Buying the dip has become one of the most popular strategies with a wide range of investors, and generally quite a reliable one. We saw it in action yesterday, when the S&P 500 (SPX) recouped about two-thirds of Friday’s declines. So far this month, however, we have seen a pattern of lower highs and lower lows. That is the definition of a downtrend, short as it is. Here is the concern: buying a dip works really well in an uptrend but becomes treacherous if a downtrend becomes more sustained.

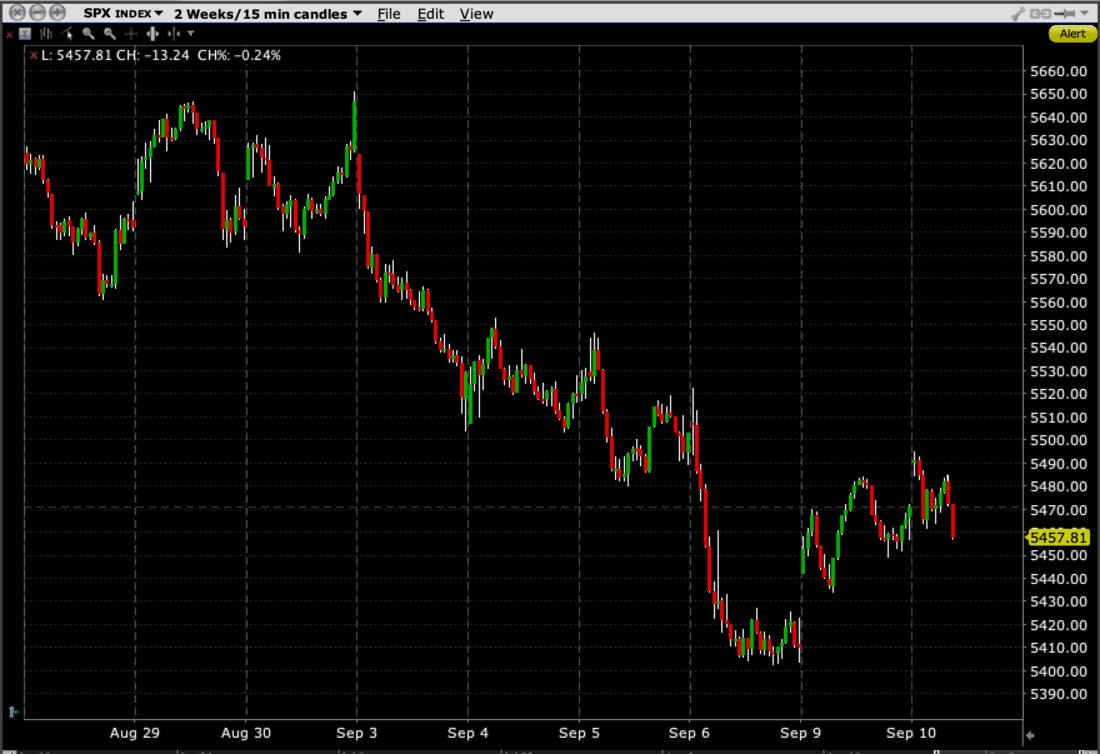

In the chart below, note the activity since the end-of-month spike that occurred at the end of August. There have been tradeable rallies, but the prevailing short-term trend is lower.

SPX 2-Weeks, 15-Minute Candles

Source: Interactive Brokers

If buying dips works in an uptrend, the opposite must be true in a downtrend. Selling rallies becomes the preferred strategy. The direction of the trend dictates which type of trade – long or short – is more likely to be profitable over a longer period. In theory, that change is easy enough to identify. In reality, it is extraordinarily difficult to recognize turning points. Every change in a secular trend starts as a modest change in the shorter-term trends. Sometimes that trend change is triggered by a major market event, say a day when advances outpace declines (or vice versa) by 10:1 on high volume; but other times the change is subtle.

A subtle change in trend can be like the proverbial frog in a pot. The water can seem pleasant, but if the temperature is raised gradually, the frog might not react in time to escape the boiling water.

Now consider active investors who have been accustomed to seeing every dip as a buying opportunity. The dips can be bought – even bear markets have (sometimes ferocious) rallies – but the window for profitable trades from the long side shrinks dramatically. Those who expend their capital chasing downticks risks piling on losses.

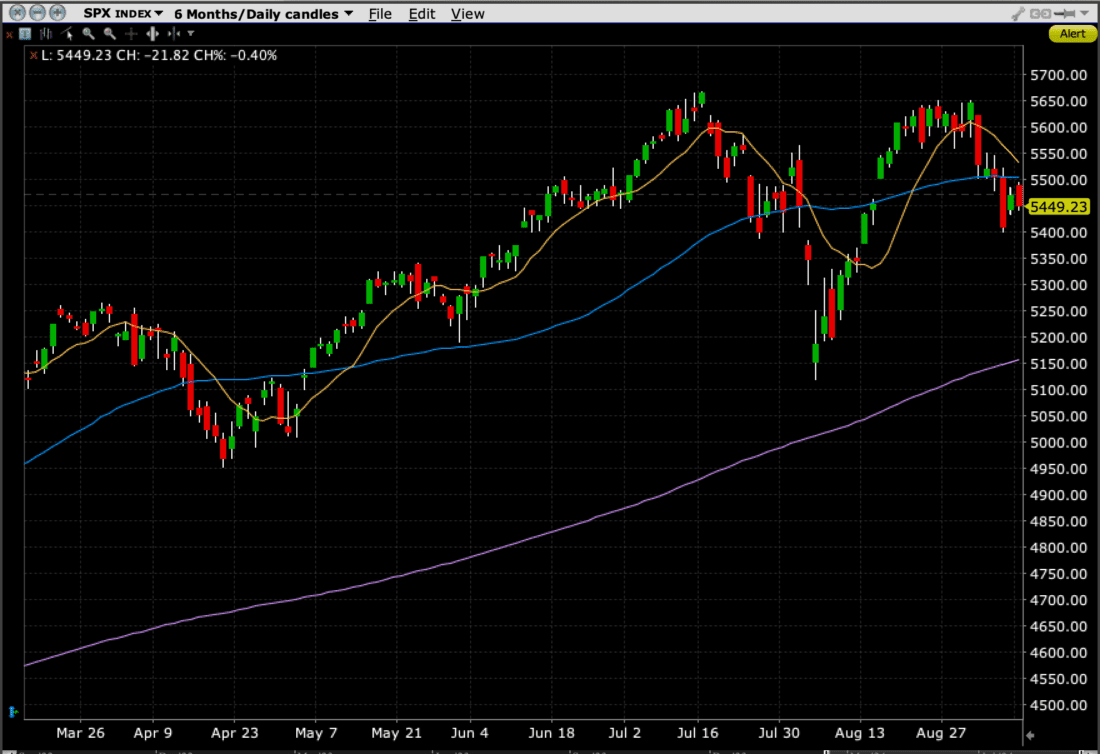

That said, so much of this depends upon the trader or investor’s time horizon. Trends can play out over simultaneously. For example, in the chart below, we can see that while a shorter-term moving average (10 days) is pointing sharply lower, the longer-term 50-day moving average is flattish, while the 200-day is still pointing solidly higher.

SPX 6-Months, Daily Candles with 10-day (yellow), 50-day (blue), 200-day (purple) Moving Averages

Source: Interactive Brokers

Thanks to the fractal nature of price movements, even shorter-term trends might be up or down over any given time period even within the longer trends. The key is matching the trend to the user’s time horizon. If one is day trading, for example, the longer-term trend may certainly be informative, but the decisions should be based on shorter intervals. If one is a long-term investor, however, short-term moves might simply be noise amidst a secular move.

The problems arise when people forget that logic, when normally disciplined traders hold onto long positions under the guise of them becoming good investments, or when stolid investors react to short-term dislocations. Knowing your style and risk tolerance is key. There’s an old adage that says “bulls make money, bears make money, pigs get slaughtered.” I know of none regarding frogs getting cooked.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Yeah, this is all good. However, I need to know which stock I can buy today that will help—all this talking. Please explain how this helps me.

good article, thank you.

We hope you continue to enjoy Traders’ Insight!

The author certainly doesn’t leave the reader with a directive on what to do today, but I thought that he articulated well the importance of knowing what kind of market you are in. I have been trading, and investing, for fifty years and know well both the difficulty and the importance of knowing what kind of market you are in. I am inclined to think that we are in a topping formation, but I will remain flexible for the moment. BTW, as much as one may disparage Jim Cramer, he does say, “there is always a bull market somewhere.” That’s a true statement. Said another way, even in a bear market, different stocks bottom at dramatically different times, but as we used to say, “when they raid the whore house, all the girls go.”

It seems to me that anyone who thinks Steve’s role is one of a stock advisor has missed the point. Should you wish to find a stock that is attractive consider doing your homework. Looking at HV in comparison with IV is a start, where is the stock in it’s iv rank? where is it in it’s earnings cycle. That’s how you find stocks that are interesting not asking others how to guide you.

If you are holding long term for say five to ten years, buying dips will work out whether it’s a short term up trend or down trend. Because in the long run it’s an up trend for these index funds and tech funds I like to buy. In fact buying in the short term down trend is great as you will accumulate more shares for later on when you sell at the all time high.