In the first three installments we described an exercise utilizing the long term momentum in asset classes, the relationship between those classes and the Organization for Economic Co-operation and Development (OECD) Composite Leading Indicator (CLI) for the United States, in order to anticipate the business cycle and markets. Those posts are linked below.

Since October when this series was mostly written, several markets have made promising changes in their momentum states and chart patterns. But, this is a teaching exercise so we will mostly work with the data available at the end of September 2023 and mostly (aside from rates) ignore the dramatic changes of last few weeks.

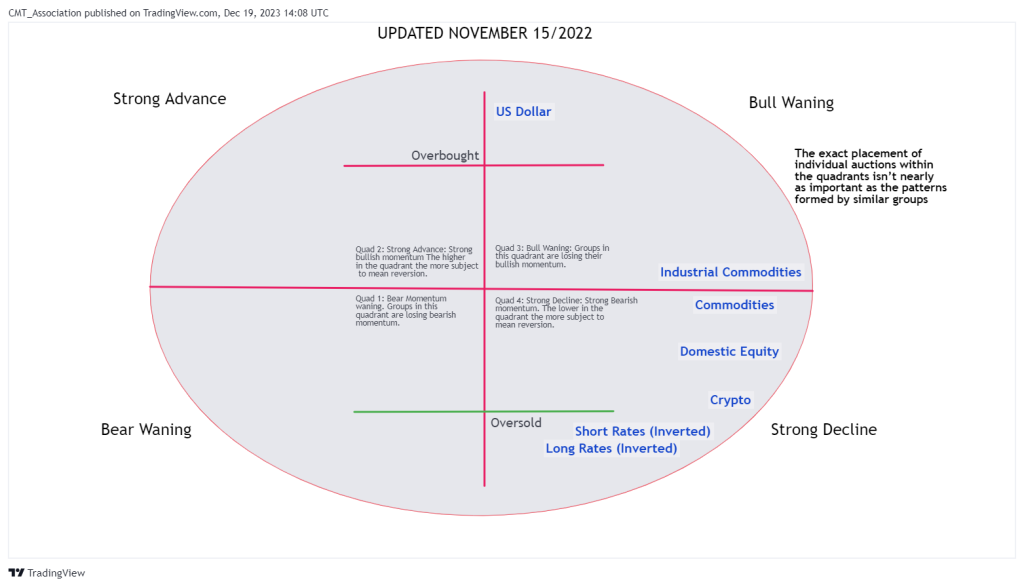

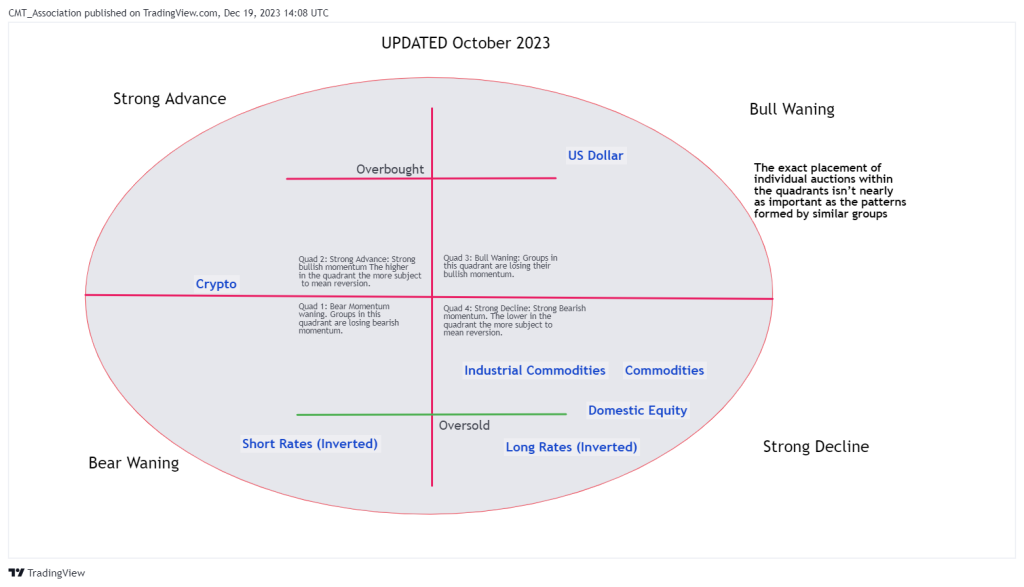

We begin by assessing the change between November 2022 and October 2023. Ideally we should measure at the same point each year. When I was actively managing money this was an exercise I updated in early January so that I could include it in my yearend recap and provide forward guidance to my team. But, given the time perspective involved, slight differences built over a month or two typically make little difference. Interestingly this year may be the exception.

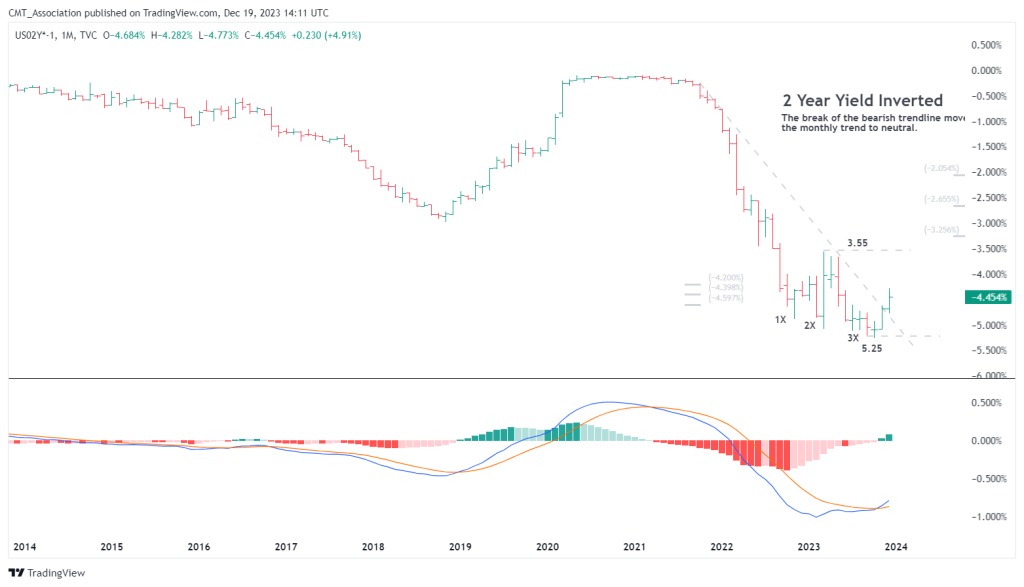

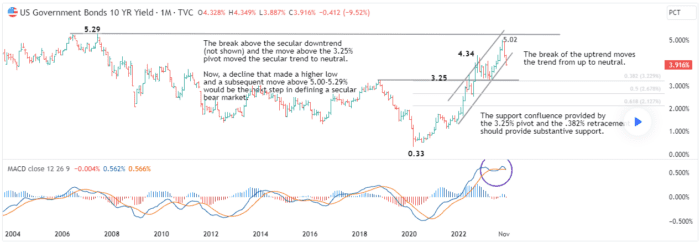

I have included a chart of the two and ten year Treasury yields (inverted). Note the three drives to a low pattern in twos, (a sign of waning supply/growing demand), the break of the downtrend (yet to be confirmed by a monthly close above) and the tentative turn into the bullish quadrant.

I think of rates as the first mover in the cycle. To believe that the business cycle has turned virtuous I would like to see ten year rates make a solid top and begin to reverse at least some of the technical damage created by the break above the multi decade downtrend and the 3.25% pivot that had defined the bull market structure. I would also like to see a more definitive turn higher in twos. In October rates were oversold in terms of momentum and the structure from the 2020 low was completely intact Until I see solid signs of a monthly perspective yield top in the two year and ten year, it will be difficult for me to label this as the kind of high that would lead a change in the economic cycle. Note that the trendline break in the month of December has turned the shorter term 10 year Treasury (inverted) trend from down to neutral.

Commodites: Commodities have moved from the bull waning to strong decline sector. The weakness in commodities remains consistent with a business cycle that continues to weaken.

Dollar: The Dollar remains in bull waning. It has benefited from global flight to quality, carry and the aggresiveness of our central bank verses other central banks. But, of the asset classes, the Dollars relationship to the business cycle is the least consistent.

Equities: Domestic equities have been mired in the strong decline sector (in part two we discussed at length why equities were still plotted in this sector). In October we were still categorizing equities as lower due to the lack of a rally in most of the equal weight and broader indexes. That remains the case, but barely, with the equal weight moving slightly above the top of its range.

In part 5 we will draw final conclusions and attempt to extrapolate them to 2024.

And finally, many of the topics and techniques discussed in this post are part of the CMT Associations Chartered Market Technician’s curriculum.

—

Originally Posted December 19, 2023 – Business Cycle Rotation Part 4

Disclosure: CMT Association

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CMT Association and is being posted with its permission. The views expressed in this material are solely those of the author and/or CMT Association and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!