TLDR:

At first, they seemed like a blowout: Amazon results last Thursday floored the market. Shares rocketed higher. When the earnings call revealed its cloud business was growing at its lowest levels ever, shares immediately dropped 4%. Tech companies are seeing growth slow from post-COVID hard-to-believe levels. But is earnings growth slowdown actually bad for stocks?

Tech companies were literally minting money during the pandemic as COVID drove dramatic behavior changes. They over-hired and over-spent as a result. Eventually, they had to confront bloated payrolls and other cost excesses as earnings growth came down faster than Icarus. They are still down a combined $372 billion in market valuation from a year ago.

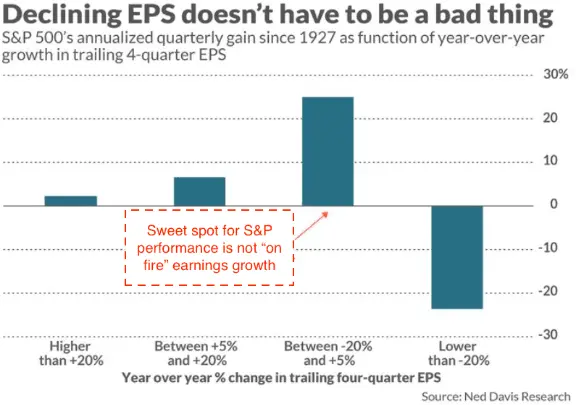

When you look at the data, however, you find that a slowdown in earnings growth is not a bad thing. Not a bad thing at all … up to a point. As the chart below shows, when it comes to market performance, the “sweet spot” in earnings growth is actually somewhere between negative and positive growth.

Surprising, right?

The source of this otherwise surprising inverse relationship between the market and earnings growth rates is the stock market’s focus on several quarters into the future.

By the time earnings growth rates are extremely high—as they were until early in 2022 – —they have long since been reflected in stock prices. During such periods, the market has instead shifted its focus to earnings several quarters hence—to factors such as the Federal Reserve having to put the brakes on an overheating economy.

Note below the insight Toggle’s Investing Copilot generated back in March for Amazon: analyst forecasts had become too pessimistic, suggesting that there was substantial upside if earnings didn’t turn out to be quite so bad. The rest is history.

The point is …

The slowdown in earnings growth we are seeing has long been anticipated. Seeing it first hand is actually cathartic for the market – and may well be how the market low is ultimately put in.

What stocks are doing well today?

This section is powered by Open AI connected to TOGGLE AI

Thanks for all your feedback! This section is still paused but an enhanced version is on the way (we promise)!

Aggregated Leading Indicators!

Market Phase Shift is now one pixel away from piercing one of its barriers. And Peak moved towards the bearish threshold after last week’s squeeze.

Learn more about the Leading Indicators in the Learn Center!

Upcoming Earnings: COVID who?

Click here to test how PFE stock could perform after missing earnings expectations.

Discover how other companies could react post earnings with the help of TOGGLE’s WhatIF Earnings tool.

Asset Spotlight: All Eyes on AAPL

TOGGLE analyzed 4 similar occasions in the past where prices for Apple are close to a recent high and historically this led to a median decrease in the stock over the following 1M. Read full insight!!

General Interest: An interesting speech on success and failure

The topic of failure is a major inspiration for Commencement speeches – think of Denzel Washington’s famous ‘fall forward’ one.

Last week browsing the WSJ we were led to an interesting take by Milwaukee Bucks’ Giannis Antetokounmpo.

A reporter asked him if he considered the game a failure (the Bucks obviously lost) and Antetokounmpo provided an interesting and articulate take on what it takes to build towards a goal.

Check it out on Twitter here and read the WSJ piece here ($).

—

Originally Posted May 1, 2023 – The little secret about earnings

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

How can I withdraw my earnings to my registered account? thank

Hello Junamith, thank you for reaching out. To initiate a withdrawal of funds from your IBKR account, please visit https://ndcdyn.interactivebrokers.com/sso/Login?action=TransferFunds&type=WITHDRAWAL.