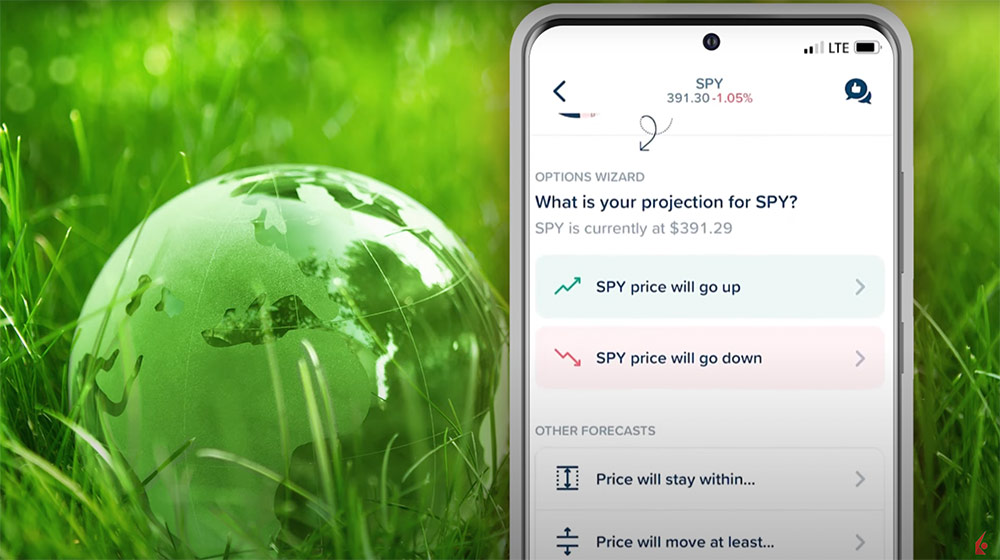

The Option Wizard, available on the IBKR IMPACT App, allows the investor access to over 30 market centers to trade options. The IBKR Option Wizard prompts the investor answer a few questions on either the price or volatility associated with the stock and identifies some standard strategies based on the investor’s parameters.

The investor can access the Option Wizard by choosing a symbol in the Watchlist, Portfolio, or Explore screen and tapping on the Options icon in the bottom right-hand corner. The Investor can also tap on the orange Trade icon in the lower right-hand corner of any screen, tap on Options and type a symbol or the name of a company into the search bar. Once selected, the investor can choose to either go to the Option Chain or use the Option Wizard by entering in their forward calculations on either price or volatility.

The investor can make their own calculation as to:

- The price will go up

- The price will go down

- The price will stay within a range

- The price will go up and/or down by a certain amount or percent

- Volatility will go up

- Volatility will go down

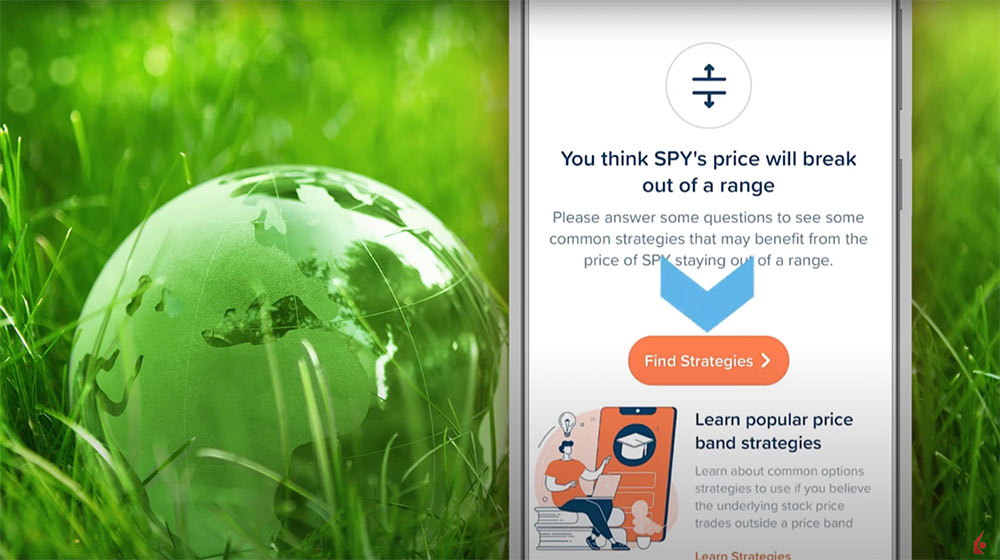

For this example, the investor believes the price of the underlying will move out of a certain range so they select “price will move at least”. The investor is taken to another screen confirming that they are calculating that the price is likely to break out of a range. Next, the investor taps on the orange Find Strategies button and chooses the time horizon in which they believe this event will occur by scrolling through the option expiration dates at the bottom of the screen. When ready, the investor taps the orange Next button.

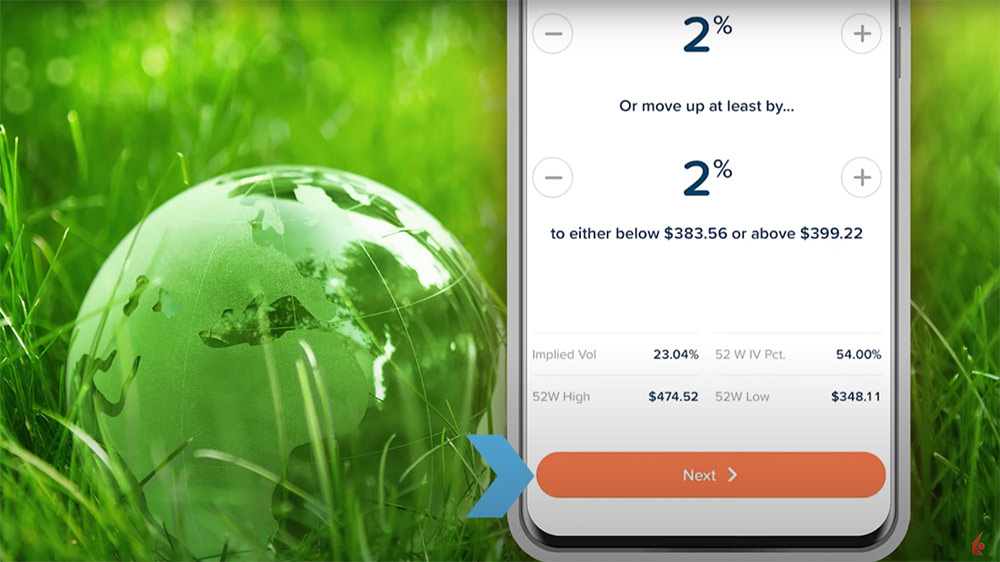

The investor can choose whether to use a percentage or currency value for the move and whether the underlying price will increase, decrease, or either. In this example, the investor chooses a 2% increase or decrease. When ready, they tap the orange Next button at the bottom of the screen.

The Option Wizard will identify strategies that could benefit if the price of the underlying moves the same way as the investor believes. The investor can sort the strategies by:

- Aggressiveness: Low to High,

- Aggressiveness: High to Low,

- Highest Probability of Profit,

- Max Potential Gain: High to Low,

- Price: Low to High, and

- Price: High to Low

Generally, a strategy with a higher level of aggressiveness has a lower chance of realizing a profit but when a profit is realized the return on investment can be higher for the more aggressive strategy.

The investor can also choose to select Debit only, Credit only or either as payment type, limit loss to Premium Paid, and choose to see the Probability of Profit based on Market Implied or User Defined data.

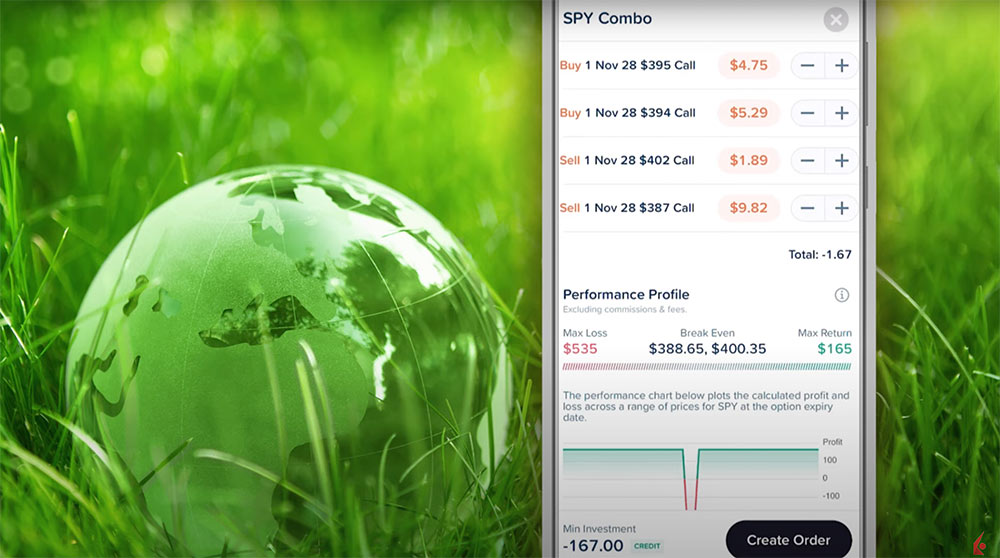

Once the investor selects a strategy, an informational screen will appear where the investor can adjust the strike ratio of the original strategy, see the total cost of the trade, excluding commission, see a Performance Profile of the strategy showing the max loss, breakeven point or points, and the max return as well as other relevant information. When ready, the investor taps the Create Order button in the bottom right-hand corner of the screen.

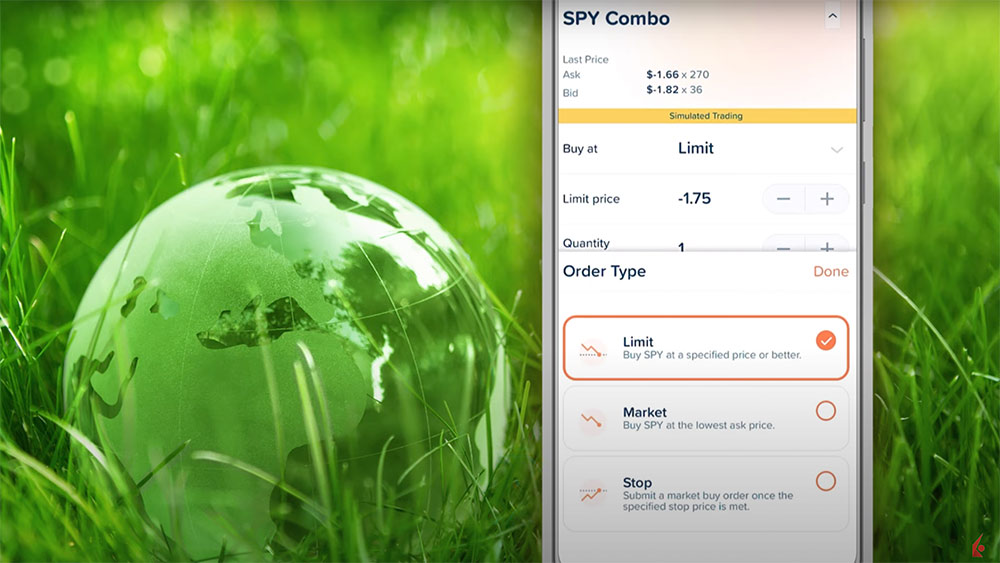

An order ticket will be created where the investor can choose to submit a Limit, Market, or Stop order. Notice that the Impact App offers the investor a definition for the order type. For a Limit or Stop order, the investor can also adjust the price and Time In Force. Once the investor selects the quantity, they can either preview the order or slide the toggle in the lower left-hand side of the screen.

The Interactive Brokers’ Option Wizard is an easy-to-use trading tool that identifies strategies based on the investor’s own beliefs or calculations as to the price or volatility movements over a specified time horizon.

Resources

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!