The article “Understanding Theta and Time Decay in Options” was originally published on PyQuant News.

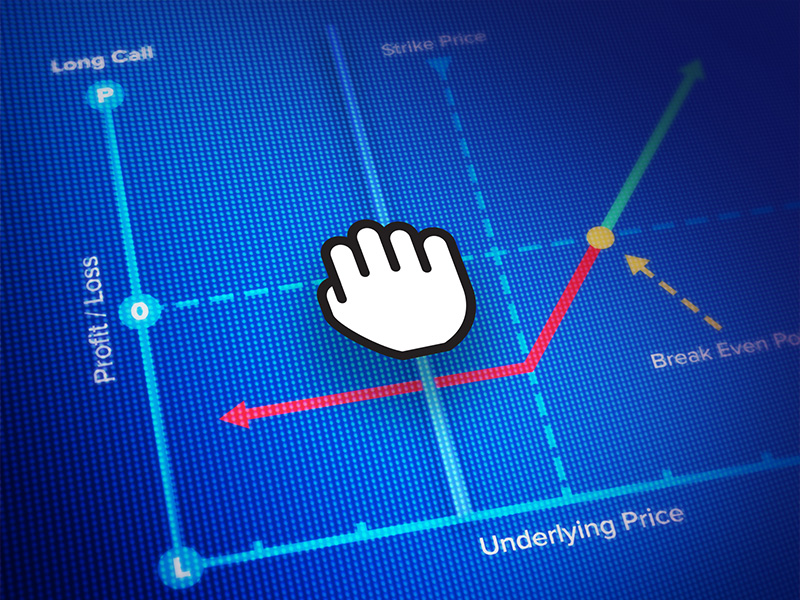

Investing in options can be profitable but also comes with its own set of challenges and risks. One key aspect that every options trader should grasp is “time decay,” which refers to the gradual decrease in the price of options as they near their expiration date. This article delves into the concept of Theta in options, its role in options pricing, and strategies for managing time decay effectively.

What is Theta in Options Trading?

In the realm of options trading, Theta measures how much an option’s price is expected to decrease as it approaches its expiration date. Essentially, Theta quantifies the impact of time on an option’s value. It is part of the “Greeks,” which are financial metrics used to assess the sensitivity of options prices to various factors.

Mathematically, Theta represents the change in an option’s price for a one-day decrease in time to expiration, assuming other factors remain constant. For instance, if an option has a Theta of -0.05, its price will decrease by $0.05 each day, assuming no changes in the underlying stock price or volatility.

The Impact of Time Decay on Options Pricing

Time decay is an inherent aspect of options pricing because options contracts have a finite lifespan. As the expiration date draws closer, the likelihood of the option being profitable (i.e., “in the money”) diminishes due to less time for the underlying asset’s price to move favorably. Consequently, the time value component of the option’s price erodes over time.

Intrinsic Value vs. Extrinsic Value

Intrinsic Value: This is the difference between the underlying asset’s current price and the option’s strike price, provided it is favorable. For a call option, it’s the current asset price minus the strike price. For a put option, it’s the strike price minus the current asset price.

Extrinsic Value: Also known as time value, this portion of the option’s price accounts for its potential to become profitable before expiration. Factors such as time to expiration, volatility, and interest rates influence the extrinsic value.

As time progresses, the extrinsic value of an option decays, reducing the overall price of the option. This decay accelerates as the expiration date approaches, often depicted by a “Theta decay curve.”

Factors Influencing Theta

Several elements influence the rate of time decay, and understanding these can help traders make better decisions.

Time to Expiration

Options with longer periods until expiration have higher extrinsic values and lower Theta values, meaning their prices decay more slowly. As the expiration date nears, Theta increases, causing the option’s price to decay more rapidly.

Volatility in Options

Higher volatility raises the potential for favorable price movements, thus increasing the extrinsic value of the option. Therefore, options on highly volatile assets tend to have lower Theta values. Conversely, options on low-volatility assets have higher Theta values, leading to faster time decay.

Moneyness

- In-the-Money (ITM): These options have intrinsic value and lower extrinsic value, resulting in lower Theta.

- At-the-Money (ATM): These options have the highest extrinsic value and Theta, leading to rapid time decay.

- Out-of-the-Money (OTM): These options rely entirely on extrinsic value and have higher Theta, causing their prices to decay quickly as expiration approaches.

Strategies to Manage Time Decay

Understanding Theta and time decay can significantly impact the profitability of options trades. Here are some strategies to manage time decay effectively.

Selling Options (Writing)

Selling options allows you to collect the premium upfront. As time passes, the option’s price decays due to Theta. If the option expires worthless, you keep the entire premium. This strategy is effective when expecting low volatility and minimal price movement.

Calendar Spreads

A calendar spread involves buying and selling options with different expiration dates but the same strike price. Typically, you buy a long-term option and sell a short-term option. The short-term option decays faster due to higher Theta, allowing you to profit from the difference in time decay rates.

Managing Expiration Dates

Choosing the right expiration date is essential in managing time decay. If you expect significant price movement in the underlying asset, consider selecting longer-term options with lower Theta. Conversely, if you anticipate minimal price movement, shorter-term options with higher Theta may be more advantageous.

Volatility Considerations

High volatility can offset Theta’s effects by enhancing the extrinsic value of options. Conversely, low volatility can accelerate time decay, making options with higher Theta more attractive for selling strategies.

Real-World Examples

Let’s consider two examples to illustrate the impact of Theta on options pricing:

At-the-Money Call Option

Suppose you purchase a 30-day at-the-money call option with a strike price of $100 and a Theta of -0.05. The option’s premium is $3.00. As time passes, the option’s price will decay by approximately $0.05 per day due to Theta. Assuming no changes in the underlying stock price or volatility, the option’s price will decrease to $1.50 after 30 days.

Out-of-the-Money Put Option

Now, imagine you sell a 60-day out-of-the-money put option with a strike price of $90 and a Theta of -0.03. The option’s premium is $1.50. Over the next 30 days, the option’s price will decay by approximately $0.03 per day, reducing its value to $0.60. If the option expires worthless, you keep the entire premium.

Resources for Further Learning

To deepen your understanding of Theta and options trading, consider exploring the following resources:

- “Options, Futures, and Other Derivatives” by John C. Hull – Comprehensive coverage of options pricing, including the Greeks and time decay.

- The Options Industry Council (OIC) – Educational materials, webinars, articles, and tutorials on options trading and risk management.

- “Options Made Easy: Your Guide to Profitable Trading” by Guy Cohen – Simplifies complex options concepts and provides practical strategies for managing time decay and other risks.

- Investopedia’s Options Trading Guide – Comprehensive guide to options trading, including detailed explanations of Theta, time decay, and various trading strategies.

Conclusion

Understanding Theta and the impact of time decay is vital for successful options trading. By mastering the nuances of how options prices erode over time, traders can make informed decisions, manage risks, and optimize their strategies for maximum profitability. Whether you are a novice or an experienced trader, mastering Theta can significantly enhance your options trading journey. The clock is ticking—use your time wisely.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from PyQuant News and is being posted with its permission. The views expressed in this material are solely those of the author and/or PyQuant News and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!