For the trading sessions that spanned May 26 to Jun 1, the Straits Times Index (STI) slipped 1.3 per cent while the Hang Seng Index fell 2.8 per cent and the FTSE Bursa Malaysia KLCI declined 1.4 per cent.

Institutions were net sellers of Singapore stocks over the five sessions with S$93 million of net outflow following the preceding five sessions of S$4 million of net inflow.

DBS, CapitaLand Investment, Sats, Singtel, and Yangzijiang Shipbuilding (Holdings) led the net institutional outflow for the five sessions.

Meanwhile, OCBC, Sembcorp Industries, UOB, Mapletree Logistics Trust, and City Developments led the institutional inflow over the five sessions.

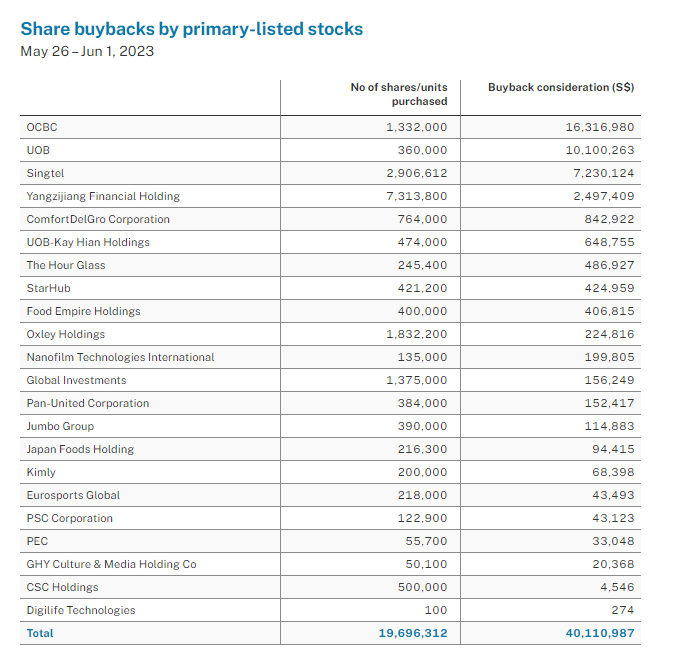

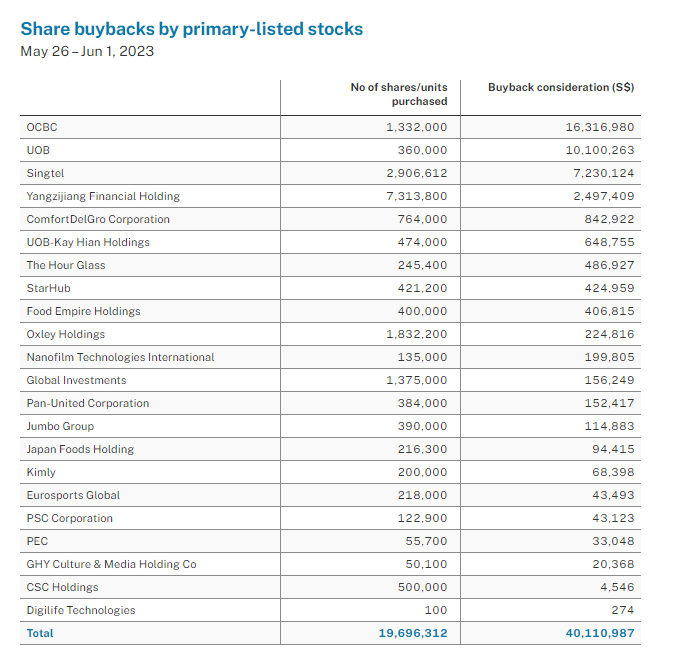

Share buybacks

There were 22 companies conducting share buybacks over the five trading sessions through to Jun 1 with a total consideration of S$40.1 million, following the S$22.1 million filed for the preceding five sessions.

Director and substantial shareholder transactions

The five trading sessions saw close to 100 changes to director interests and substantial shareholdings filed for more than 40 primary-listed stocks.

This included 19 company director acquisitions with three disposals filed, while substantial shareholders filed five acquisitions and four disposals.

Wilmar International

On May 31, Wilmar International chairman and CEO Kuok Khoon Hong increased his deemed interest in the agribusiness. Longhlin Asia and Hong Lee Holdings both acquired 1.5 million shares of Wilmar at an average price of S$3.907 per share.

The consideration of the acquisitions totalled S$11,721,000, increasing Kuok’s total interest in the company from 13.19 per cent to 13.24. His preceding acquisition was on May 3, with a total of 311,000 shares acquired at S$3.85 per share.

Kuok has extensive experience in the agribusiness industry and has been involved in the grains, edible oils and oilseeds businesses since 1973.

Back in FY22, Wilmar conducted S$278 million in buybacks at an average price of S$4.11.

Responding to a question from the Securities Investors Association (Singapore) or Sias, prior to the Apr 20 annual general meeting (AGM), Wilmar International said that the buybacks were conducted because the share price was grossly undervalued. Management reasoned that as at Dec 31, 2022, the market capitalisation of the share of its Chinese subsidiary, Yihai Kerry Arawana, was S$40.38 billion, and that of its Indian associate, Adani Wilmar, was S$5.65 billion, which translated to a combined value of S$7.37 per share.

Wilmar also provided an update on the central kitchen (CK) business noting that the CK Food Park project is an important new extension of the group’s value chain and complements it existing businesses.

It added that it will build multiple integrated food park complexes and site most of them in the integrated manufacturing plants throughout China to address the growing need for efficient and quality food production.

The first CK Food Park project in Hangzhou (Zhejiang province) commenced operations in April 2022, followed by three more in Zhoukou (Henan province), Chongqing, and Xingping (Shaanxi province) respectively.

Another six projects are under construction in Langfang (Hebei province), Shenyang (Liaoning province), Kunshan (Jiangsu province), Yanzhou (Shandong province), Guangzhou (Guangdong province) and Huai’an (Jiangsu province). The Langfang and Shenyang projects are expected to be operational this year.

Wilmar maintained that the Food Parks generate multiple sources of revenue, including revenue from the group’s own central kitchen, rental income from tenants (that is, other central kitchen operators, food manufacturers, ingredient suppliers, service providers), sale of its products to Food Park tenants (for example, cooking oil, rice, flour, noodles, condiments, detergents) and provision of services (for example, warehousing, distribution).

Bonvests Holdings

On May 30, Bonvests Holdings executive chairman Henry Ngo acquired 486,000 shares in a married deal at S$1.00 per share. The acquisition was made through Allsland, which is wholly owned by Ngo, while lead independent director Chew Heng Ching was on the other side of the married deal. Ngo also made a small market acquisition of 1,500 shares on May 30.

The two acquisitions saw his total interest in Bonvests Holdings increase from 84.41 per cent to 84.54 per cent.

Ngo has gradually increased his total interest in the group from 82.93 per cent in August 2018.

The three core businesses of the group span property development and investment, hotel ownership and management, and waste management and contract cleaning of buildings.

YKGI

Between May 25 and 26, YKGI executive chairman and executive director Seah Boon Lock acquired 1,341,900 shares at an average price of S$0.131 per share. With a consideration of S$175,327, this increased his deemed interest in the Catalist-listed food and beverage (F&B) player from 76.92 per cent 77.23 per cent.

Seah has gradually increased his deemed interest in YKGI from 76.70 per cent on Feb 6.

He has more than 30 years of experience in the F&B industry and was a founder the group.

YKGI, an abbreviation for Yew Kee Group International, represents the aspirations of the group expanding internationally from Yew Kee, a household name which started in the 1950s as a pushcart selling braised duck rice in Nee Soon, to Yew Kee Group which manages a diverse portfolio of brands.

Marco Polo Marine

On May 29, Marco Polo Marine (MPML) non-executive director Darren Teo Junxiang acquired 1.5 million shares at S$0.05 per share. With a consideration of S$75,000 this increased his total interest in the integrated marine logistics company from 16.17 per cent to 16.21 per cent.

He is currently the managing partner of Apricot Capital, a private investment company with business interests in real estate, offshore marine, education and consumer lifestyle business. These business interests include a 16.17 per cent interest in MPML. This accounts for Teo’s deemed interest in MPML, given that he indirectly owns 20 per cent of the issued and paid-up share capital of Apricot Capital.

Teo’s responsibilities at the private investment company include evaluating investment opportunities, executing strategic deals and managing the investment portfolio.

On May 11, MPML reported its H1FY23 (ended Mar 31) revenue at S$55.9 million, more than double its H1FY22 revenue. The significant increase was attributed to the outstanding performance of both the ship chartering and ship building & repair operations.

For H1FY23, ship building & repair operations contributed 56 per cent of total revenue while the other 44 per cent came from ship chartering.

As a result of the growth in both segments, MPML’s H1FY23 gross profit surged to S$17.7 million, a 116 per cent increase from H1FY22.

MPML CEO Sean Lee noted that the ship chartering and shipyard operations experienced strong growth due to increased demand and also as a result of the group’s expansion plans.

He added that the offshore windfarm sector continues to present vast potential for the group, with positive momentum expected to continue into the second half of 2023 and beyond, delivering sustainable growth and value to stakeholders.

Ban Leong Technologies

Between May 29 and 30, Ban Leong Technologies managing director Ronald Teng Woo Boon increased his deemed interest by 120,000 shares at an average price of S$0.366 per share.

With a consideration of S$43,950, the acquisitions by Teng’s spouse, Teo Su Ching, saw him increase his total interest in the distributor of technology products from 26.96 per cent to 27.06 per cent.

Headquartered in Singapore, Ban Leong Technologies distributes a diverse range of IT accessories, multimedia, and data storage products in both commercial and consumer segments. Teng is the founder of the group.

Enviro-Hub Holdings

On May 26, Enviro-Hub Holdings executive chairman Raymond Ng acquired 1,112,500 shares of the company at S$0.034 cents per share. With a consideration of S$37,825, this took his total interest in the environmental management solutions group from 28.46 per cent to 28.53 per cent.

This followed his acquisition of 550,000 shares of the company at S$0.032 cents per share on May 22.

Ng is responsible for the group’s overall management, business development, investment decisions as well as strategic direction and planning.

He has accumulated over 35 years of experience in the recycling and e-waste management & recovery business. He is also a property developer with more than 20 years of industry experience.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted June 5, 2023 – Wilmar chief Kuok Khoon Hong adds to his stake

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!