- Japan’s Nikkei 225 eclipsed 33,000 for the first time in 33 years, and the significant rally has attracted major investor interest.

- Global portfolio managers are increasingly bullish on Japan, and they are allocating more cash to this rising market.

- Upcoming events, such as shareholder meetings and sales reports, are expected to provide insights into the future direction of Japanese equities as the first half of the year concludes.

While the Magnificent Seven remains in the limelight, international investors may be missing out on an exciting show in Japan. We touched on it earlier this month, but the Nikkei’s massive run-up has taken another leg higher lately.

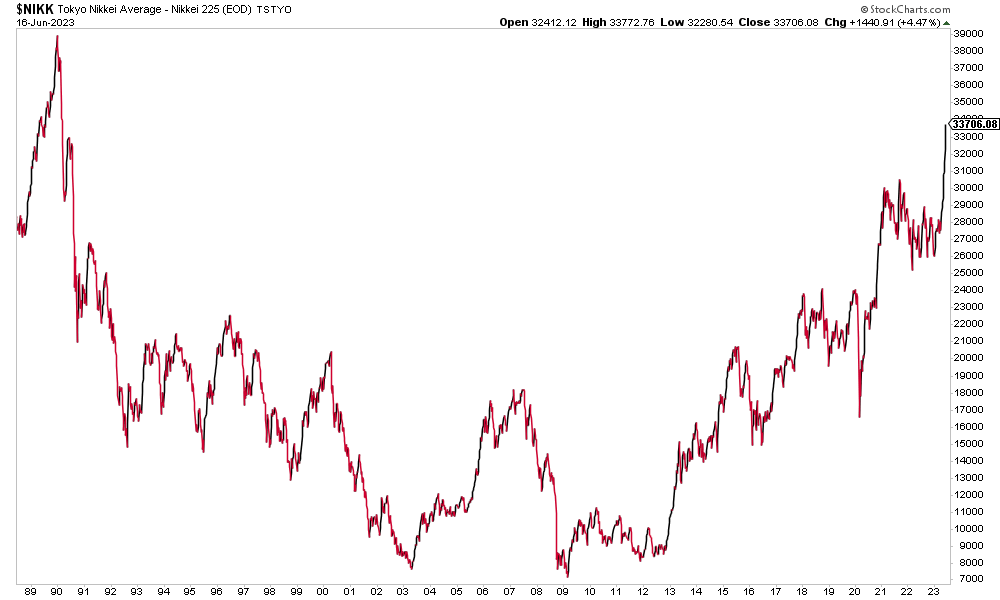

The mother of all bull markets and bubbles grew in the 1970s and 80s in Japan. Its real estate sector, along with the country’s equities, surged to valuation ratios that would make today’s U.S. tech stocks blush. Alas, all good things seem to come to a harsh end when fear and greed are at play.

The Nikkei 225 peaked just shy of 39,000 shortly in advance of the go-go 90s. Right before American investors would enjoy a tech boom and bust, the land of the rising sun was on the verge of one of the most gut-wrenching bears of all time.

Closing In on a Round Trip

The Nikkei’s drawdown reached 80% by early 2003. The bear market then undercut that low at the depths of the global financial crisis in 2009. Twenty years of lower highs and lower lows is the epitome of despondency. Japanese stocks were indeed left for dead, and a meaningful rally would not begin until 2013. Amid an aging population and constant economic flirts with deflation, investors were none too interested in being overweight a nation lacking growth catalysts.

Nikkei 225 Index: From Big Bear to a Rock-Solid Brahma Bull

Source: Stockcharts.com

A New Global Market Leader

But a bull market has been raging for about a decade. Flying under the radar given the persistent alpha seen among domestic equities, Japan’s Nikkei 225 is up more than three-fold over the last 10 years. The index’s last five thousand points have finally caught the attention of big money managers. According to the latest BofA Global Fund Manager Survey, Japanese stock allocations are the highest since late 2021. Furthermore, “long Japan equities” is seen as the No. 3 most crowded trading among global portfolio managers.

Global PMs Turning Bullish on Japan

Source: BofA Global Research

Going Micro

Fascinating macro trends, no doubt, but what can individual company events tell us about where the land of the samurai may go next? While the end of the first half is often a quiet time on Wall Street, there are key data points served up by a handful of Japanese firms over the final two weeks of June.

Auto Data Acceleration Ahead

After the Juneteenth holiday weekend, Honda Motor held its annual shareholders’ meeting on Tuesday night, June 20. The automaker then reports June monthly sales on the 30th. It’s not the only car OEM with key data on the horizon, though. Subaru paid a 38 JPY dividend on Thursday, June 22 after its shareholder gathering the day prior. Mazda and Subaru issue interim sales data on the final Friday of June while the former hosts its shareholders’ meeting on Tuesday the 27th. Maybe the biggest data point of all comes from Toyota’s June sales report which also happens on June 30th.

Other Industries Offer Cyclical Clues

Outside of the car industry, broader key sales monthly sales and production figures cross the wires over the coming days:

- June 26: NH Foods Limited (Packaged Foods and Meals)

- June 26: Japan Hotel REIT Investment Corp. (Hotel & Resort REITS)

- June 26: Invincible Investment Corp. (Hotel & Resort REITS)

- June 28: Askul Corporation (Internet Retail)

- June 29: Wacoal Holdings Corp (Apparel, Accessories, and Luxury Goods)

- June 30: Trusco Nakayama Corporation (Industrial Distribution)

The end of H1 also marks many semi-annual dividend pay dates among these companies.

The Bottom Line

Thirty-three years to recapture 33,000 on the Nikkei 225 Index is a catchy summary to grab investors’ attention. After enduring a prolonged period of decline and stagnation, Japanese stocks have experienced a significant rally over the past decade, and large money managers are increasingly allocating funds to Japanese equities, according to one recent survey. Upcoming key events, such as shareholder meetings and sales reports from prominent Japan-domiciled companies, are expected to provide further insights into the direction of the Nikkei and TOPIX as the first half of the year comes to a close.

—

Originally Posted June 26, 2023 – The Sun Shines on Japanese Stocks, Anticipating Key Events to Finish the First Half

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!