Using Trading Central’s “Technical Insight” screener, I screened for U.S equities that have listed options available and have confirmed a bullish classic technical pattern with a possible upward price move of at least 15%.

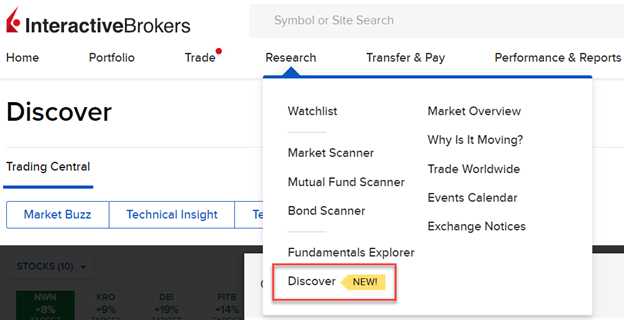

You can locate Featured Ideas in the IB portal under Research-Discover New:

What we found

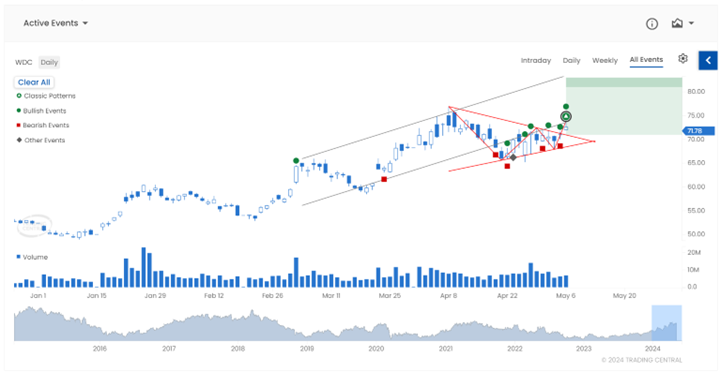

Western Digital Corp (WDC: NASDAQ) confirmed a bullish Symmetrical Continuation Triangle.

The price has broken upward out of a consolidation period, suggesting a continuation of the prior uptrend.

A Symmetrical Continuation Triangle (Bullish) shows two converging trendlines as prices reach lower highs and higher lows. Volume diminishes as the price swings back and forth between an increasingly narrow range reflecting uncertainty in the market direction. Then well before the triangle reaches its apex, the price breaks out above the upper trendline with a noticeable increase in volume, confirming the pattern as a continuation of the prior uptrend.

More about Trading Central

Trading Central is a global leader in financial market research and investment analytics for retail online brokers and institutions. Trading Central’s product suite provides actionable trading ideas based on technical and fundamental research covering stocks, ETFs, indices, forex, options, and commodities.

Dell Technologies Inc (DELL: NYSE) also confirmed a bullish Symmetrical Continuation Triangle.

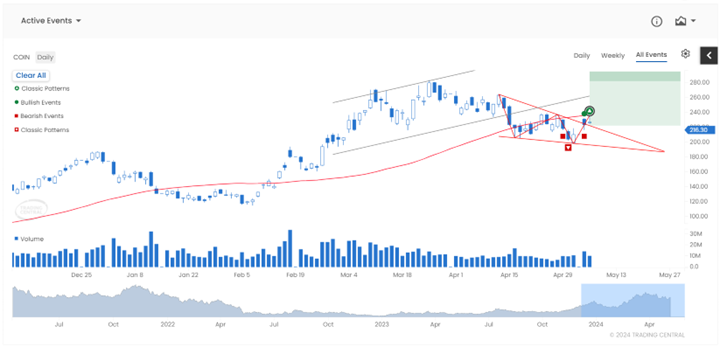

Coinbase Global Inc (COIN: NASDAQ) confirmed a bullish Continuation wedge.

A Continuation Wedge (Bullish) represents a temporary interruption to an uptrend, taking the shape of two converging trendlines both slanted downward against the trend. During this time the bears attempt to win over the bulls, but in the end the bulls triumph as the break above the upper trendline signals a continuation of the prior uptrend.

Chart Sources: Trading Central Technical Insight

Trading Central’s event-driven technical analysis “Technical Insight” allows investors to cover more ground and find more investing opportunities through the use of software automation.

The investment ideas presented here are for information only. They do not constitute advice or a recommendation by Trading Central in respect of the investment in financial instruments. Investors should conduct further research before investing.

Gary Christie is head of North American research at Trading Central in Ottawa.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Trading Central and is being posted with its permission. The views expressed in this material are solely those of the author and/or Trading Central and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

I tried IBKR as a trial to see if it works with my E.W. software called MotiveWave. Since TD Ameritrade is not in business anymore , I was told lot of people now using IBKR for data.

If ok with your Client services, I can open IBKR account with a small amount. If your data works with my software, I will transfer my Charles Schwab account to IBKR.

Thanks.

Hello, we appreciate your interest in IBKR!

To open an account: http://spr.ly/OpenAccountfromIBKRCampus

Please view this FAQ for information about linking MotiveWave to your IBKR account: https://www.ibkr.com/faq?id=137779201

Please reach out with any more questions. We are here to help!