For this lesson let’s begin with a story, a wise man asks a king for a simple reward during a chess game, just one grain of rice on the first square of a chessboard, two on the next, then four, eight, sixteen, doubling with each step. What seemed like a modest request quickly escalates into a mind-boggling sum—by the 64th square, the number of grains exceeds the entire wealth of the kingdom. This story illustrates the incredible power of exponential growth.

Now, picture this, instead of rice, it’s your money. This is what may happen when you reinvest stock dividends.

Dividends are cash payments companies give to their shareholders, often quarterly. But instead of pocketing the cash, you use it to buy more shares. Over time, those extra shares start paying dividends of their own, and the cycle continues.

Why is this important?

The key is time. The longer you allow dividends to reinvest, the faster your portfolio grows.

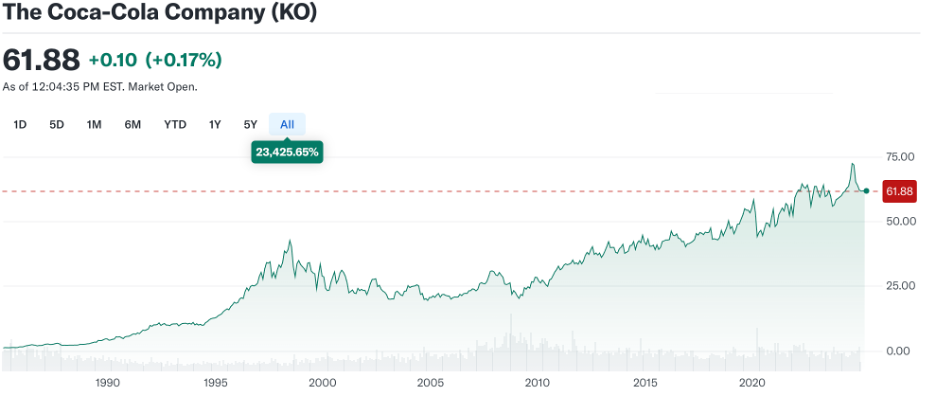

Small investments made early can compound into significant sums, thanks to the power of reinvestment. Let’s consider an example: Coca-Cola, a company that has been paying dividends for decades.

If you’d invested in Coca-Cola 20 years ago, you’d have seen your money grow not just from the stock price increase, but from the power of reinvesting those dividends. In 2004, Coca-Cola’s stock price was around $15 per share, and it paid a dividend of about $0.28 per share annually.

Let’s say you had invested $1,000. That would have bought you approximately 66 shares. Over time, as Coca-Cola continued to pay and increase its dividend, those 66 shares would have generated more income, which you could reinvest to buy even more shares.

By 2024, Coca-Cola’s stock price had risen to over $60 per share, and its annual dividend had grown to $1.76 per share. If you had reinvested your dividends over the past two decades, your 66 shares would have grown into approximately 150 shares. That’s more than double the number of shares you originally owned.

What’s the result of all this?

Not only would your original investment of $1,000 have grown in value due to the increase in Coca-Cola’s stock price, but your dividends would have also compounded—potentially turning that initial $1,000 into $3,000 or more, depending on how long you let the reinvestment cycle run. Over time, you build more shares, and those shares generate even more dividends. Without reinvesting dividends, your investment would still have grown, but at a much slower pace.

So, Should You Always Reinvest Dividends?

The decision depends on several factors, such as the stock’s future outlook, the company’s financial health, and the long-term investment goals. If a company is experiencing short-term difficulties but has strong long-term prospects, reinvesting dividends might still be a smart strategy. But if the stock is in long-term decline, you may want to reconsider your approach.

For instance, let’s look at Blackberry (BBRY). Once the leader in smartphone technology, BlackBerry failed to adapt to the rise of touchscreens and app-based ecosystems that made iPhone and Android phones dominant.

- In 2004: BlackBerry’s stock was trading at around $80 per share.

- In 2014: BlackBerry’s stock had fallen below $10 per share as its market share in the smartphone industry evaporated.

- In 2024: BlackBerry, while still in business, has transitioned into software and security, and its stock has remained low, typically trading under $10 per share.

So, keep a watchful eye on all of your investments. Even if you reinvested dividends, the slow death of a core business would have made it a poor long-term investment.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!