This will be an interesting week. After all, the S&P 500 is not often down for five consecutive weeks, so one has to think this might be the week the market attempts a rebound. From what I can tell, the last time it declined for at least five weeks in a row was in April and early May 2022, and before that, such occurrences seemed rare.

The index also closed below its lower weekly Bollinger Band, which indicates that it is pretty oversold at these levels, suggesting a potential bounce.

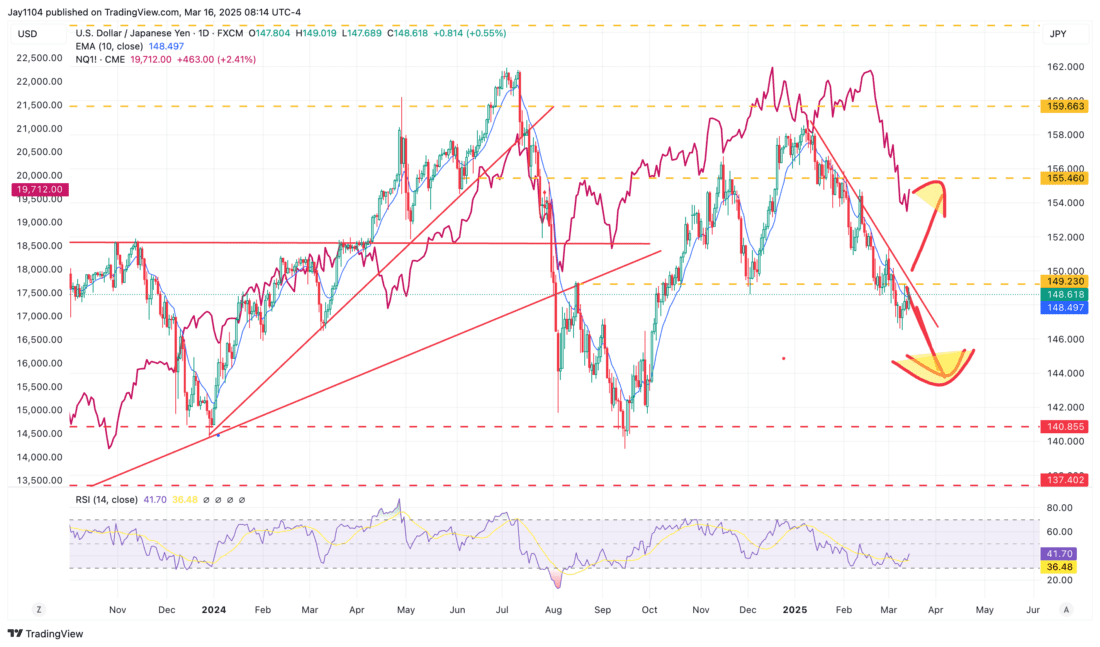

Can we expect a bounce? There’s a good chance, but whether it happens is another question. Technicals may not apply in an environment that seems to be experiencing a buyer’s strike. More importantly, the Bank of Japan is likely to set the tone for future rate hikes, which could significantly impact USD/JPY. While the BOJ is not expected to raise rates this week, It is expected that they will signal further hikes later this year. This will put the spread between U.S. Treasury rates and JGBs in focus, which will play a major role in determining where USD/JPY moves.

The USD/JPY is at crucial level and will significantly impact what happens next. However, predicting its direction from here isn’t easy, as it’s facing a downtrend, horizontal resistance, and the 10-day exponential moving average. There is strong resistance around 149 to 149.25, and if the BOJ signals more rate hikes—as they should—the general trend in USD/JPY is likely to remain lower, meaning the yen strengthens.

I think a stronger yen suggests the potential for lower stock prices, while a weaker USD/JPY means higher stock prices. That’s how the relationship has played out recently, and I don’t believe we’ve reached a point where it should change or stop working.

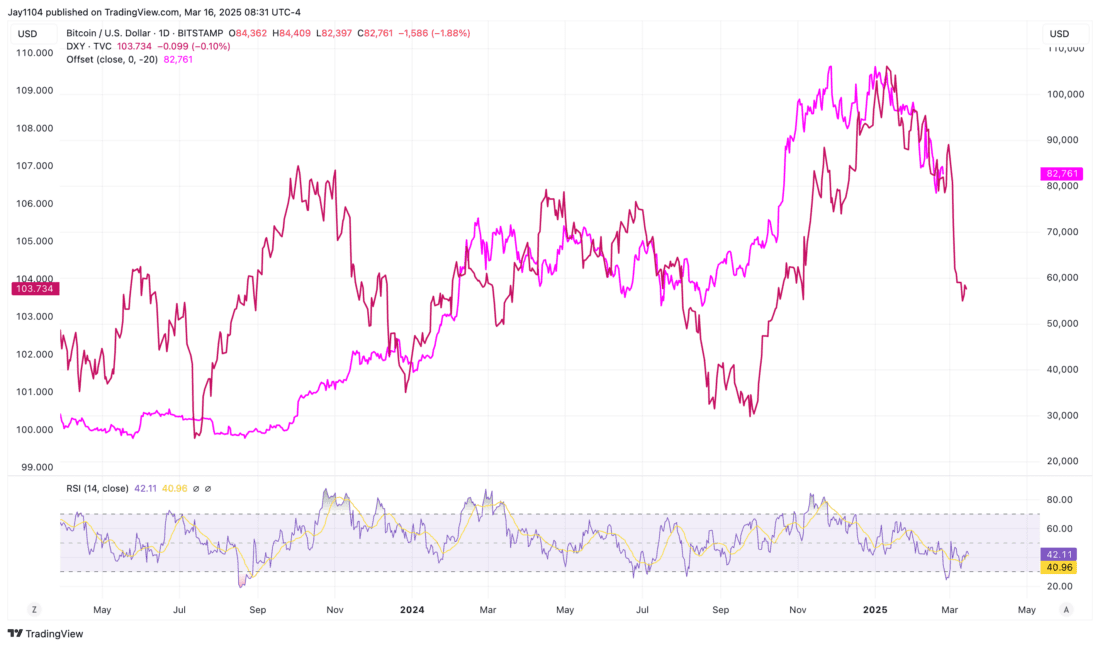

Talking about liquidity and currency—have you ever seen those dumb charts on social media where they overlay “Global M2” with Bitcoin, making it look like Bitcoin is following “Global M2”? First, M2 values are typically updated only once a month, so there is no precise way to know where M2 is between the monthly updates. Secondly, global M2 is measured in U.S. dollar terms, meaning the “Global M2” is essentially just a dollar proxy. Essentially, you take Eurozone M2 and convert it from euro to dollars, Japan’s M2 to dollars, and so on, so if the dollar weakens against the euro, then the value of M2, when measured in dollars, will increase if M2 is denominated initially in euros, and vice versa.

So, at least since Q4 2023, the chart shows that Bitcoin, in this case, has traded about 20 days behind the DXY Index.

That is likely because, perhaps more importantly, foreign investors were selling local currency to buy dollars to invest in Bitcoin, giving them the added advantage of gaining dollar strength and bitcoin gains. That trade appears to be unraveling.

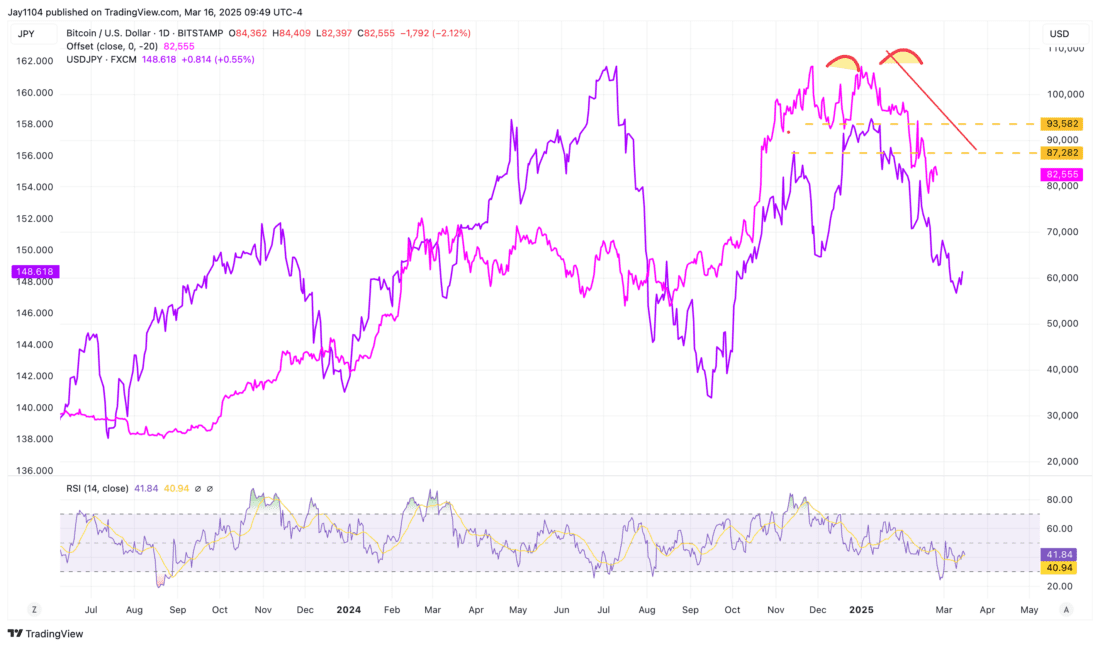

This becomes more apparent when you examine the relationship between the USDJPY and Bitcoin, with the 20-day lag.

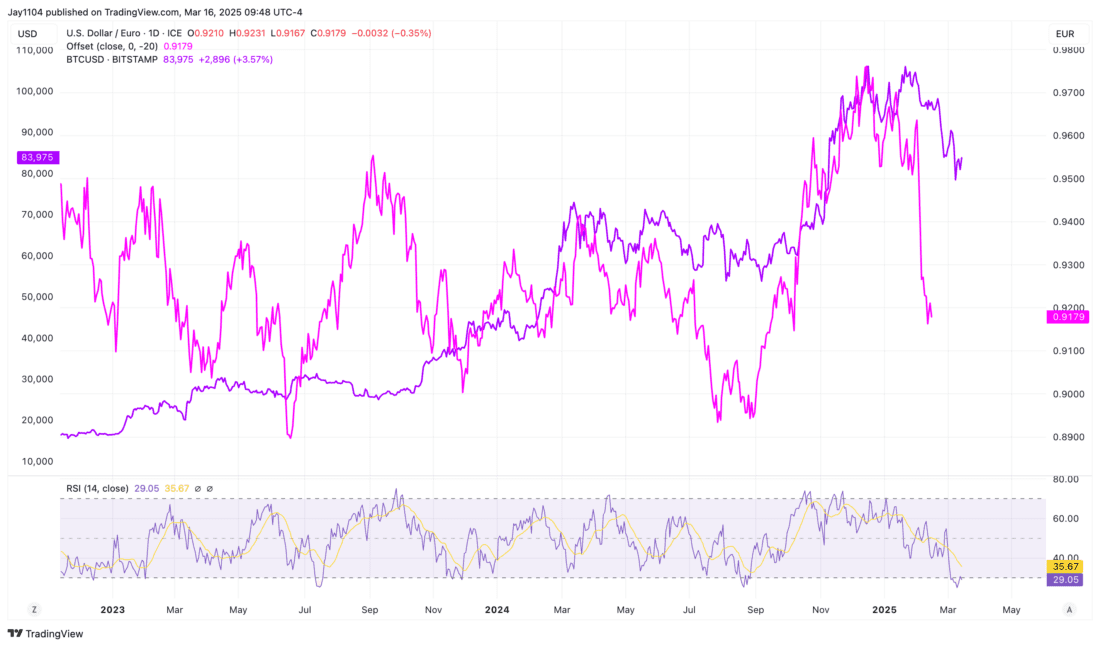

And with the EURUSD, but instead, use USDEUR for visual purposes.

Again, it may appear in some ways to be an M2 play, but it is a dollar proxy. But then again, I could be completely wrong. You can decide for yourself; you know what I think, at least.

—

Originally Posted on March 16, 2025 – Stocks and Bitcoin’s Fate Lie in the Dollar’s Hands

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. Eligibility to trade in digital asset products may vary based on jurisdiction.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

a stronger yen suggests the potential for lower stock prices, while a weaker USD/JPY means higher stock prices. what does this mean?

I don’t think Bitcoin is correlated with ANYTHING. Who is buying it here? It went from $2 to $100,000 in 15 years. Talk about missing the boat! To this day, nobody knows the true identity of the person who started it. It could be the biggest Ponzi scheme in the history of mankind. If it were to collapse 95% the people who bought it the first couple of years would still be mega millionaires, but those who jumped in late would get destroyed. Of course, you could say that about any asset, but as far as I’m concerned, Bitcoin is worth only what any fool is willing to pay for it on any given day.