In a piece last week, we asserted that this week would be the “main course” of the earnings season buffet. This afternoon we hear from Microsoft (MSFT) and Alphabet (GOOG, GOOGL), which alone represent just under 10% of the weight of the S&P 500 Index (SPX) and about 17.5% of the NASDAQ 100 (NDX). With other mega-cap heavyweights like Apple (AAPL), Amazon (AMZN) and Meta Platforms (META) to come later this week, the earnings season entrees are hitting the table.

On Wednesday afternoon, traders enjoyed the tasty morsel that was Tesla (TSLA) earnings, pushing that up just under 10% in the subsequent day’s trading. Interestingly, the options market was somewhat blasé ahead of what turned out to be an upside surprise. Since then, SPX has given back its gains, though TSLA has been resilient. Traders appear to be more focused on the positive surprise than the limp overall market, however, at least when it comes to GOOG.

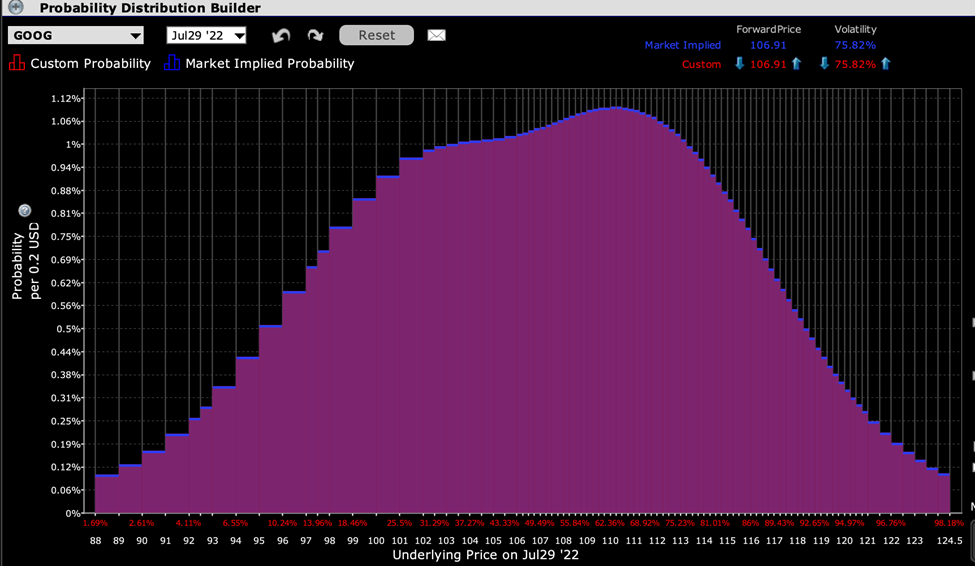

The IBKR Probability Lab shows an unusual hump in above market options expiring Friday. We see a peak in the area around $111, about 5% higher from current levels. That alone would not be particularly unusual, but the relatively linear rise in at-money options and a secondary bump above market is. It appears that traders are sanguine about upside for GOOG after results:

IBKR Probability Lab for GOOG Options Expiring July 29th

Source: Interactive Brokers

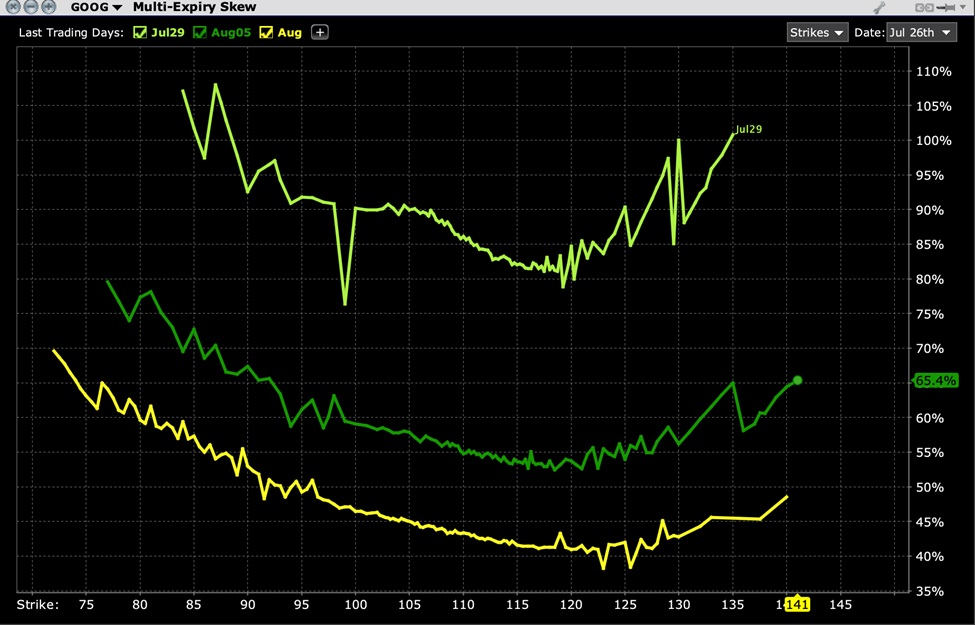

This sanguine view becomes apparent when we look at the skews on near-term options. Note the big decline in the current week’s implied volatilities for above-market options in the graph below:

GOOG Options Skew, July 29th (top), August 5th (middle), August 19th(bottom) Expirations

Source: Interactive Brokers

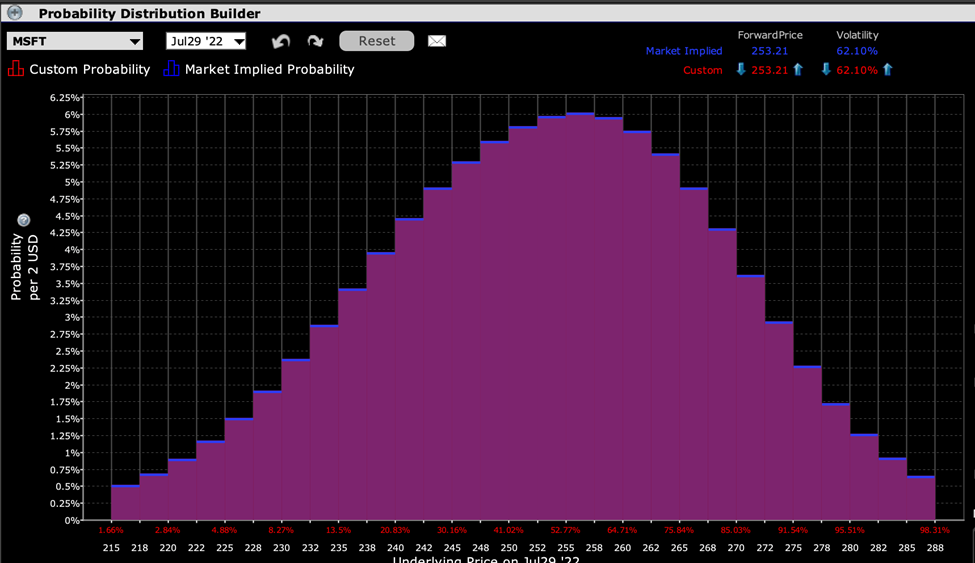

Meanwhile, the options market’s view of MSFT is much more neutral. Perhaps it is because the company already warned that a stronger dollar would be impacting its views. In any event, we see a fairly standard symmetrical probability distribution for options expiring this week, with the peak probability in at-money options:

IBKR Probability Lab for MSFT Options Expiring July 29th

Source: Interactive Brokers

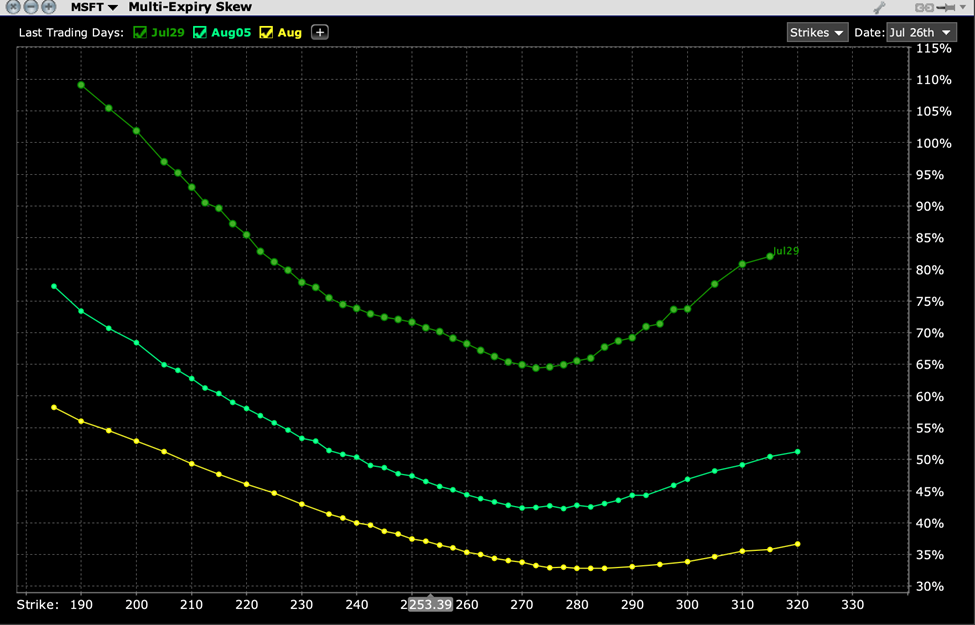

The skew graph also appears fairly standard, with a nadir in implied volatility in above-market options, and the normal assymetric “Elvis Smile” in its skew graph (downside options with generally higher implied volatilities than similarly upside options).

MSFT Options Skew, July 29th (top), August 5th (middle), August 19th(bottom) Expirations

Source: Interactive Brokers

Now the question becomes whether the market has its expectations properly calibrated or not. With TSLA, the options market missed the move. Today with GOOG, they are anticipating an upside move, while with MSFT they are basically neutral. It’s now up to the companies to let us know if more caution was warranted.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!