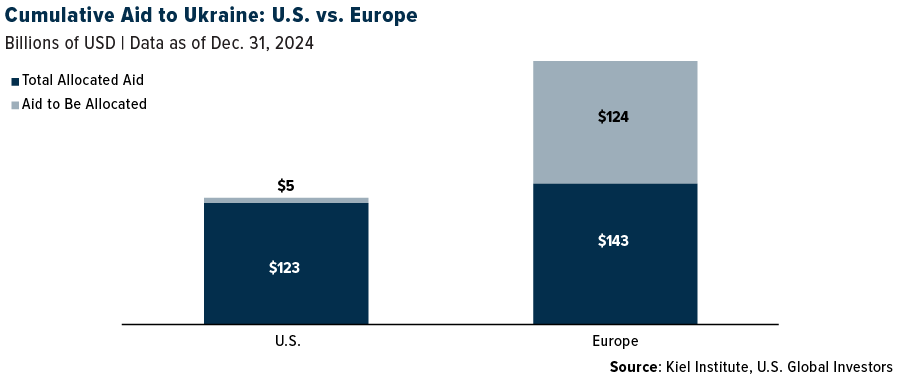

The U.S. has poured more than $120 billion into Ukraine since its war with Russia began three years ago, but with a new administration in Washington, that support is grinding to a halt.

The White House announced last week that further military aid will be paused until President Donald Trump can determine that Ukrainian President Volodymyr Zelenskyy is making a “good faith” effort toward peace negotiations with Russia.

This decision has left Ukraine in a precarious position. Without additional U.S. support, Western officials estimate that the Eastern European country has enough weaponry to sustain its current pace of fighting until mid-2025.

In response, European leaders are taking decisive action, launching an unprecedented military spending spree that is already reshaping global markets.

Germany Takes the Lead in Ramping Up Military Spending

Germany, Europe’s largest economy, is leading the charge, with Chancellor-in-waiting Friedrich Merz vowing that his government will do “whatever it takes” to support Ukraine. He’s even pledged to amend the German constitution to exempt defense spending from the country’s strict fiscal constraints.

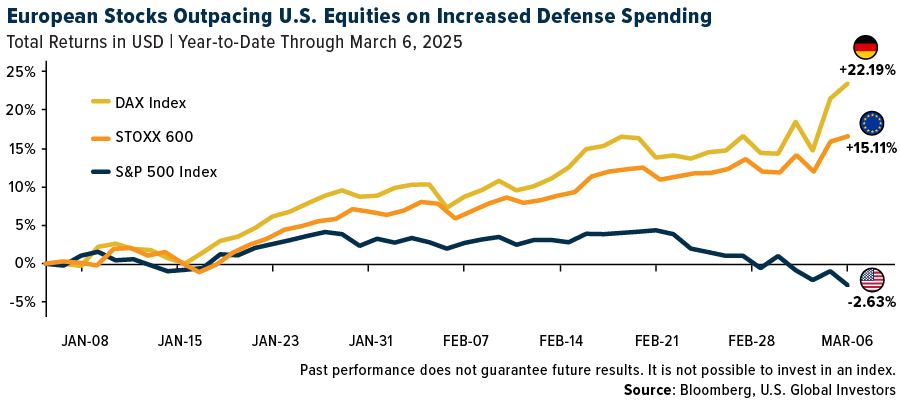

The markets have responded positively. German equities are rallying, with the DAX Index up more than 22% through March 6, compared to a loss of over 2% for the S&P 500.

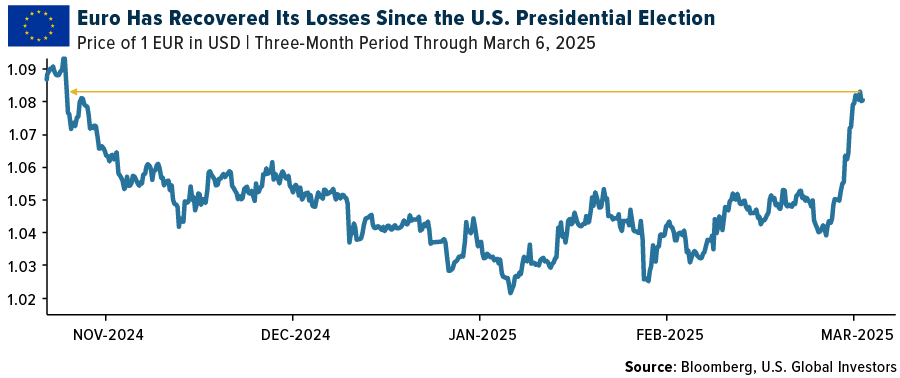

The euro has also rebounded from recent lows, erasing its losses since November’s U.S. presidential election.

EU Unveils $840 Billion Plan to Strengthen Defense

Other European nations are making similar moves. France’s President Emmanuel Macron delivered a stark warning in a televised address last Wednesday, declaring that Europe must be prepared to defend Ukraine without U.S. support. He made it clear that abandoning Ukraine now would only embolden Moscow, stating, “Who can believe that… Russia will stop at Ukraine? Russia has become, and will remain, a threat to France and Europe.”

The Czech government, meanwhile, has announced plans to raise its defense budget to 3% of GDP by 2030, up from its current 2%.

Brussels has responded with an unprecedented $840 billion plan to boost military readiness across the continent. Last week, the European Commission laid out a framework to mobilize resources on a scale never seen before.

The bulk of this money will reportedly come from direct national spending, as European Union (EU) leaders have agreed to temporarily lift fiscal rules that limit government deficits. Additional funds will be made available in the form of loans to governments looking to modernize their defense industries.

An analysis by European research firms Bruegel and Kiel estimates that for Europe to establish a truly independent military deterrent against Russia, it will require at least 250 billion euros in annual defense spending. That means deploying tens of thousands of additional soldiers, acquiring thousands of new tanks and infantry fighting vehicles and ramping up production of long-range drones and other advanced military technologies.

European Arms Manufacturers See Record Gains

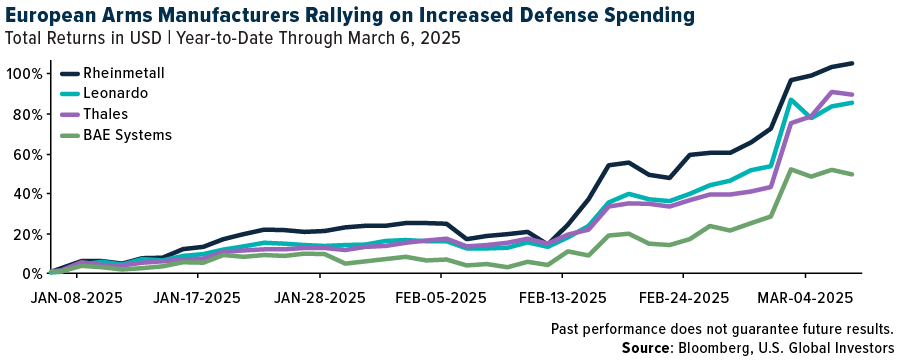

This wave of spending has fueled a blistering rally in European defense stocks as investors bet on long-term demand for military hardware.

Defense companies have been among the best-performing stocks in global markets this year. Italy’s Leonardo and France’s Thales have seen their shares jump 85%, while Britain’s BAE Systems has climbed close to 50%. Germany’s Rheinmetall, a leading supplier of armored vehicles and artillery systems, more than doubled in value as of Thursday, March 6, but fell on Friday on news that Russian President Vladimir Putin may be ready to agree to a truce.

Russia’s Military Losses Mount

Europe’s military buildup comes at a time when Russia’s ability to stay in the fight is increasingly being questioned. While it still holds a strategic advantage in nuclear capabilities—Russia has an estimated 5,580 nuclear warheads, the most of any other country—its conventional forces have suffered immense losses.

Russia’s $2 trillion economy is dwarfed by the EU’s GDP, estimated at $20 trillion, and its population of roughly 145 million is significantly outnumbered by the EU’s 450 million. Hundreds of thousands of Russians have left the country since 2022, the largest exodus since the Bolshevik Revolution, further straining the country’s labor force.

On the battlefield, Russia is estimated to have lost over 875,000 soldiers, according to the U.K.’s Ministry of Defence. These losses, coupled with Western sanctions, have made Russia’s long-term military position more vulnerable than it might appear.

China Expands Defense Budget as Pacific Tensions Rise

The arms race is not confined to the West. China has announced a 7.2% increase in military spending this year as it continues its efforts to expand its influence in the Pacific.

Taiwan is under increasing pressure to boost its defense budget to deter a potential invasion from Beijing. Japan, too, has been urged to increase its military spending, though its leaders insist they will not allow foreign governments to dictate their defense budget.

Investors Are Taking Notice

With Washington shifting its focus inward, the post-World War II security order is changing, and Europe must now take greater responsibility for its own defense.

The consequences of this are already playing out in financial markets, as I’ve covered. For investors, I believe this is not just a short-term trend but a transformation of the global defense landscape. As history has shown, when nations prioritize military spending, the market follows.

—

Originally Posted March 10, 2025 – Surge in War Spending Sends European Defense Stocks Soaring

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!