It’s all too easy to get caught up in the moment, especially if one is an active trader. In an environment where many of us utilize momentum-based or trend-following strategies, often via short-dated options, it can be sobering to examine long-term trends and examine current statistics vis-à-vis historical readings.

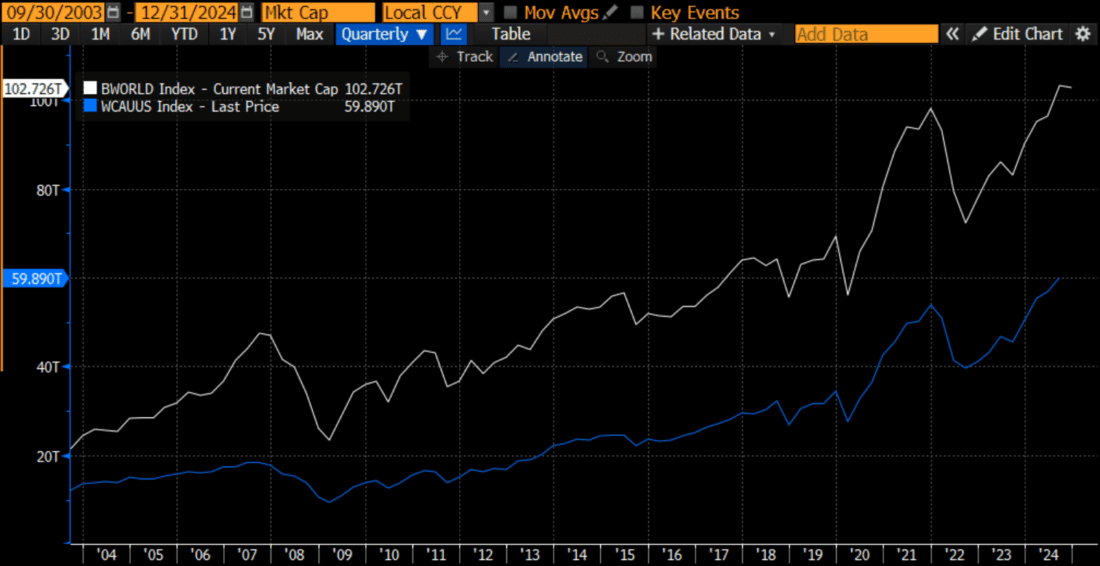

First, we will take a look at the total stock market capitalization of global and US markets. The most stunning feature is that they are both up about fivefold over the past 20 years. That is over 8% compounded annual growth. Not too shabby. Interestingly, the US was 57% of global market cap at start of graph in September 2003; now it’s 58.3%. It is easy to believe that the enormous growth in the largest US stocks would cause them to dominate global market cap. Instead, a chart like the one below can offer a reminder about how much growth came from other parts of the world as well.

Total Stock Market Capitalizations Since September 2003, Global (white) and US (blue)

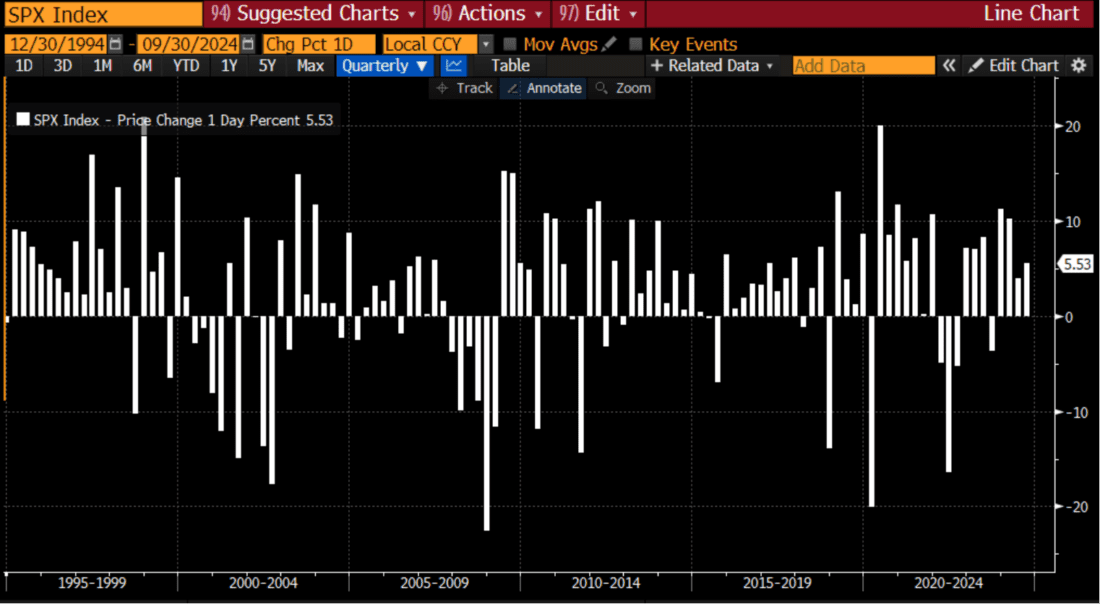

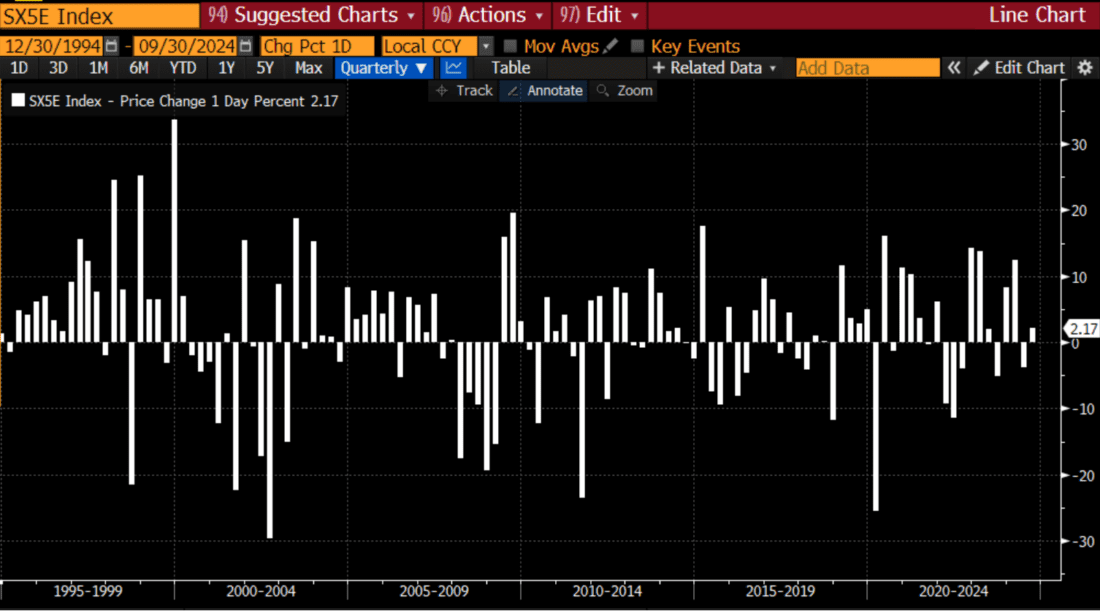

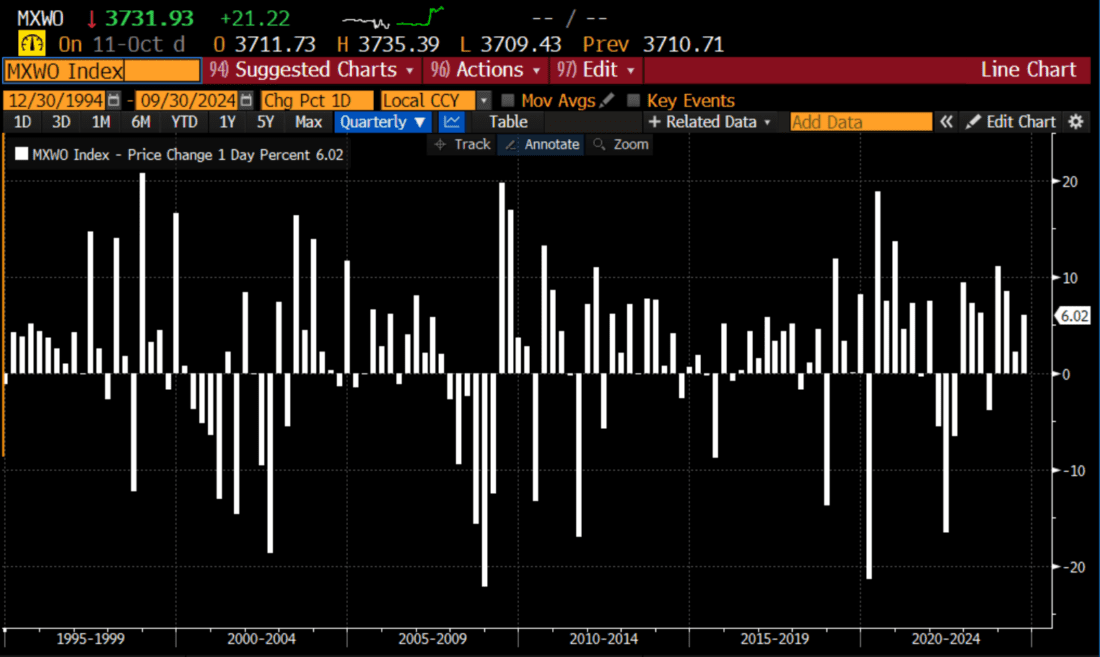

The charts below show quarterly returns for the S&P 500, Stoxx 50, and MSCI Global indices. All have certainly been on nice runs, though Europe has lagged somewhat. Note the relatively uninterrupted period of gains that prevailed in the late ‘90s. The current and recent magnitudes of gains have been relatively high, but have indeed been punctuated by periodic declines:

SPX Quarterly Returns Since December 1994

STOXX 50 Quarterly Returns Since December 1994

MSCI World Index Quarterly Returns Since December 1994

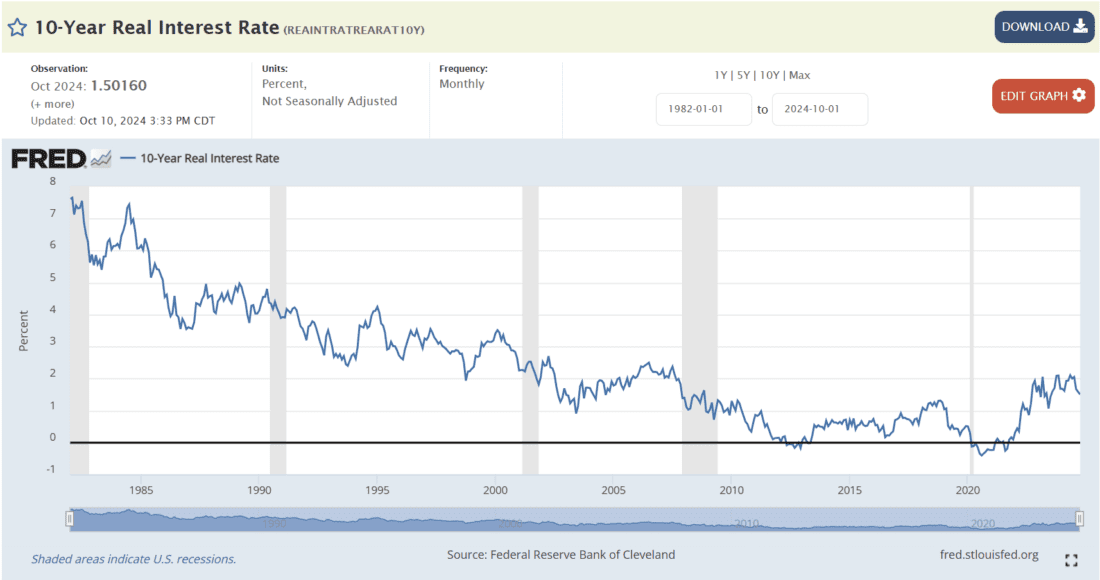

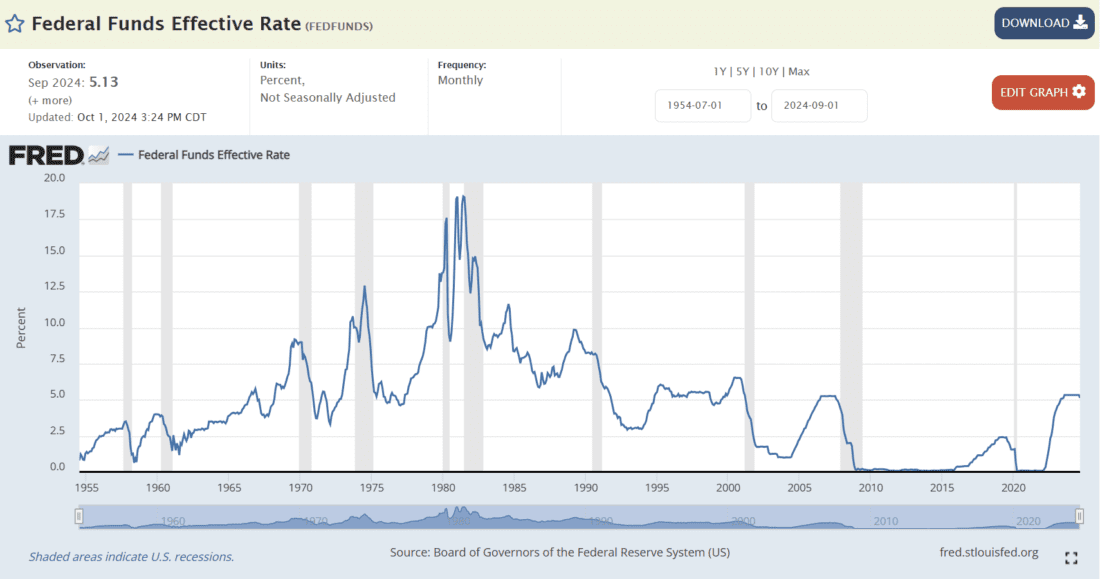

The next few charts focus on interest rates in the US and abroad. Compared to the years since 2008, aka the post-GFC period, we have been recently experiencing very high rates – especially after long stretches of negative real rates. But over a period of multiple decades, the currently elevated rates are actually relatively normal, or even low, on a historical basis. When we consider that the above charts showed steadily positive equity returns during the late ‘90s, when rates tended to be above current levels, we have to wonder whether rate cuts are truly necessary.

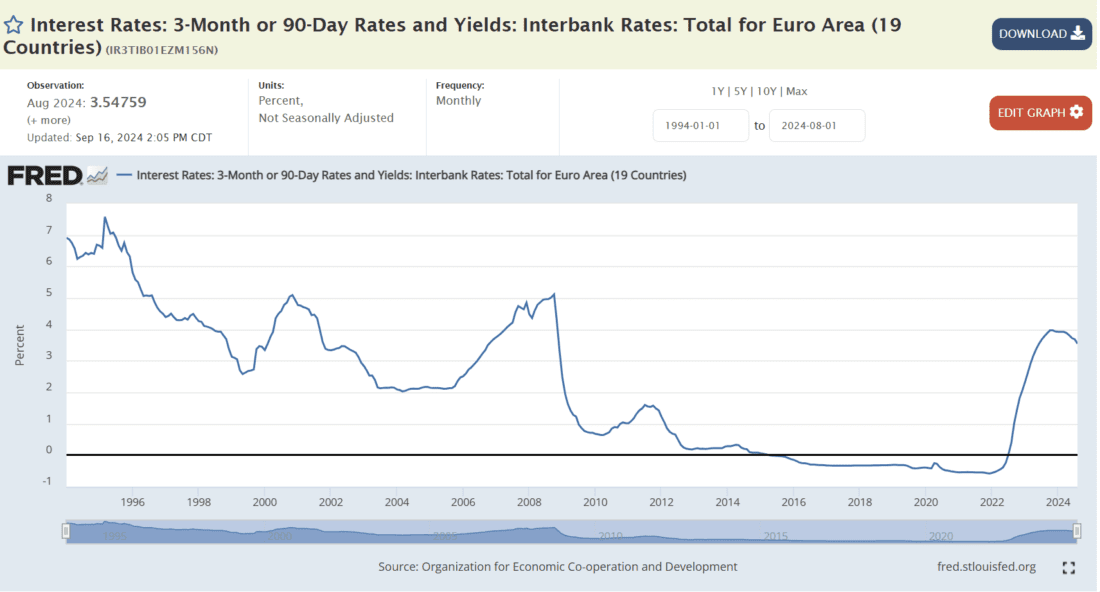

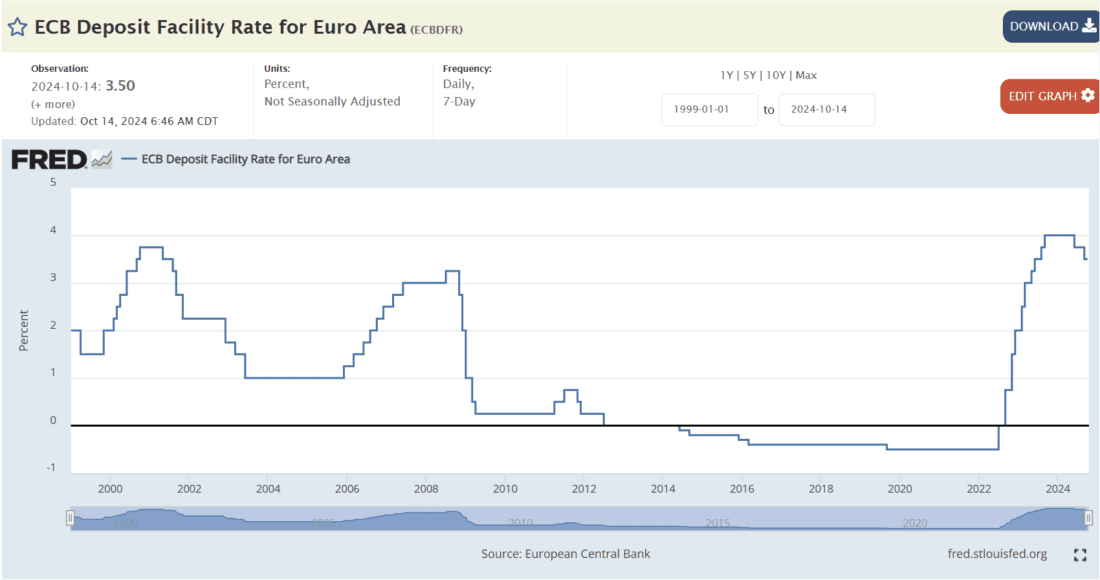

The same goes for Europe, though the historical chart for the ECB only goes back to the creation of the Eurozone. The rates appear historically high, but that is because the timeframe is shorter. Like the US, it is relatively high for the 21st century.

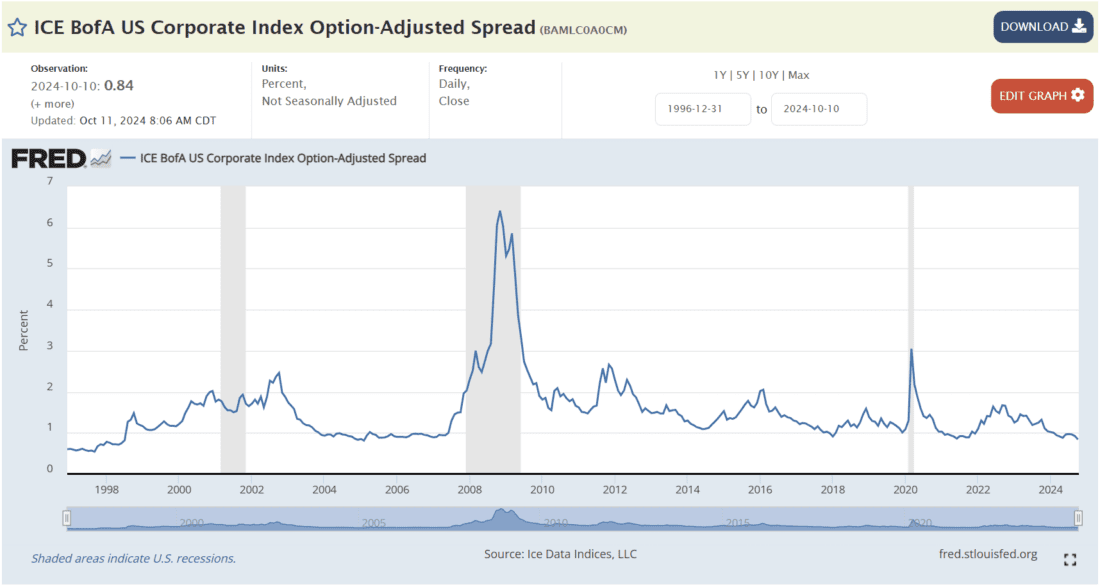

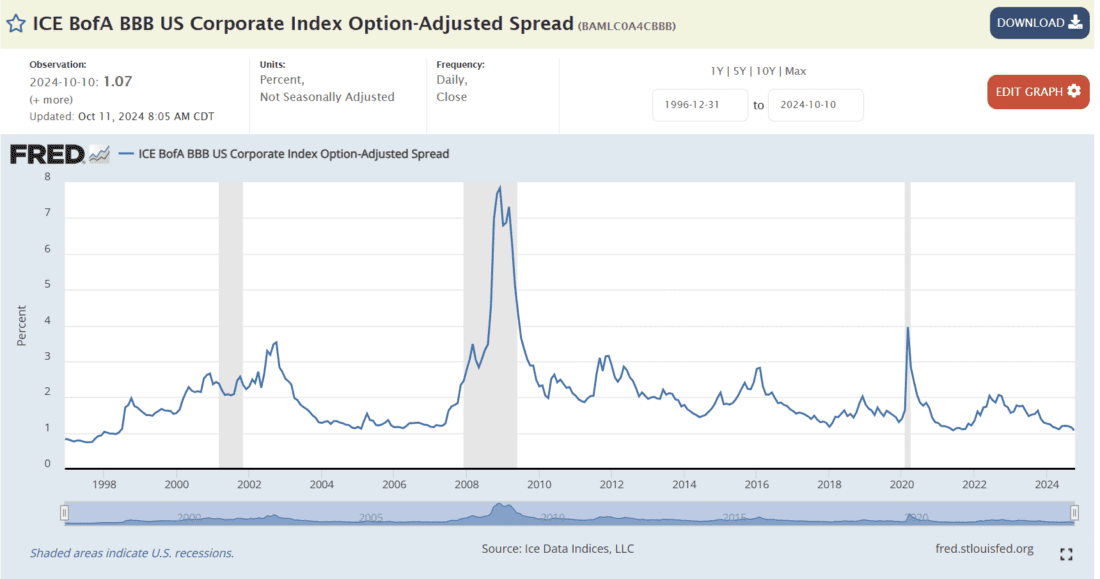

Although it is important to examine the key base rates, that is only one component of the cost of borrowing for key companies. Their debt is typically priced at some level above Treasury securities of similar durations to account for their relative credit risk. From that viewpoint, major companies are not having much trouble borrowing money, since US Corporate credit spreads at or near 25-year lows:

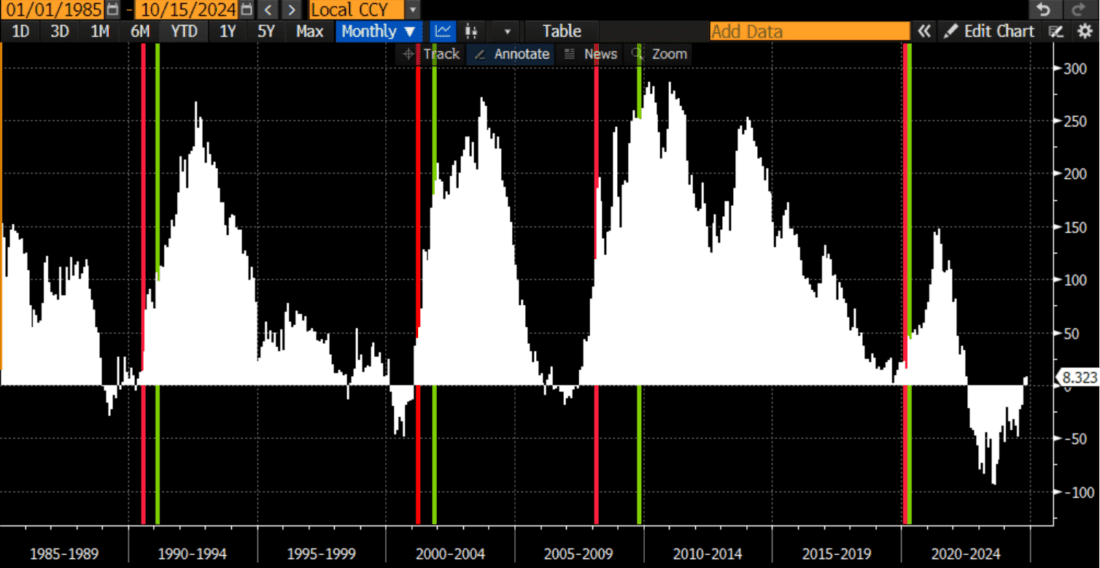

Finally, we return to a graph that we have used before that attempts to map the difference between 2 and 10-year Treasury yields to recessions. While it is true that inverted yield curves typically precede recessions, note that the recessions only begin after the curve normalizes:

Difference Between 2-Year and 10-Year Treasury Rates, with NBER Recession Start (red) and End (green) Dates

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

whatever the point was, I missed it.

I think it was something like ‘4 years from now, as long the US can somehow manage to keep making interest-only payments on the Federal Debt/Deficit/CreditCard/CreditLine, politicians/congress and Wall St. don’t really care about the size of the deficit itself’

In other words, maybe it will all get figured out at some point in the future, but for now, party on!

I think there were a few points he was making. Some probably over my head as well. Point one, rates are still relatively low. Point two, do we really need to lower rates right now. And a third and final point I see seemed more like a question; now that the 2 year and 10 year treasuries have normalized, is a recession imminent?

Nice article and applies to many. In my case, I am a short term options trader. A good reminder of putting prices, rates and valuations in perspective.