- Singapore’s visitor arrivals surpassed 1.1 million in April 2023, the highest in a month since the pandemic, bringing the total number of visitor arrivals to over 4 million in the year-to-date (YTD).

- The 10 most traded stocks that represent the travel and hospitality industries have returned an average 1.3% gain in the YTD ending 18 May, outperforming STI’s 0.3%. The 10 stocks booked net institutional inflows of S$186.7 million, while the broader Singapore stock market recorded over S$2.3 billion of net institutional outflows.

- Together, the 10 stocks have contributed 9% of the day-to-day turnover of all stocks listed on SGX in the YTD. The 10 stocks span across three sectors – Industrials, Consumer Cyclicals and REITs – with Singapore Airlines (SIA), Genting Singapore (Genting) and CapitaLand Ascott Trust (CLAS) being the most traded stock in each sector. The 3 stocks generated a total return of 10.1%, 7.7% and 3.0% respectively in the YTD.

Rebound in tourist arrivals

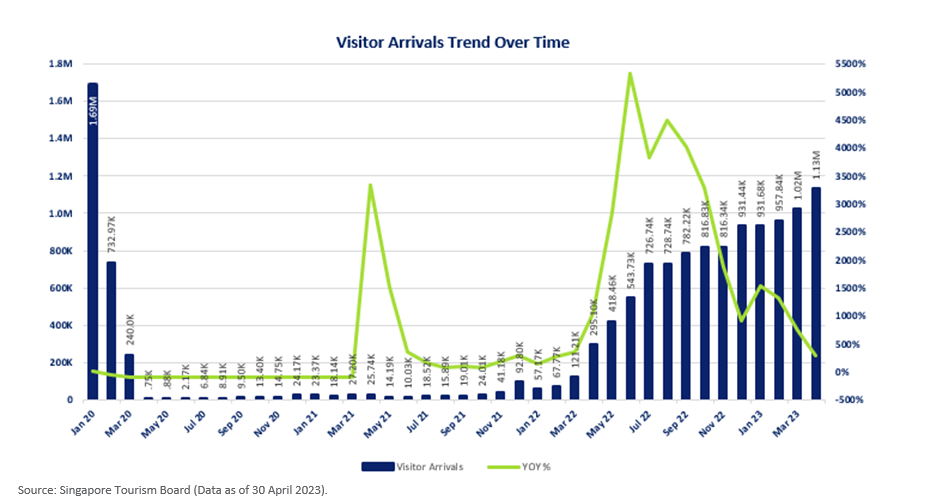

The World Economic Forum noted that global tourism rebounded strongly in 2022, with international tourist arrivals more than doubled when compared to the previous two years. As international travel continues to pick up, Singapore’s tourism sector has seen similar growth momentum. Data from the Singapore Tourism Board (STB) showed that Singapore’s visitor arrivals in April 2023 surpassed 1.1 million, the highest in a month since the pandemic, bringing the total number of visitor arrivals in 2023 to over 4 million as of 30 April. This result coincided with gains being seen in hospitality S-REITs, which were among April’s top S-REITs performers, as elaborated here.

With China’s reopening and the increase in international flight capacities, STB estimated that international visitor arrivals to Singapore would be in the range of 12 to 14 million in 2023, with full tourism recovery expected by 2024. Tourism receipts are anticipated to net $18 billion to $21 billion accordingly.

This forecast coincided with the latest air traffic statistics provided by Changi Airport Group (CAG), which reported that the airport handled over 4.6 million passenger movements in April, or around 82% of pre-pandemic levels; while aircraft movements totalled 26,300, which was around 83% of April 2019 levels. CAG is set to reopen the northern wing of Terminal 2 in October this year, bringing the total passenger capacity to 90 million passengers per annum, higher than the pre-pandemic levels of 85 million passengers per annum.

Recovery momentum in travel & hospitality industries

Singapore’s 10 most traded stocks that represent the travel and hospitality industries have returned an average 1.3% gain over the first 20 weeks of 2023 ending 18 May, outperforming the STI’s YTD total return of 0.3%. The 10 stocks booked a combined net institutional inflow of S$186.7 million in the YTD, which was in contrast to the broader Singapore stock market, which booked over S$2.3 billion of net institutional outflow. Amongst the 10 stocks, Genting Singapore and Singapore Airlines led the net institutional inflow YTD.

Together, the 10 stocks have contributed 9% of the day-to-day turnover of all stocks listed on SGX over the past 20 weeks of 2023. The 10 stocks span across three sectors – Industrials, Consumer Cyclicals and REITs – with Singapore Airlines (SIA), Genting Singapore (Genting) and CapitaLand Ascott Trust (CLAS) being the most traded stock in each sector. The 3 stocks generated a total return of 10.1%, 7.7% and 3.0% respectively in the YTD ending 18 May.

| Name | Stock Code | YTD AvgDaily T/O(S$M) | Mkt Cap (S$M) | Net InstiFlow YTD(S$M) | 2023 YTD Total Return % | Sector |

| Genting Singapore | G13 | 33.3 | 12,193 | 174.2 | 7.7 | Consumer Cyclicals |

| SIA | C6L | 23.8 | 18,091 | 80.6 | 10.1 | Industrials |

| CapitaLand Ascott Trust | HMN | 6.9 | 3,671 | 5.1 | 3.0 | REITs |

Source: SGX, Bloomberg (data as of 18 May 2023)

Singapore Airlines

- In its latest FY2022/23 result, SIA posted a 133.4% year-on-year (YoY) growth in revenue to $17.8 billion while its net profit grew $3.12 billion to reach $2.16 billion, the highest in 76 years, as compared to its $962 million net loss in FY2021/22. Group passenger load factor reached a record high of 85% in FY2022/23 as compared to 30% in FY2021/22, attributing the positive results to strong demand for air travel after Singapore fully reopened its borders in April 2022. Both its carriers, SIA and Scoot, were among the first to launch flights and capture the pent-up demand upon the reopening of borders.

- Prior to COVID-19, SIA commanded a 1.3% weight in the FTSE ST ALL-Share Index. Following on from a significant fund raising in 2020, the company maintained a 2.2% weight in the FTSE ST ALL-Share Index as of 18 May 2023. Similarly, the stock is now the second largest by weight in the Bloomberg Asia Pacific Airlines Index, moving up 4 spots from end 2019.

- While the socio-economic impacts of COVID-19 devastated the airlines industry, back in mid-2020, SIA signalled its resolve that the next chapter of its transformation journey would focus on how it strengthens its position as a global aviation leader in the new world. So far this year, SIA is ranked fourth highest in net institutional inflow stock, after ranking as the tenth highest net institutional fund inflow stock in 2022.

- Riding on the recovery momentum, SIA noted that “demand for air travel remains robust in the first quarter of FY2023/24, underpinned by the recovery in air travel in East Asia.” However, it also highlighted that “near term cargo demand is expected to remain soft as the industry navigates headwinds from the macroeconomic environment which include inflationary pressures, geopolitical tensions and high fuel cost”.

Genting Singapore

- In the YTD ending 18 May 2023, Genting booked the highest net institutional inflows across the Singapore stock market. In 1Q2023, the group’s revenue grew 54% YoY to $484.5 million and EBITDA grew 56% YoY to $189.7 million. Genting highlighted the growth was due to the ongoing recovery of regional travel and gaming demand.

- Going ahead, Genting will continue with its RWS 2.0 strategy, a $4.5 billion expansion project over different phases, and continue enhancing its brand identity as a premium luxury destination that appeals to trendy and affluent customers.

- The Group noted that ongoing construction works for RWS 2.0 strategy including Minion Land at the Universal Studios Singapore and the Singapore Oceanarium are progressing well with soft opening scheduled for early 2025. It has also been successful in securing premium lifestyle events that appeal to affluent visitors, having become the official venue to host signature events such as the Asia’s 50 Best Restaurants 2023 and Wine Pinnacle Awards 2023.

CapitaLand Ascott Trust

- In its 1Q23 business update, CLAS reported an increase in gross profit by 59% YoY. This was due to stronger operating performance and contributions from new properties. The trust also saw an increase in Revenue per Available Room (RevPAU) by 90% YoY, with key markets – Australia, Japan, Singapore and USA – performing at pre-Covid levels or above. Notably, CLAS’ Japan RevPAU jumped 351% YoY to 105% of same-store pre-Covid levels, following the country’s reopening to independent leisure travellers in October 2022.

10 Most Traded Tourism & Hospitality Related Stocks

Sorted by highest average traded turnover in the 2023 YTD ending 18 May.

| Stock | Stock Code | YTD AvgDaily T/O(S$M) | Mkt Cap (S$M) | Net InstiFlow YTD(S$M) | 2023 YTD Total Return % | Sector |

| Genting Singapore | G13 | 33.3 | 12,193 | 174.2 | 7.7 | Consumer Cyclicals |

| SIA | C6L | 23.8 | 18,091 | 80.6 | 10.1 | Industrials |

| SATS | S58 | 15.1 | 3,971 | -28.3 | -0.6 | Industrials |

| ComfortDelGro | C52 | 7.9 | 2,427 | -42.0 | -5.7 | Industrials |

| CapitaLand Ascott Trust | HMN | 6.9 | 3,671 | 5.1 | 3.0 | REITs |

| CDL Hospitality Trusts | J85 | 2.0 | 1,467 | 0.0 | -3.0 | REITs |

| Far East Hospitality Trust | Q5T | 0.8 | 1,198 | -2.0 | -0.6 | REITs |

| SIA Engineering | S59 | 0.8 | 2,648 | 1.0 | 0.9 | Industrials |

| Frasers Hospitality Trust | ACV | 0.3 | 905 | -1.2 | 8.4 | REITs |

| Mandarin Oriental Intl | M04 | 0.3 | 3,001 | -0.6 | -7.7 | Consumer Cyclicals |

| Total | 91.2 | 186.7 | ||||

| Average | 1.3 |

Source: SGX, Bloomberg (data as of 18 May 2023)

—

Originally Posted May 23, 2023 – Tourism and Hospitality Stocks Benefit from Recovery Momentum

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!