Read about the Impact of High-Frequency Trading in Part I and learn about job roles at HFT firms in Part II.

Resources for learning HFT

Learning High-Frequency Trading (HFT) requires a strong foundation in finance, mathematics, and computer science. Here are some resources to get you started, categorised by format:

Books:

- All About High-Frequency Trading: This book provides straightforward insights into the various markets where high-frequency trading occurs. It explains how traders capitalise on mispriced securities to generate returns and examines the statistical and algorithmic methods used in this trading approach. Furthermore, it discusses the technology and techniques needed to build a high-frequency trading system (for enhancing your knowledge) and addresses the current debates surrounding its benefits, risks, and future trends.

- High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems: This book covers everything you need to know about high-frequency trading, from understanding its basics and developing trading strategies to evaluating how well the HFT strategies perform. The book dives into different trading strategies and provides detailed explanations of market microstructure, event arbitrage, and deviations arbitrage. Additionally, the book provides the information regarding the tools and techniques required to build your own trading system and explains how to analyse trades to measure their success.

Blogs:

Explore QuantInsti’s blogs section for insightful articles on various aspects of algorithmic trading, quantitative finance, and potentially HFT-related topics.

Suggested read:

High-Frequency Trading (HFT): Strategies, Algorithms, Job Opportunities, and Firms

Additional Resources:

Industry Events and Conferences: Attending industry events and conferences can be a great way to learn about the latest trends in HFT and network with professionals in the field.

We will now move to the responsibilities of each employee of an HFT firm in detail.

Job responsibilities at HFT firms

As an employee of an HFT firm, you need to take care of the important job responsibilities for which we have mentioned the details below, to give you a fair idea of the same.

So, at an HFT firm, you will be:

- Working at the cutting edge of technology and quantitative research will require you to be updated with the new technology with time.

- Needed to have a highly motivated attitude for conducting research and for developing fully automated systematic strategies.

- Needed to create new systematic strategies from the ground up after which you will receive benefit from a profit-sharing model.

- Required to help improve existing strategies, carry out post-trade analysis, day-to-day trading activities, etc.

- Needed to hold interest in finance /algorithmic trading, prior knowledge of financial domain and derivatives is desirable but optional.

- Needed to be comfortable with a high-paced work environment, and steep learning curve.

Further, let us move to how to apply as a potential employee in an HFT firm.

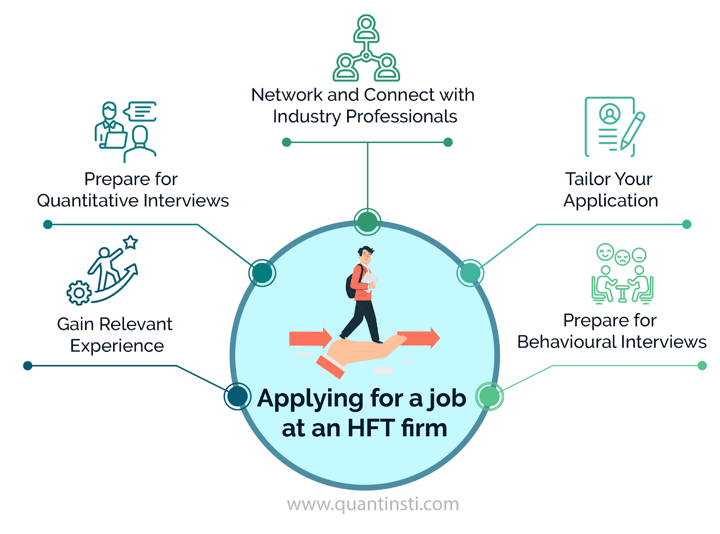

Applying for a job at an HFT firm

HFT firms look for candidates with exceptional quantitative and technical skills, a strong understanding of financial markets, and the ability to thrive in a fast-paced environment. Applying for a job at a High-Frequency Trading (HFT) firm can be a competitive and rigorous process but if all the necessary steps are taken, the application can be easier as compared to being completely unprepared.

Here are some key steps and tips to help you prepare for the application process:

1. Gain Relevant Experience:

- Internships or entry-level positions in trading, quantitative research, or risk management can provide valuable experience.

- Participate in finance competitions, hackathons, or coding challenges to showcase your skills.

- Work on personal projects or research that demonstrate your ability to analyse financial data and develop trading strategies.

2. Prepare for Quantitative Interviews:

- HFT firms often conduct rigorous quantitative interviews that test your problem-solving abilities and technical knowledge.

- Prepare for quant interview questions with the help of mock tests on several subjects related to the field (such as probability, Python etc.) to build confidence and improve your performance.

3. Network and Connect with Industry Professionals:

- Attend industry conferences, seminars, and networking events to meet professionals working in HFT.

- Join online forums and communities related to quantitative finance and trading to stay updated on industry trends and job opportunities.

- Reach out to alumni from your university or professional contacts who work in HFT for advice and potential job referrals.

4. Tailor Your Application:

- Research the specific HFT firm you are applying to and tailor your resume and cover letter to highlight relevant skills and experiences for the job role you are interested in.

- Emphasise your quantitative and technical abilities, as well as any hands-on experience with trading systems or financial modelling.

- Showcase your ability to work under pressure, make quick decisions, and adapt to rapidly changing market conditions.

5. Prepare for Behavioural Interviews:

- In addition to technical interviews, HFT firms may conduct behavioural interviews to assess your fit within their team and company culture.

- Prepare to discuss your past experiences, teamwork skills, and how you handle stressful situations.

- Demonstrate your passion for finance and technology, and explain why you are interested in working at an HFT firm.

Now that you have reached the end of this blog, let us take a look at some frequently asked questions regarding getting placed at a High-Frequency trading firm.

Frequently asked questions regarding High-Frequency Trading jobs

Getting a High-Frequency trading job requires dedicated efforts for skill-building, knowledge in subjects such as Python, risk management, etc as well as the right steps to take for interview preparation and job application.

There are some frequently asked questions by individuals who wish to thrive in an HFT firm as an employee and these questions are:

Q: How competitive is the job market in HFT?

A: The job market in HFT is highly competitive due to the lucrative nature of the field and the specialised skills required. Candidates often compete with top graduates from prestigious universities and experienced professionals from related industries.

Q: What does the interview process for HFT jobs typically involve?

A: The interview process usually includes multiple stages, such as initial screenings, technical interviews, quantitative problem-solving tests, coding challenges, and behavioural interviews. Candidates may also be asked to complete take-home projects or participate in live trading simulations.

Q: What kind of questions can I expect in a quantitative interview for an HFT job?

A: Quantitative interviews often include brainteasers, probability puzzles, logic problems, and questions on algorithms and data structures. Candidates may also be tested on their knowledge of financial mathematics, stochastic processes, and statistical modelling.

Q: What are the typical work hours in an HFT firm?

A: Work hours in HFT firms can be demanding, especially during market hours when trading activity is high. However, the intensity of work can vary by firm and role. Some roles may require long hours and a high level of commitment, while others may offer more balanced work schedules.

Q: What is the career progression like in HFT?

A: Career progression in HFT can be rapid for those who demonstrate strong performance and innovation. Successful traders and quants may quickly advance to senior roles, take on more significant responsibilities, or even start their trading firms. Continuous learning and adaptation to new technologies and market conditions are crucial for long-term success.

Q: What are the typical salary ranges for HFT professionals?

A: Salaries in HFT are generally high, reflecting the demanding nature of the work and the profitability of successful trading strategies. Entry-level positions can start with six-figure salaries, and experienced professionals can earn significantly more, often with substantial bonuses tied to performance.

Q: What are some of the challenges faced in HFT?

A: Challenges in HFT include maintaining low latency in trading systems, managing and analysing massive amounts of data in real-time, staying ahead of regulatory changes, and continuously developing and optimising trading algorithms to remain competitive.

By understanding these frequently asked questions, you can better prepare for a career in High-Frequency Trading and position yourself for success in this dynamic and fast-paced field.

HFT firms surely hold great career opportunities, once you gain the required knowledge, qualifications, and skills to help you achieve your goals!

Visit QuantInsti for additional insight on this topic.

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!