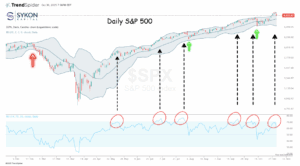

Stocks reached fresh records for the third-consecutive day this morning in cautious fashion since there is a plethora of significant catalysts coming up. Indeed, investors are awaiting the green light before pushing the S&P 500 to the monumental 7,000 level, which is only 1.5% from today’s top. Tomorrow can certainly open the pathway for a robust advance, with a Fed rate decision to be released just a few hours prior to three members of the magnificent seven reporting. Meanwhile, Thursday features the long-awaited meeting between presidents Trump and Xi as well as earnings results from two other big-tech firms. Participants are enthusiastic so far, as both Apple and Microsoft have joined Nvidia in the $4 trillion market cap club this session. Economic data helped subdue rates, and ADP announcing it will offer hiring statistics every Tuesday was pivotal. The most recent print signaled a mere 14,250 positions added in the four weeks ending on Oct. 11, which supports further monetary policy easing to bolster employment conditions. Consumer confidence and home valuations also decelerated, which together with the jobs number is sending the yield curve south in bull-flattening style led by duration, as economists worry that payrolls could sink into negative territory. Cheaper borrowing costs are weighing on the dollar and the commodity complex is retreating across the majors as traders price in the potential for slowing activity. Volatility protection instruments are catching bids, despite equities advancing, as the importance of upcoming events motivated hedging practices. Bitcoins and forecast contracts are additionally seeing interest, and the latter is benefiting from strong enthusiasm regarding NYC, VA and NJ elections; volume marked a new year-to-date peak of approximately 2.143 million trades yesterday.

The Path to 7000 Could Widen

To send the S&P 500 north of 7000 this week, we’ll likely need positive outcomes from the Fed, strong magnificent 7 earnings alongside buoyant outlooks and progress in cross-border relations between Washington and Beijing. From the central bank, a reduction together with commentary favoring a few more cuts would be music to the ears of stock and Treasury bulls alike; this morning’s economic data, especially from ADP, certainly supports the need for looser financial conditions. Robust profitability numbers from big-tech paired with solid guidance amidst enthusiasm about artificial intelligence would additionally assist investors in pricing in next year’s growth now, with less than 10 weeks left until 2026. Finally, a US-China trade deal would strengthen optimism that the cycle is far from over, quelling inflation expectations, lightening the geopolitical premium and further bolstering animal spirits. There’s room for disappointment, but if only two out of the three aforementioned developments are favorable, we could have enough momentum to reach the important 7000 milestone before November.

International Roundup

South Korea Growth Exceeds Estimates

South Korea’s economy overcame weak construction activity to grow 1.2% quarter over quarter (q/q) and 1.7% year over year (y/y) during the three-month period ended in August, according to preliminary data from the country’s central bank. Gross domestic product expansion accelerated from the 0.7% q/q and 0.6% y/y rates in the preceding period and exceeded economist consensus expectations of 0.9% y/y. Construction activity slipped 8.1% y/y, but exports and manufacturing jumped 6% and 3.3%, due, at least in part, to US importers frontrunning orders to avoid tariffs.

Relative to the second quarter, shipments to foreign markets were up 1.5% and private consumption climbed 1.3%, with the latter category benefiting from strong spending for goods, such as motor vehicles and communication devices. Government outlays expanded 1.2% in response to health care demands and purchases of capital goods. Overall spending on facilities ascended 2.4%. Regarding production, services and manufacturing advanced 1.3% and 1.2%, respectively, but agriculture, forestry and fishing slipped 4.8% while construction was unchanged.

Consumer Sentiment Drops

The South Korea Consumer Sentiment Index sank 0.3 points from September to 109.8 but remained above the negative-positive threshold of 100, according to the Bank of Korea (BOK). It was the second consecutive month of declines with the September print falling 1.3 points after gaining for five straight months. Consumers’ views of future domestic economic conditions descended 3 points to 94 and expectations for one-year, three-year and five-year ahead inflation all climbed from 2.5% to 2.6%. Views of future interest rates were more favorable with the category strengthening from 93 to 95. A BOK official told the Korea Herald that the central bank attributes consumers’ negative outlook regarding economic conditions to prolonged trade discussions with the US and the ongoing commerce dispute between the world’s largest economy and China.

European Banks Tighten Loan Standards

A handful of banks in Europe increased lending standards for businesses and consumers while making no changes to mortgage requirements during the third quarter, according to the European Lending Survey (BLS) from the European Central Bank. Net percentages of 4% and 5% of financial institutions raised standards for business and consumer loans. In the second quarter, requirements were unchanged. Banks that implemented stiff hurdles for loan qualification cited uncertainty regarding international trade and risks to the economy. The survey also found a small net increase in the share of rejected loans, in aggregate, while demand was weak despite increasing slightly.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!