I’m senior economist Jose Torres for Interactive Brokers and I’ll be explaining one of the leading economic indicators of the Canadian economy: The Purchasing Managers Index for manufacturing, also known as the manufacturing PMI.

The manufacturing PMI for Canada is based on data collected by the US corporation S&P Global from about four hundred manufacturing firms. As a result of survey responses from manufacturing purchasing managers, the headline number represents a seasonally adjusted, weighted average of the following five components.: New Orders comprise thirty percent, output twenty five percent, employment twenty percent, suppliers’ deliveries times fifteen percent and stocks of purchases ten percent. Survey respondents are asked to report an increase, decrease, or no change in each variable compared with the previous month, along with the reason for any change.

The data release is generally published around the 1st business day of each month at 9:30am eastern time. S&P Global provides PMI data to help governments, financial institutions, corporates and market participants forecast, analyze and plan for current and future economic developments. The PMI is an indicator of manufacturing conditions published by S&P Global and other commercial providers in the United States, China, India, Latin America and others. Nevertheless, each provider follows a similar diffusion model.

The PMI is derived through a diffusion index that uses a reading of 50 as its central index to indicate that there has been no change from the previous reading. As PMI levels rise above 50, the series indicates expansion, while those below 50 indicate contraction. The new orders component is the heaviest weighted component of the manufacturing PMI and is widely regarded by market participants as a leading indicator of the Canadian economy.

The manufacturing sector, which is capital intensive and influenced greatly by interest rates, requires the coordination of many moving parts in the economy. Often, banks are needed to lend money, people and heavy machinery for labor and real estate for space. Since the manufacturing sector has so many moving parts, the PMI is a valuable indicator of future economic growth. Whenever a component of the manufacturing sector shows fragility, that often indicates deeper economic weakness. Normally, a decrease in manufacturing activity is a sign that businesses are hesitant to invest, that credit become less available, or that demand from customers is weak. Elevated PMI readings suggest businesses are ordering goods because demand is strong, credit conditions are benign, and business investment levels are high.

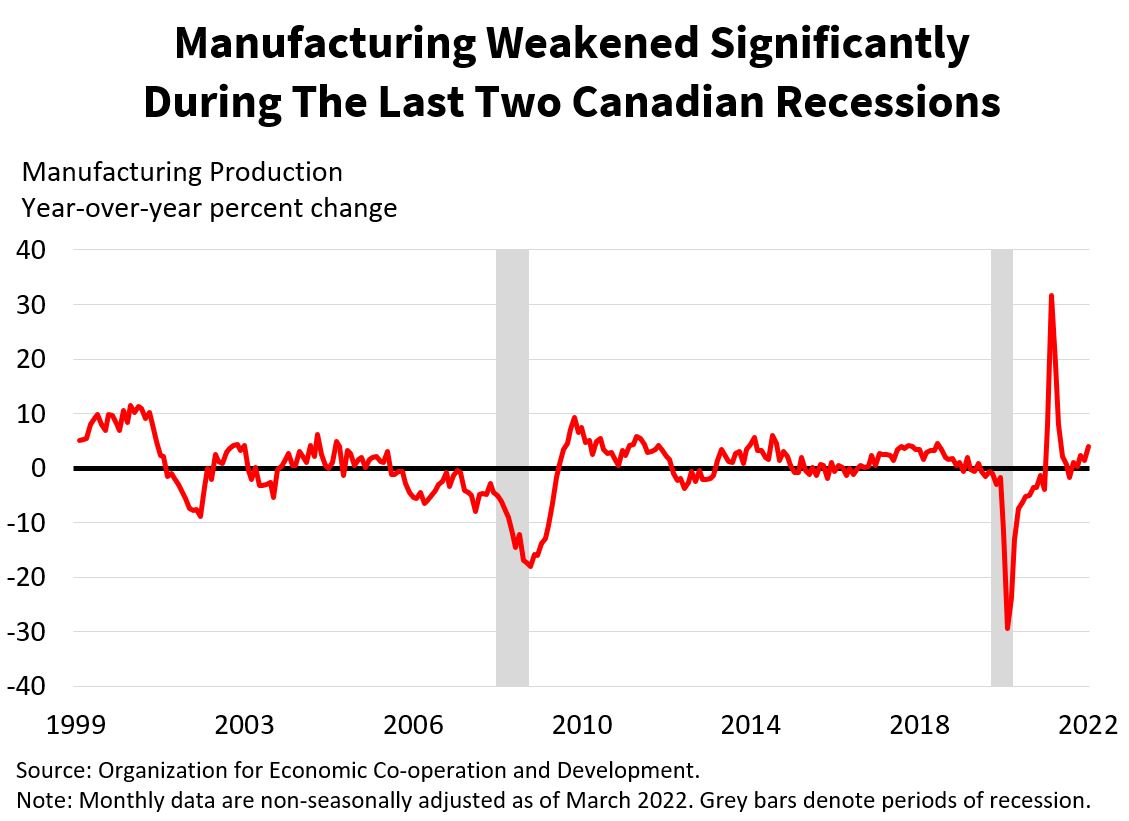

PMI expansion signals a positive economic outlook, which will likely lead to a series of positive events. A growing economy is generally characterized by growth in consumer spending, job opportunities, business expenditures, capital flows, and government revenue. If manufacturing weakens significantly in Canada as it did during the 2008 financial crisis and the COVID-19 recession, it may signal weakness for the Canadian economy that could possibly have consequences for the global economy due to its globalized nature. Economic weakness may

initially spread to Canada’s largest trade partners: the U.S., the EU, China, and Mexico. For a full and comprehensive look at manufacturing conditions globally, following the PMIs from Canada and its largest trade partners are useful since they comprise over half of global GDP.

To forecast manufacturing PMI, we’d look at economic indicators such as retail trade as a measure of consumer demand, daily commodity price action to get a gauge of how manufacturing inputs are doing, and consumer confidence and business sentiment to monitor business and consumer confidence, expectations, and uncertainty. Our analysis will also include listening to the quarterly earnings calls of some of the largest manufacturing companies and monitoring their stock performance for signs of economic growth or decline. Furthermore, the Bank of Canada’s meetings and commentary should also be closely monitored because higher interest rates and tighter credit conditions are a barrier to business investment and constrain certain capital-intensive industries, such as manufacturing and real estate.

PMI readings below expectations may cause stocks to decline due to expectations of weaker economic trends, but this is not always the predominant factor driving market movements. Stock prices may rise if the PMI reading beats expectations due to economic optimism.

Before large purchases are made, the purchasing manager approves or rejects them. Their understanding of the short-term outlook for manufactured goods is quite strong. When analyzing the prospects of economic growth or contraction, it is important to monitor how purchasing managers behave and feel.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!