Pricing matters, people consider the prices of the goods and services that they purchase. The consumer price index or CPI measures changes in prices by comparing the cost changes of a fixed basket of goods and services.

The eight major segments in the basket of goods and services are food, shelter, household operations, clothing, transportation, health and personal care, recreation and education, and alcohol and tobacco products.

Shelter, transportation and food are weighted heavier in the index since together, they represent roughly sixty-two percent of Canadian household budgets. Many economic series are adjusted for inflation-free dollars via the CPI, including collective bargaining wages, pricing contracts, pension payments, and more.

The CPI is seasonally adjusted, since some goods and services like clothing and recreation have fluctuating sales and prices throughout the year. The CPI is calculated at Statistics Canada after 100 field interviewers collect roughly 90,000 price observations from roughly 5,000 outlets. In addition, some prices are collected at headquarters via internet and from administrative data.

The numbers are released near the 19th day of each month within the Consumer Price Index press release at 8:30am eastern time. Statistics Canada measures price changes in the Canadian economy to support informed decision making made by individuals, businesses, non-profits and governments.

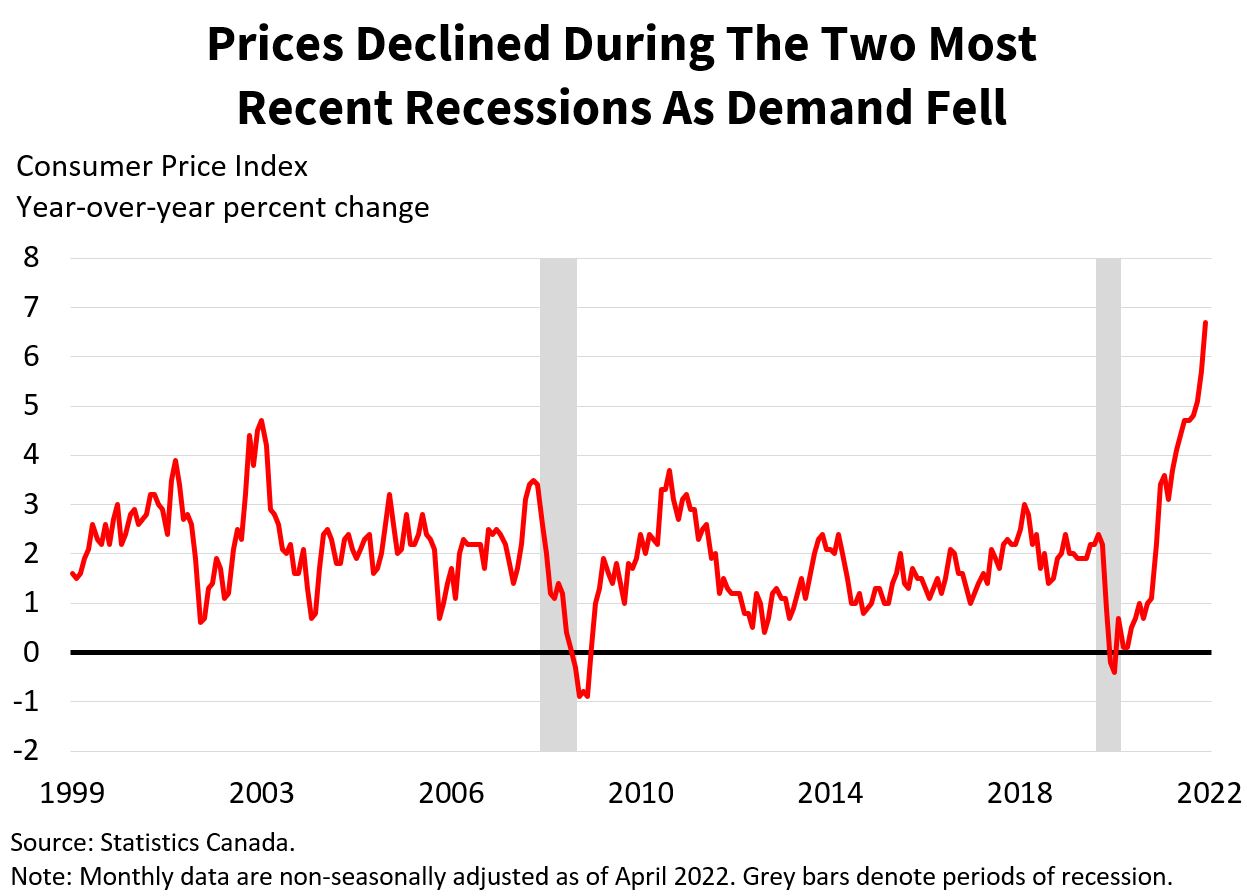

As a key indicator of supply, demand, and the state of the Canadian economy, prices are important. When demand for goods and services is very high, and supply does not meet the demand, price pressures rise as more funds chase fewer goods and services. Conversely, if demand weakens and supply remains unchanged, price pressures weaken as inventories rise and businesses lower their prices to move goods. The year-over-year percent changes in consumer prices and the month-over-month changes are valued by market participants. Due to food and energy’s volatile characteristics, they also analyze the CPI independently of them.

Since food and energy can disproportionally shift the index, it is important to analyze different parts of the CPI in order to understand how prices are changing.

The acceleration of consumer prices could make things less affordable and lead to longer-term inflationary problems. This may prompt the central bank to tighten policy in order to contain inflation, keep inflation expectations at a safe level, and regain balance in the economy. A deceleration in consumer prices or falling consumer prices, deflation, can signal sluggish economic activity, weak population growth, and/or recession.

In the event of a long-term drop in demand, wages may decline, jobs may be lost, and investment portfolios may be significantly reduced. As a result of the Great Depression of the 1930s, central banks have avoided deflationary episodes and favored a gradual and stable increase in prices to accommodate economic growth and population growth; the Bank of Canada’s inflation target is two percent.

If the Bank of Canada restricts monetary policy to control inflation, demand could decline. In the event that rates rise to combat inflation, the dollar could strengthen, which could harm the nation’s trade strength since foreign buyers would be forced to pay more for exports. A stronger dollar could result in a decline in the value of global corporate sales and profits for Canadian corporations. When Bank of Canada monetary policy tightening is needed during inflationary episodes, equity and bond prices are likely to decline.

To forecast CPI, we examine the growth of the money supply to see if more money in the system without commensurate growth in productivity increases the risk of inflation.

As inputs to consumer goods and services, daily commodity prices can be used by forecasters to estimate future prices. Wages, employment and unemployment provide information on whether the labor market is tight. High wages alongside a tight labor market can push businesses to increase prices and trigger higher and more resistant inflation. Furthermore, retail trade can be used to measure transactions in the economy and to see how hot demand is.

Consumers typically experience budget constraints, reduced purchasing power, and difficulty planning for the future as a result of inflation. A recession is likely to occur when inflation is severe and central banks must tighten monetary policy to resolve it. In order to conduct effective economic analysis, the CPI is a crucial tool for determining how fast or slow prices are rising or falling.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!