Stocks & ETF – $GOOGL, $AMD, $SMH

Macro – $SPX, #Rates #Fed

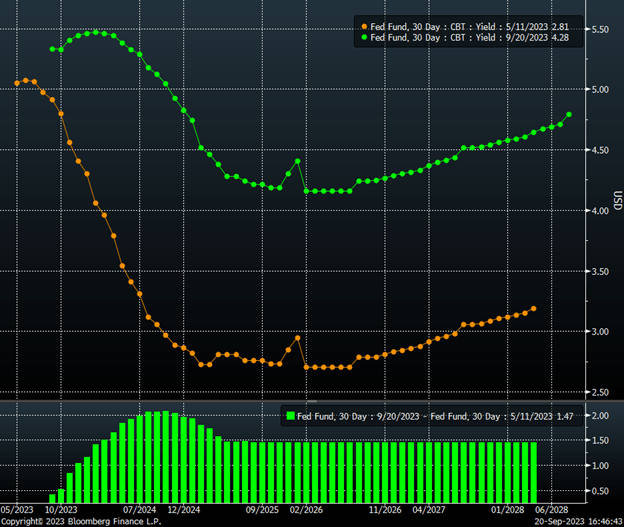

Stocks finished lower for the day, following more hawkish-than-expected projections from the Fed for 2024 and 2025. The Fed anticipates rates to be at 5.1% by the end of 2024, signaling just 50 basis points of rate cuts next year. This is a significant departure from market expectations in mid-May. At that time, the December 2024 Fed Funds Rates were trading at 2.86%. Today, those same Fed Funds Rates are trading at 4.8% and are likely to continue rising towards the Fed’s target of 5.1% over time, which is more than a 200 bps difference.

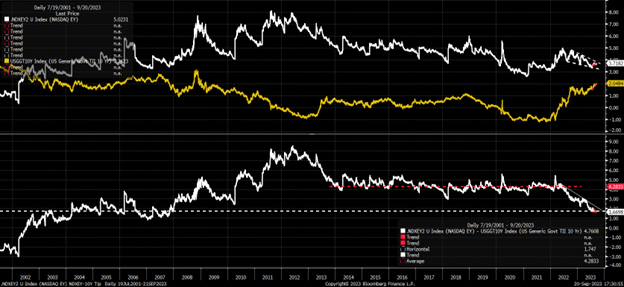

This is crucial to note: as real rates began to rise in mid-May, the NASDAQ earnings yield declined, causing the two measures to converge. The equity market had been betting on many rate cuts in 2024 and a corresponding decline in real yields. This turned out to be a misguided bet. For months, the Fed has been signaling that its policy would be “higher for longer.” It indicated that rate cuts were not on the horizon anytime soon. If there were to be any rate cuts, they would merely be adjustments for lower inflation, while real rates would remain restrictive.

On May 11, the spread between the NASDAQ’s earnings yield and the 10-year Real yield was 2.7%; today, that spread has narrowed to just 1.7%, a difference of 100 basis points. While this may not sound significant, consider that the earnings yield of the NASDAQ would need to increase to 4.7% from its current 3.7% to return to that May 11 spread. This would require the NASDAQ’s P/E ratio to fall from its current 27.0 to 21.3, representing a drop of 21.1%. Such a decrease would bring the index back to its lows from March 13.

The equity market appears to have made an incorrect bet on the direction of interest rates. If rates continue to rise, it’s logical to expect that the earnings yield of the NASDAQ will need to increase correspondingly, leading to a lower valuation multiple.

Additionally, Powell stated twice today that the neutral interest rate could be higher than initially anticipated, suggesting that rates may need to rise more than once in the future. His comments during the press conference made it clear that there is no fixed rate plan; I would interpret that as the Fed will react to each new piece of data as it comes in and ultimately has no clue what comes next.

S&P 500 (SPX)

From a technical analysis standpoint, it appears that the diamond pattern on the S&P 500 has broken. If this is the case, we could see the index reach 4,330 rather quickly. Should the 4,330 level break, it would also likely signify that the neckline of the head and shoulders pattern has been breached, pointing to further downside potential.

Meanwhile, the 10-year real yield saw a notable breakout today, clearing both resistance levels and ending a month-long period of consolidation.

Meanwhile, the 2-year rate also experienced a breakout, clearing a nearly six-month-long period of consolidation at 5.1%. It appears poised to run up to 5.25%, which is now only eight basis points away, after closing at 5.17%.

AMD (AMD)

Meanwhile, AMD looks weak and sits on support at $100. A break of support probably leads to a decline to around $93 and maybe as low as $81.

Alphabet (GOOGL)

Meanwhile, Alphabet appears to have a rising wedge pattern that has formed and a giant gap that was never filled at $122, as well as another one at $111 and a downward-sloping RSI.

—

Originally Posted September 20, 2023 – The Stock Market Bet Wrong On Fed Rate Cuts

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!