Consumer confidence reflects how consumers feel about the present and future. Confidence is important because consumer activity comprises over half of the economy in the United Kingdom as well as in other countries. The Consumer Confidence Barometer is comprised of five survey answers from randomly sampled participants regarding their personal financial situation and general economic situation over the last twelve months and over the next twelve months as well as whether now is the right time to make a major purchase such as furniture or electrical goods. Taken together, the overall Consumer Confidence headline index is an average of the responses to the five questions. More positive responses mean higher consumer confidence while more negative ones mean lower consumer confidence. German corporation, GfK (Growth From Knowledge) conducts interviews with 2,000 randomly sampled survey respondents to generate the data. The figures are generally published near the 20th day of each month at 10:00pm London time. GfK’s mission is to produce high quality data and intelligence so that their individual, corporate, and governmental clients can be well-informed. Other providers also produce consumer confidence figures for the United Kingdom.

Consumer confidence is an important indicator of the economy’s health and more specifically, consumer demand. The global economy depends heavily on the consumer to fuel the economy as consumption makes up over half of the international economy, the UK’s economy also depends heavily on consumer spending.

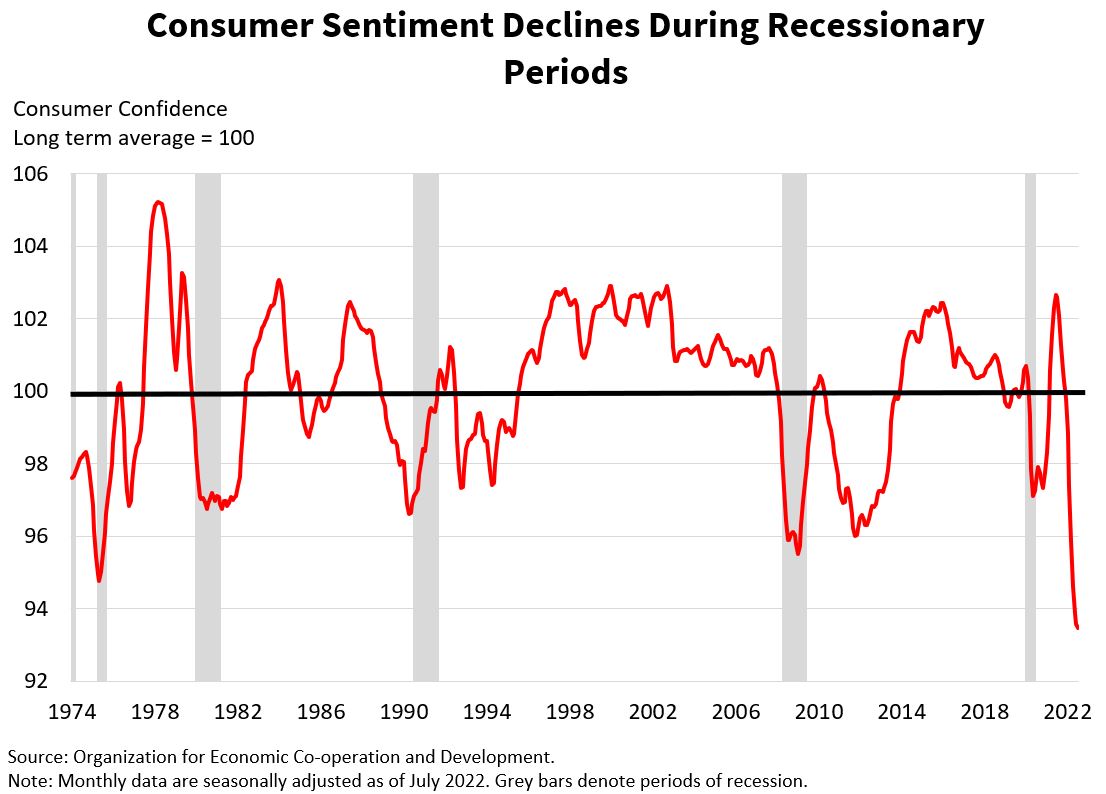

High consumer confidence would reflect positive sentiments from consumers on the economy as they continue to spend. Weak readings would reflect negative sentiments on behalf of consumers and the potential for economic weakness as they slow spending. Elevated confidence benefits economic growth and paves the way for companies and the economy to continue growing. This leads to a positive chain of events as revenue growth will likely lead to growth in employment, income, investment, loans, tax revenue, and ultimately GDP. Weakening consumer confidence is a risk for the domestic economy and the international economy as folks purchase less goods and services locally and abroad. Falling consumer confidence, such as occurred during the 2008 financial crisis and during the COVID-19 recession, would likely weaken global economies.

Various economic indicators, such as retail trade, job vacancies, PMI-manufacturing and the yield curve are helpful in predicting consumer confidence and in examining the possible risk of layoffs hampering spending, investment and economic activity. To determine whether consumers and goods are actively moving, foot traffic, port traffic, air passenger levels, and fuel sales can also provide valuable insights. Moreover, we would monitor the earnings calls and the stock performance of some of the most influential companies for signs of an economic slowdown or expansion.

Higher interest rates have weighed on consumer confidence in the past as consumers faced higher costs to finance durable items such as cars, refrigerators and furniture. Paying attention to changes in monetary policy and the possible subsequent falls in consumer confidence and company revenues are worth monitoring.

UK confidence may be the driving market force for equities, stock prices might drop if consumer confidence falls short of economists’ expectations, and might lead to rising stock prices when better than expected. Increased confidence from consumers leads to more economic activity and fundamentally supports higher stock prices globally.

Because consumers fuel company revenues on a global scale, tracking the United Kingdom’s consumer confidence, for signs of an economic slowdown or expansion is integral.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!