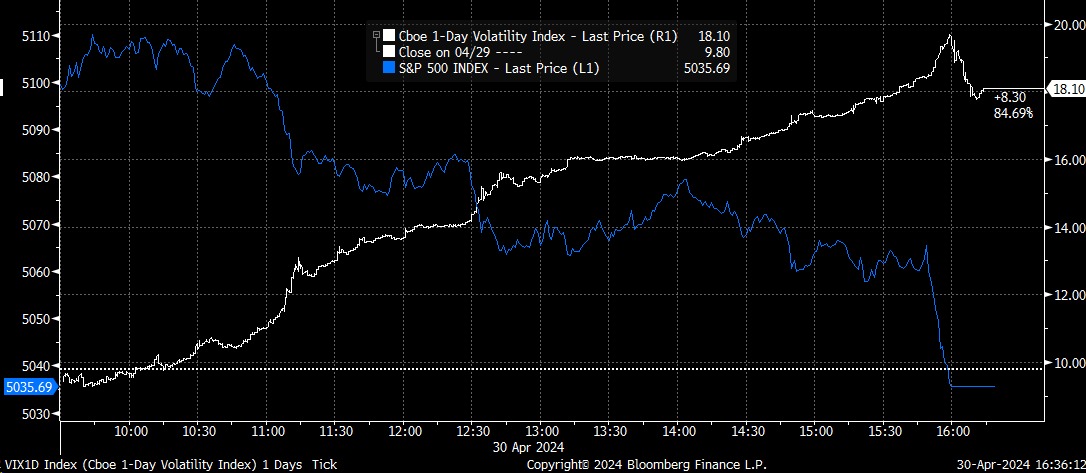

The S&P 500 was down about 1.6% heading into the FOMC meeting and Quarterly Refunding Announcement tomorrow. The VIX 1-Day was up 8.3 points to 18.10, which suggests much of the decline today could have been attributed to hedging activity. It seems likely that once we get past the Fed, we could see that usual volatility crush at around 2:35 PM ET. That is typically when the S&P 500 rallies and everyone starts to comment about the market, with Powell having a dovish tone. Even though we know that the rally has nothing to do with Powell but the passing of the event risk as the VIX 1 Day drops like a stone and heads lower.

(BLOOMBERG)

How much it could rally depends entirely on how much IV rises ahead of time and what the Fed and Powell have to say. If Powell says that the Fed is going to be staying higher for longer, that rate cuts are likely to be somewhat fewer than projections in March, and that financial conditions have eased too much. Then, any IV bump we get probably won’t last. If he talks about still thinking we will have three rate cuts in 2024, the rally could have some legs to it.

But before we get to the Fed, we will have the QRA, and we will find out how the Treasury plans to issue all of the debt. Will it be more bill issuance or coupons? I have no idea. But it will be important to know how that goes because it can determine which way the flow of liquidity goes.

Dollar (DXY)

The dollar had a big move today, given the hotter-than-expected Employment Cost Index report, which rose by 1.2% Q/Q SAAR. This led to the DXY surging by almost 60 bps and perhaps, once again, breaking out of that bull flag, which could lead to a move up to 107 and potentially much higher than that.

Canadian Dollar (CAD)

This also meant that the US dollar rallied against the Canadian Dollar as we started heading up to that all-important resistance level around 1.3860. This is the fourth test of that level, and the last three times the USDCAD failed to push through, it led to an important turning point in the equity market. If the USDCAD pushes higher this time, it will probably indicate that the equity market has further to fall.

2-yr

Meanwhile, the US 2-yr is also poking its head up above the bull flag as well. Again, if the 2-year trend starts heading back to 5.25%, it is a good signal that either rate hikes or rates are being held higher for a long time.

Bitcoin (BTC)

Bitcoin was crushed today, falling 6.5% and dropping below the critical $60,000 level. At present, there doesn’t seem to be much support between its current price and $51,000

Gold

Meanwhile, Gold also fell 2% on the day, with support next up at $2,150. With Gold and Bitcoin falling sharply on the same day, it is either a dollar-related move or a move related to liquidity being removed. Given our conversation the last few days about reserve balances and the TGA, my guess is it is a liquidity thing, another way of saying deleveraging.

Anyway, the S&P 500 finished today down 1.6ish% and is pretty close to breaking the lower bound of a bear flag formed over the last several trading sessions. If the flag is punctured tomorrow, then there is a good chance the next stop could be in the 4,700’s.

It is the same look in the NASDAQ 100, with the next stop potentially in the 16,000’s.

SMCI

Finally, now that the SMCI is in the S&P 500, its results tonight could impact the market. The stock is down about 8%, following the results. The market was pricing in a nearly 13% move in either direction. The company actually missed revenue estimates, coming in at $3.85 billion versus estimates for $3.864 billion. I know it’s minor, but still, that’s not what you expect with a stock that has moved like it has.

Then, the company issued full-year guidance at $14.7 billion to $15.1 billion, versus estimates for $14.6 billion, which doesn’t sound that impressive to me, again, given the runup. It also sees 4Q revenue of $5.1 billion to $5.5 billion versus estimates of $4.7 billion, which sounds good. Still, with an implied move of 13%, an IV for this week’s expiration in the 150s, and lots of positive call delta that will lose lots of value tomorrow, I can’t see this stock going higher. But I guess we will see what happens tomorrow.

(BLOOMBERG)

It seems like everything has lined up for a more significant market drop at this point. Will it happen? Come back tomorrow.

—

Originally Posted April 30, 2024 – The Bears Can Feel It In The Air

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. Eligibility to trade in digital asset products may vary based on jurisdiction.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!