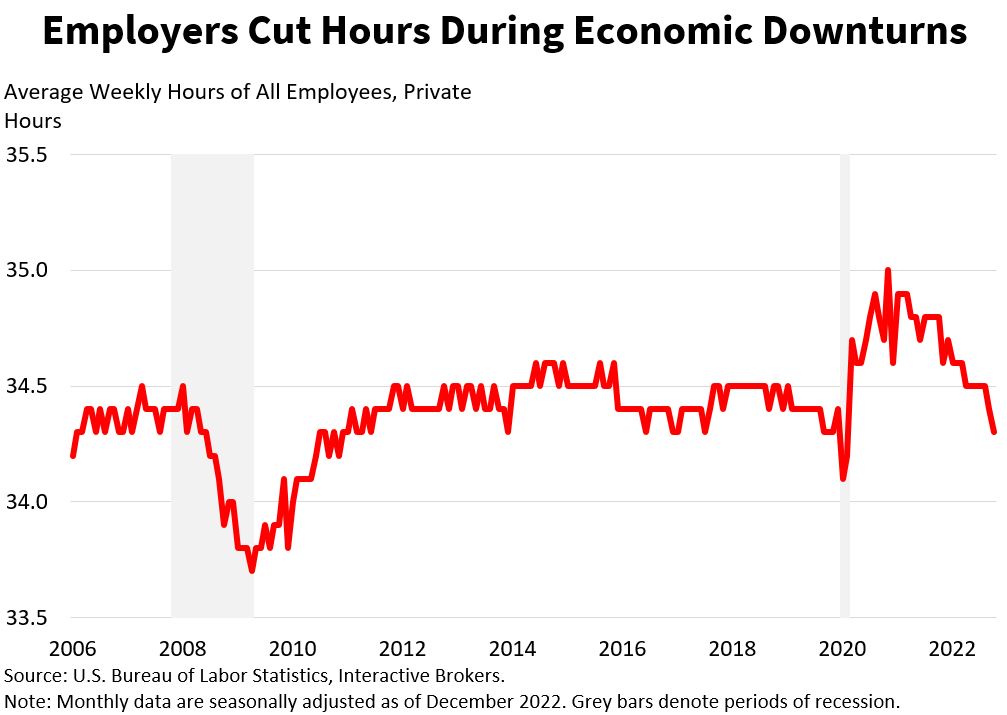

One of the economic indicators of the U.S. economy: Average hours in a workweek.

The health of the economy can be measured by labor demand as businesses increase or cut production of goods and services in response to executives’ overall sentiment and anticipation of future sales volumes. Changes in labor demand can also point to the general strength of consumers as increasing use of workers can boost overall compensation, which supports increased consumption, but if wages grow too fast inflation can occur. Declining demand for workers, of course, can imply weakening incomes, reduced consumer spending and reduced wage pressures for employers. Demand for labor, as measured by the average hours worked in a work week provide insight into what percentage of the economy is being utilized. When utilization is relatively low and as indicated by average hours worked per week the economy has capacity for expanding. When average hours worked per week is high, it’s terrific news as it generally leads to gains in productivity, earnings, and GDP.

Average hours worked in a workweek is included in the Bureau of Labor Statistics Employment Situation Report issued at 8:30 a.m. eastern time on the first Friday of the month. The seasonally adjusted data is compiled by surveying employers and includes the average hours worked in a week along with the average amount of overtime for nonsupervisory employees. By using the surveys, the Bureau estimates the aggregate number of hours worked and hours of overtime worked. The Bureau divides those numbers by the number of employed individuals to come up with the averages.

The report provides information on goods-producing and service-providing categories. Goods-producing includes manufacturing, mining, construction, durable goods and nondurable goods and the service- providing category includes transportation and warehousing, utilities, wholesale and retail trade, information, financial services, professional services, education and health services, leisure and hospitality, government and other services. The Bureau provides the report so that policymakers, businesses and investors can understand the strength of the job market and make informed decisions regarding the economy.

Average hours worked is rather stable and changes are often small, but the data can still provide insight into phases of economic cycles and the labor market. When production demands increase, employers tend to increase the hourly workweek for existing employees before hiring additional workers. This

means increases in the average hourly workweek can point to the need for employers to eventually hire more workers if demand for products and services continues to grow.

The global financial crisis illustrates how the data can also indicate different phases of the economic cycle. Average hours worked decreased 0.8 hours, or 2.3%, during late 2007 to mid-2009. Since the data is based on both aggregate hours worked and the number of employed individuals, the average hours worked didn’t fully reflect the impact upon the job market of the recession because when layoffs occur, both the aggregate hours and number of employees decline. To that end, looking at aggregate hours worked along with the number of employees can be important. In the case of the global financial crisis, aggregate hours declined significantly more than average hours while wide-scale layoffs occurred.

On its own, the data seldomly influences capital markets, but when considered with other data releases, it can influence investor sentiment. It can also be correlated with changes in GDP and productivity.

Additionally, it can influence consumer sentiment as employees either ramp up their weekly work hours or face cuts in their workweeks.

Since trends in average hours worked can provide insight into the overall labor market, the Federal Reserve closely monitors the information along with other data when setting monetary policy. If the Fed fears inflation is a concern, it may raise its fed funds rate, which is likely to increase the value of the U.S. dollar. As such, average hours worked, when combined with other indicators can directly influence the strength of the U.S. dollar and capital markets overall.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!