Late March into early May is undoubtedly one of my favorite stretches of any calendar year. A confluence of events factor into my affinity for this period. The weather in the northern hemisphere changes (for the better) and nature springs back to life. It reminds me that there is a natural cycle to everything.

In addition to the longer days and warmer temps, sports fans get to enjoy “March Madness” (plus, The Masters and the new baseball season). The annual NCAA tournament connects broadly with the public. On average, about 80 million brackets are filled out by rabid and casual fans alike.

The matchups and dramatic endings become “water cooler” fodder. Most people favor the top seeds while others look to pick upsets. Some just root for their alma mater and hometown teams (Go Marquette and Northwestern).

In my estimation, there is a significant correlation between March Madness and investing. The NCAA tournament is condensed which naturally adds excitement. By contrast, most investment horizons incorporate far more than two to three weeks. In either case, people love to pick a winner. There are perennial favorites and appealing dark horses.

In capital markets, the annual “favorites” have been Apple, Microsoft, Amazon, Alphabet, Tesla, etc. For the sake of example, they are like Duke, Kansas, Kentucky, North Carolina, and Michigan State – perennial winners.

However, none of those “blue blood” teams were represented in the Final Four in 2023. It’s highly unlikely that you had San Diego State, Florida- Atlantic, Miami and Connecticut coming out of each bracket. Congrats if you picked even one.

In the same vein, last year, the investing favorites underperformed. Apple declined by more than 26% in 2022. That was Apple’s worst annual performance since 2008 when AAPL declined nearly 57%. MSFT, AMZN, TSLA and GOOGL suffered in tandem.

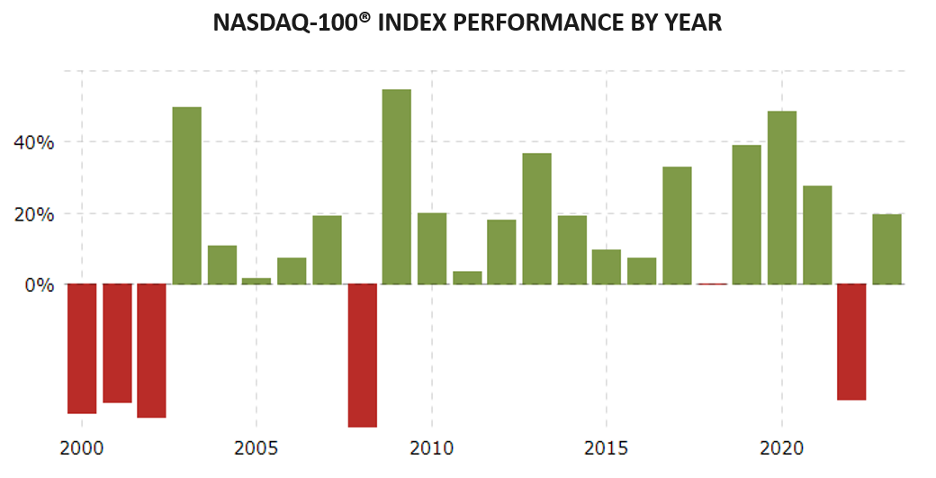

Not surprisingly, 2022 was a difficult year for the Nasdaq-100® Index (NDX). Like the major constituents, the bellwether index suffered its worst calendar year drawdown since the Global Financial Crisis.

Source: MACROTRENDS

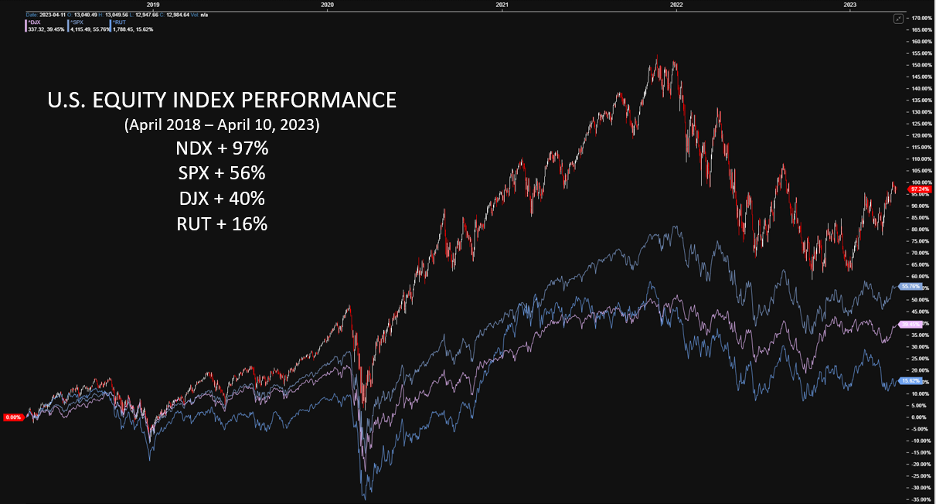

What if you zoom out? Instead of focusing on a shorter time horizon, we look at the cumulative performance over a 5- or 10-year scope. Here’s a look at the NDX (red/white bar chart) compared to the S&P 500 (dark blue), Dow Jones Industrial Average (DJIA) (pink), and Russell 2000 (light blue) going back 5 years.

Source: LIVEVOL PRO

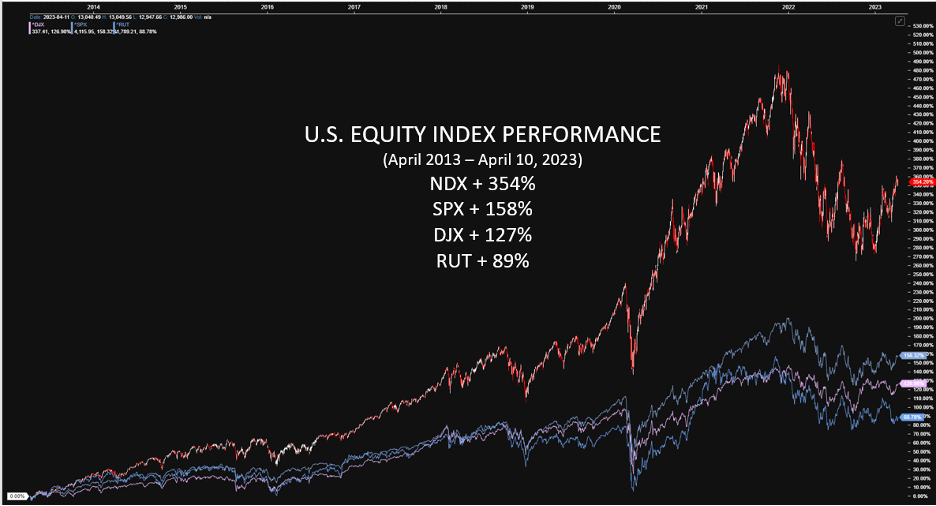

Want to see how the indexes performed over the past decade?

Source: LIVEVOL PRO

The “winner” has been the Nasdaq-100. The NDX behaved a bit like the UConn Huskies who won their six tournament games by an average of 20 points. Huzzah.

I can almost hear the readers (appropriately) saying to themselves, “that’s great Kevin, you work for Nasdaq and their index has outperformed over a variety of time horizons, but what’s the point?”

To which I respond: “You’re right. I do work for Nasdaq and the NDX has performed exceptionally well compared to other indexes.”

I’ll answer the question with one more question.

Do you know which individual equities have performed the best over the three decades?

The answer, at least according to compliance, depends on your criteria.

Example: exclude microcap companies.

Charlie Bilello from Creative Planning puts out great content on these topics. It was last updated in mid-2022 when many well-known tickers were in the midst of a significant drawdown. Nevertheless, you’ll recognize many of the firms, particularly if you track the Nasdaq-100. In alphabetical order, they include:

- Altria Group (MO)

- Apple Inc. (AAPL)

- Amazon (AMZN)

- Johnson Controls International (JCI)

- Microchip Technology (MCHP)

- Monster Beverage (MNST)

- Netflix Inc. (NFLX)

- Nvidia Corp. (NVDA)

- NVR Inc. (NVR)

- Pool Corp. (POOL)

A few things jump out.

- Seven of the ten companies are Nasdaq-listed.

- Six of the ten (bolded) are currently part of the Nasdaq-100 Index.

- Nearly every one of these stocks has endured a massive drawdown.

Amazon shares fell by nearly 95% between December 1999 and September of 2001. Apple fell by 82% over an 8-year time frame. Those are the types of declines that often shake out individual shareholders. So how can you potentially avoid those mettle-testing selloffs?

There’s a natural desire to believe we can “buy the bottom and sell the top.” Take it from someone who has tried – you almost certainly won’t. That’s like choosing Florida-Atlantic, San Diego State and Miami to be in the Final Four this year. It’s highly improbable.

Instead of choosing individual equities, perhaps it makes sense to track an index like the Nasdaq-100 which is home to most of these paradigm changing companies.

The NDX Methodology is systematic (not discretionary) and includes the top 100 largest Nasdaq-listed non-financial companies. The index is skewed toward Information Technology (49%), Communication Services (16.8%), and Consumer Discretionary (14.5%). There are also constituents in Health Care (6.4%), Industrials (4.4%), as well as Utilities.

Indexing allows for more broad exposure, which inherently reduces your risk away from individual equities. Indexes typically have lower realized volatility when compared to single name equities (but not always).

There are a variety of tools that afford end users exposure to an index. You might consider an ETF that tracks the Nasdaq-100. You could use a mutual fund or a futures contract. You may be inclined to use index options that allow for specific exposure over the life of the contract(s). It’s possible to use these tools together as well. For example, maintain passive long exposure with an index-tracking ETF and use options to manage your risk over specific time frames.

Like so many other things in life, we learn by doing. Work to figure out what approach best serves your needs. Then work to improve.

Consider investing early and be consistent. From my perspective, success in capital market adheres to the 10,000-hour rule in many ways. Most people begin investing when they start working and have discretionary income. Put succinctly – the longer your time horizon, the better.

In general, people work for 30 or more years. Those same people tend to get better at their profession in time. Making a point to consciously put earnings aside to invest early is foundational.

There’s nothing you can do about the past. Like my mom told me growing up, “you can’t should have.” You can’t should have picked Florida-Atlantic. You can’t should have put your whole nest egg in Amazon in late 2001. Don’t dwell on that.

You can, however, make a plan now and work to potentially improve the future.

Index investing may be part of that future path.

—

Originally Posted April 13, 2023 – What to Know About Index Investing

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Disclosure: Nasdaq

Index

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2023. Nasdaq, Inc. All Rights Reserved.

Options

For the sake of simplicity, the examples included do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy.

Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies may be obtained from your broker, one of the exchanges or The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, IL 60606 or call 1-888-OPTIONS or visit www.888options.com.

Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and education purposes and are not to be construed as an endorsement, recommendation or solicitation to buy or sell securities.

© 2023. Nasdaq, Inc. All Rights Reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Nasdaq and is being posted with its permission. The views expressed in this material are solely those of the author and/or Nasdaq and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!