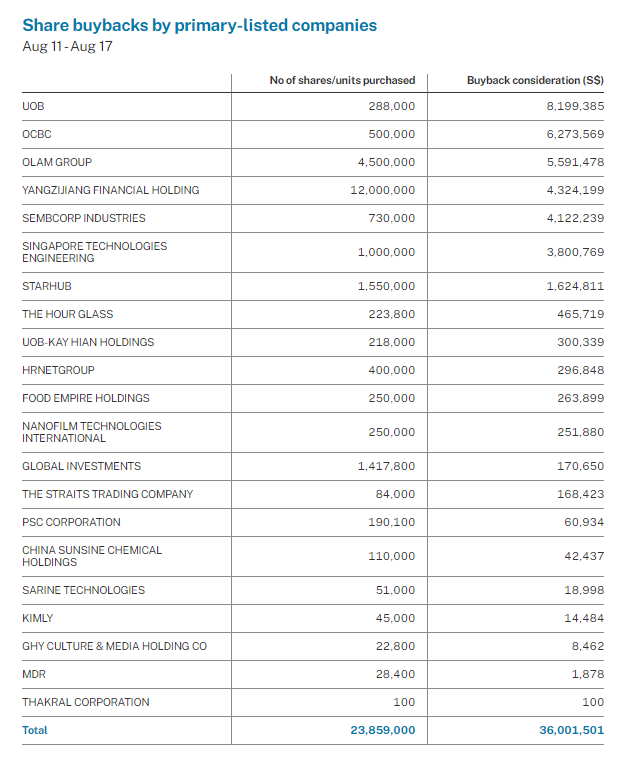

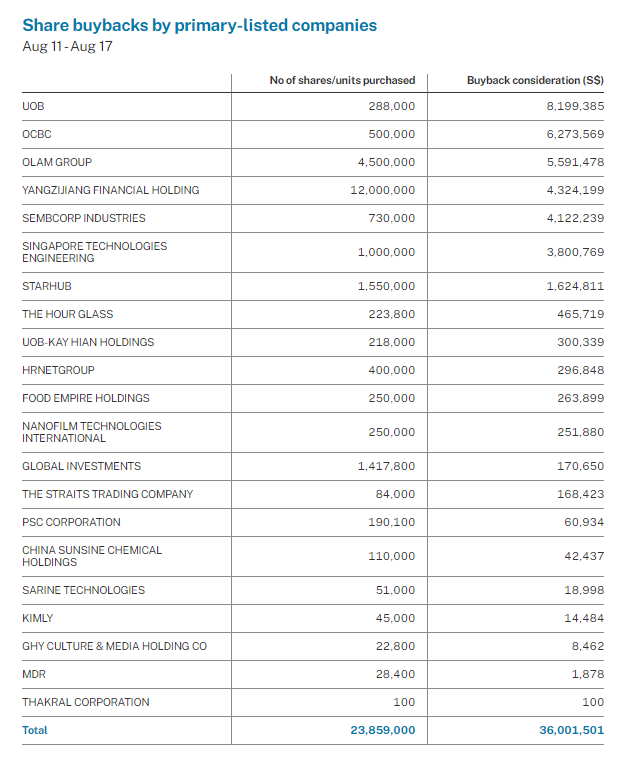

Institutions were net buyers of Singapore stocks over the five trading sessions through to Aug 17, with S$256 million of net institutional inflow, while 21 primary-listed companies conducting buybacks with a total consideration of S$36 million.

DBS, UOB, Singapore Technologies Engineering, OCBC, Seatrium, Singapore Exchange, Mapletree Logistics Trust, Yangzijiang Shipbuilding, ComfortDelGro Corporation and HongkongLand led the net institutional inflow over the five sessions.

Meanwhile, Venture Corporation, Singtel, Frasers Logistics & Commercial Trust, Sats, Jardine Matheson, City Developments, Sembcorp Industries, Suntec Reit, Keppel Corporation, and Nanofilm Technologies International led the net institutional outflow over the five sessions.

The five trading sessions saw 90 changes to director interests and substantial shareholdings filed for close to 50 primary-listed stocks.

This included 15 company director acquisitions with one disposal filed, while substantial shareholders filed 11 acquisitions and seven disposals.

Acquisitions were filed for directors/chief executives of Wilmar International, Datapulse Technology, QAF, JB Foods, Annaik, Baker Technology, Sinostar Pec Holdings, United Hampshire US Reit, Yangzijiang Financial Holding, Bonvests Holdings, Elite Commercial Reit, Ascent Bridge and Darco Water Technologies.

Wilmar International

Wilmar International chairman and CEO Kuok Khoon Hong increased his deemed interest in the company following the release of its FY22 (ended Dec 31) financial results.

Over the four sessions, HPRY Holdings acquired 5,635,200 shares, Longhlin Asia acquired 1,630,900 shares and Hong Lee Holdings acquired 1,630,900 shares.

The 8,897,000 shares were acquired at an average price of S$3.64. The consideration of the acquisitions totalled S$32,421,859, increasing Kuok’s total interest in Wilmar from 13.24 per cent to 13.38 per cent.

Kuok is deemed to be interested in Wilmar shares held by HPRY Holdings, HPR Investments, Hong Lee Holdings, Kuok Hock Swee & Sons, Longhlin Asia, KHS (Hong Kong) (formerly known as Pearson Investments), Jaygar Holdings, through trust accounts controlled by him and through his spouse Yong Lee Lee.

His preceding acquisition was on May 31, with Longhlin Asia and Hong Lee Holdings both acquiring 1.5 million shares of Wilmar at an average price of S$3.907 per share.

Kuok has extensive experience in the agribusiness industry and has been involved in the grains, edible oils, and oilseeds businesses since 1973. He has served as the chairman of Wilmar International since July 2006.

Prior to the acquisitions, on Aug 11, Wilmar reported a net profit of US$550.9 million for its H1FY23 (ended Jun 30), compared to its record US$1.16 billion in H1FY22.

Revenue for H1FY23 declined 10 per cent to US$32.54 billion from H1FY22, as prices of most commodities decreased, which was partially offset by higher sales volume during the period.

Kuok noted that most of Wilmar’s markets, except for India, experienced a slowdown in Q2FY23.

He added that the results were further impacted by lower palm oil and fertiliser prices, as well as lower processing margins for the group’s mid and downstream operations and that this was partially offset by strong performance from the sugar and shipping divisions.

He also maintained that the group has made good progress in its new businesses such as condiments, food park, and central kitchen projects which he believes will become significant contributors to the group’s operations in future.

Barring unforeseen circumstances, the group believes H2FY23 will be better than H1FY23. The global leader in processing and merchandising of edible oils, oilseed crushing, sugar merchandising, milling, and refining, production of oleochemicals, specialty fats, palm biodiesel, flour milling, rice milling, and consumer pack oils employs a workforce of around 100,000.

QAF

On Aug 15, QAF joint group managing director and executive director Lin Kejian acquired 450,000 shares at an average price of S$0.79 per share. With a consideration of S$355,410, this increased his total interest in QAF from 48.22 per cent to 48.30 per cent.

Lin’s preceding acquisitions were back in late June 2020 with 47,600 shares acquired at an average price of at S$0.78 per share.

On Aug 8, QAF reported that its H1FY23 (ended Jun 30) revenue increased 12 per cent from H1FY22, with profit after tax declining 41 per cent.

The group noted that the poorer performance for H1FY23 compared with H1FY22 was largely due to the share of losses in its joint venture, Gardenia Bakeries (KL), of S$10 million for H1FY23 compared to S$3.8 million share of profits for H1FY22.

On the other hand, better performance by both the bakery and distribution & warehousing segments improved the group’s performance.

JB Foods

On Aug 11, JB Foods executive director Goh Lee Beng acquired 552,000 shares at S$0.53 per share.

With a consideration of S$292,560, this took her direct interest in the company from 1.67 per cent to 1.85 per cent.

She also maintains a 45.52 per cent deemed interest in JB Foods through the shares held by JB Cocoa Group.

Her preceding filed acquisitions were on Jul 5 and Feb 1, at respective prices of S$0.51 per share and S$0.48 per share.

Goh has over 25 years of experience in the cocoa business.

She is responsible for procurement of raw materials and managing the cocoa trading positions of the group.

This includes sourcing of cocoa beans and cocoa ingredients, managing the group’s cocoa hedging book, monitoring world cocoa trends, and marketing of cocoa butter.

Established since the 2000s, JB Foods is a major cocoa ingredients producer with operations spanning the Asia-Pacific, Europe, North America and West Africa, and a cocoa bean processing capacity of 180,000 tonnes per year.

Prior to Goh’s acquisition, on Aug 10, JB Foods reported that its H1FY23 (ended Jun 30) revenue of US$271.2 million was fuelled by growth in demand for cocoa ingredients, which saw a marked increase in the higher shipment volume.

The group also reported profit after tax growth in H1FY23 of 15.5 per cent to US$8.4 million.

With he results, JB Foods CEO Tey How Keong maintained that despite the challenging and uncertain business environment, the group continue to grow and expand its customers base in all regions.

He added that the group is making good progress in executing on its ongoing strategy, and expanding gradually through existing capabilities and facilities, and building its in-house sustainability resources, and formalising its sustainability roadmap.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted August 21, 2023 – Wilmar’s Kuok Khoon Hong acquires 9 million shares

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!