar should take away some growth headwinds.

The bull camp should be concerned about the lack of effort in Washington towards addressing the continuing resolution on the debt ceiling, which is slated to end on January 19. Given recent history, we do not expect them to take up the subject until the last minute, which could produce new threats to credit rating for US debt and pressure US Treasury prices.

Treasury prices are expensive, the bullish euphoria from rate-cut hopes was premature, and the US economy can show resiliency. Given the potential volatility, we suggest would-be shorts use at-the-money bear put spreads to quantify risk in the face of what has been a tectonic shift in fundamentals.

—

Originally Published December 15, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!