One of the lagging economic indicators of the United Kingdom’s economy: Gross Domestic Product or GDP.

Using GDP, we can measure the size of an economy as a whole. GDP data is used by governments worldwide to assess an economy’s size and growth rate. It is calculated by adding together the final uses of goods and services in consumer prices, minus net exports, the difference between exports and imports. The quarterly GDP report provides details by two major industrial categories: production and service. Production is comprised of the agriculture, mining, manufacturing, electric, construction and water supply sub-categories. While service is comprised of the distribution, hotels and restaurants, transport storage and communications, business services and finance and government and other services subcategories. Statistics on foreign trade, consumer and producer prices, retail transactions, financial statements, government revenue, household and business surveys, and other data sources are used to produce the GDP data release. The final numbers are released by the Office for National Statistics near the 30th day of each quarter’s end referencing the previous quarter, within the Gross Domestic Product, National Accounts data release at 7:00am London time. preliminary, monthly estimates are provided for the previous month around the 13th day of each month as well but with partial data. The Office for National Statistics publishes GDP information and a wide variety of other statistics to serve the public good.

Gross domestic product is a key determinant of global financial markets. Considering the seasonally adjusted, quarter-over-quarter, percent change in real GDP is significant for economists and market watchers. Taking seasonality and inflation into account, this headline number shows if the economy is growing steadily, rapidly, or whether it is contracting. In the event of a negative real GDP report, the economy is contracting and recession is likely underway. As there are less sales and less opportunities to invest when the economy is in decline, companies cannot collectively grow. GDP is a global method of measuring economic growth that allows us to determine which economies are progressing slower or faster than others.

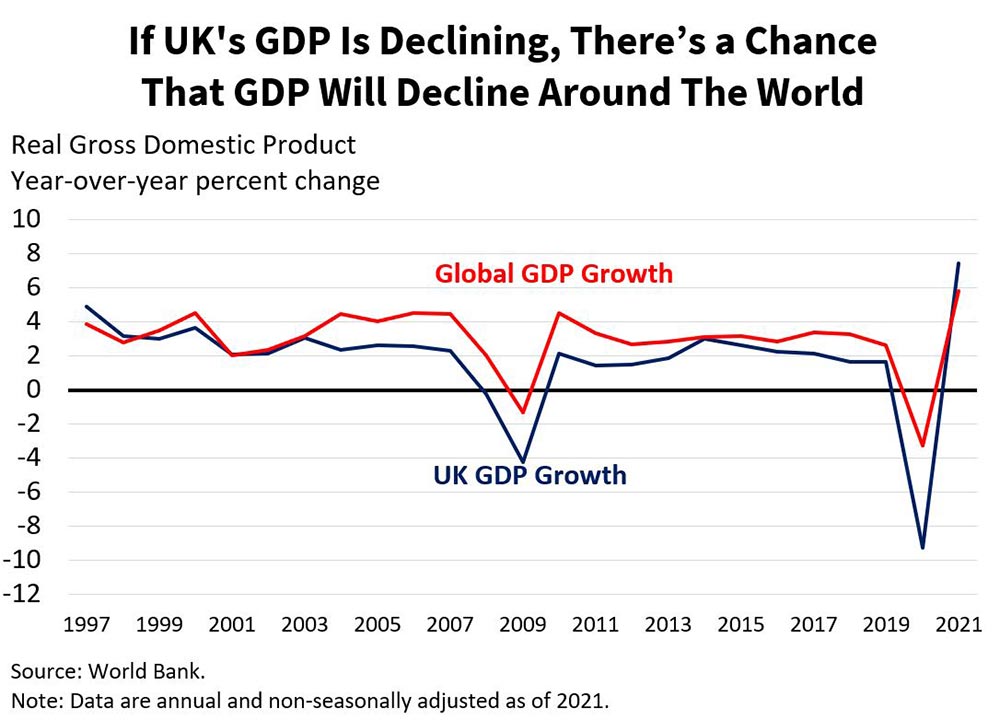

As GDP expands, there are many favorable effects across a wide range of economic areas. As a result of the robust economy, the business sector is motivated and has profitable opportunities, the consumer sector is happy and is likely to purchase goods and services, and the government can collect tax revenue from all the transactions and income. Business revenue and profits are propelled, workers take home higher earnings and governments are in an increasingly favorable fiscal position as a result. The globalization of the international economy and the massive influence of the group of seven nations, or G7, means that if the Kingdom’s economy is contracting, the world economy may also contract. Growth in GDP is likely to lead to increased gratification and joyfulness, as well as rising equity prices and interest rates. Weaker GDP readings, however, will result in weaker investment returns, reducing cash flow generating opportunities for businesses, individuals, and governments.

As GDP expands, there are many favorable effects across a wide range of economic areas. As a result of the robust economy, the business sector is motivated and has profitable opportunities, the consumer sector is happy and is likely to purchase goods and services, and the government can collect tax revenue from all the transactions and income. Business revenue and profits are propelled, workers take home higher earnings and governments are in an increasingly favorable fiscal position as a result. The globalization of the international economy and the massive influence of the group of seven nations, or G7, means that if the Kingdom’s economy is contracting, the world economy may also contract. Growth in GDP is likely to lead to increased gratification and joyfulness, as well as rising equity prices and interest rates. Weaker GDP readings, however, will result in weaker investment returns, reducing cash flow generating opportunities for businesses, individuals, and governments.

Consumer and business confidence, housing starts, purchasing managers’ index for manufacturing, retail sales, the money supply and the yield curve provide powerful predictive insights regarding GDP. As leading economic indicators, they provide coverage on the strength and sentiment of consumers and businesses, the capital intensive and interest rate sensitive real estate and manufacturing sectors, the amount of inflationary pressure in the pipeline, and finally, the level, positioning and balance of interest rates.

As credit tightens and interest rates increase, GDP growth may be hampered, resulting in a possible recession. “Soft landings” are notoriously difficult to achieve when examining the history of central banking. If central banks tighten financial conditions “just enough” to slow the economy in response to overheating inflation and/or growth without triggering a recession, soft landings are successful. However, it is challenging to tighten policy with the “just right” degree of accuracy.

Market trends can be heavily influenced by GDP, especially if there is a large surprise in either direction. GDP forecasts are often based on leading economic indicators, which are commonly used by economists and market players.

A country’s GDP measures its economic transition, trajectory and opportunity. Investors need to be aware of economic trends and analyze whether GDP is accelerating, slowing, or reversing when analyzing investment choices. In a strong economic environment, financial assets will appreciate. In contrast, financial asset values cannot increase sustainably when GDP is in decline.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!