So much for the idea of equity investors rooting for a stronger economy, at least for today. This morning’s reaction to the stronger-than-expected December jobs report revealed that stock traders are once again more concerned about the potential for monetary accommodation rather than the type of robust economy that can improve corporate fundamentals.

My initial comment immediately after seeing the numbers this morning was “Wow!” A set of key statistics that are so outside consensus will inspire that type of reaction. I happened to be on live TV at the time, and went on to say:

The problem here now is if you were looking for [interest] rate cuts based on a weakening labor market, this fits in with the Fed [Federal Reserve] rhetoric that we’ve heard. Stop looking for those. It’s not going to happen, at least in the immediate term… Unfortunately for stocks, the bond market doesn’t like that.

We can forget about the weaker labor narrative for a while, and that anyone basing hopes for a more accommodative Fed on the employment portion of the dual mandate need[s] to wait a while.

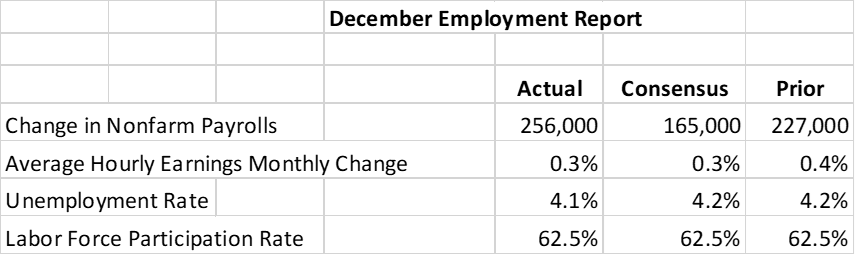

Remember, the Federal Reserve has a “dual mandate” to “foster economic conditions that achieve both stable prices and maximum sustainable employment.” One of the justifications for the 1% cuts in the Fed Funds target that we saw over the past three Fed meetings was a softening labor economy, one that was moving away from maximum sustainable employment. Today’s report pushed the data in the opposite direction. It is impossible, at least for now, to assert that these numbers reflect any sort of labor market weakness:

Sources: U.S. Bureau of Labor Statistics, Bloomberg

Combine the strong labor report with the comments made in the recently released minutes to the December FOMC meeting that showed members’ concerns about inflation risks and it becomes difficult to justify rate cuts – not when we are running closer to “maximum sustainable employment” while our ability to maintain “stable prices” is in question. Fixed income markets agree with that notion. The CME FedWatch now prices in only a single rate cut for 2025 no earlier than September, whereas yesterday two cuts beginning in June were expected. The IBKR Forecast Trader is broadly in line with that assessment, showing a 67% chance that rates will not be above 4.125% (a 25bp cut) in June while the CME is at 76%.

Having assessed the changing rate cut picture, we can only assume that it is driving the woeful stock market response. Indeed, bond yields are higher across the curve, though the curve is flatter. We have 2-year yields up 10bp to 4.37% while 10-years are up 6bp to 4.75%, which reflects the lower likelihood of near-term cuts. But the vast majority of stocks are lower, with decliners outpacing advancers by over 4:1. We do have stocks like Walmart (WMT) and Target (TGT) rising – people with jobs can buy things at stores – but the general malaise is the “tell”. A stronger economy should broadly help the earnings, dividend, and cash flow streams of a wide range of companies, but that clearly doesn’t matter right now. Don’t forget that at this time last year that we were expecting 7-8 cuts for 2024 yet the market rallied solidly even though we got only the equivalent of 4. The solid economy more than made up for that deficiency.

One final observation: volatility appears to be back. Assuming we close as weakly as we appear at midday, this would be the fourth week in a row with two S&P 500 closes of greater than +/- 1%. That would make 8 of the past 15 sessions with relatively sizeable moves – 5 up and 3 down. While some might interpret the current readings of VIX around 20 as showing fear, it more likely reflects the recent propensity of SPX to move more aggressively in recent weeks and concerns that the upcoming earnings season and potential policy moves by the incoming administration could result in outsized moves. Remember, volatility measures moves in both directions – up AND down – even if traders’ desire to pay to hedge that volatility tends to reflect concerns about the potential for downdrafts.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

100% cash. Waiting the “pro-business” president to crash the markets.

100% on point – Trump crashed the markets last time he was president and will do the same again. But folks never learn their lessons.

Crashed the markets? The S&P almost doubled last time he was president

Your memory is either failing you, or you’ve conjured up a fantasy to support your delusional tendency to blame absolutely everything on Trump

What the markets really want to see is that the trillions of dollars irresponsibly printed in the past several years (“Inflation reduction act”, covid stimulus) has moved through the system. It is still lingering. The cash infusion has continued to prop up the system artificially (no pun intended). It is amazing how that money is still sloshing around – that’s how big it was. Given the current state of the consumer, it won’t take much to set off a market collapse. The sugar high free money is over. M2 money supply is shrinking on a 2-year basis, frozen housing market which will continue, and maxed out credit cards are not the recipe for a successful consumer driven market. The only bright spot in the economy last year was the massive B to B investments by large tech. Eventually, it is the consumer who supports the economy. The consumer may be employed but his mortgage and credit cards interest rates are cutting into his wallet. about as fragile as it gets even though we haven’t seen a collapse in spending…YET. As a betting man, the idea that we get out of this inflation driven mess without paying the price for it is not appealing odds. Who knows what it will be, but something in the economy is likely to snap soon. Will there be a return to the banking crisis? A resurgence of inflation? I suppose the B to B economy could keep things afloat for a while but

Simply ‘put’, upside junkies are being denied their ‘fix’.

To ‘put’ it another way, I don’t want to buy this extended market, ‘you first…’,, so… wh should I risk my money/profits on further seemingly small profits when you have done so miserably of late? I think I’ll wait, and let you upside junkies take the risk and if you go there, fine, I’ll just be another ‘ride-along’. Please, spend all your money showing me that you continue to be “right”.

Maybe Joe can pardon the stock market before he steps aside.

Markets are finding a low after a 5% correction. No biggie. And…The Fed is once again behind and IMO wrong about the effect of Trump policies. Less regulation and reduced spending will not increase inflation nor will extending the 2017 tax cuts. Closing the border and deporting illegals may cost more upfront but the longer term savings will be substantial. Economic figures simply do not support the idea that rapidly rising inflation is a continuing problem. i am a patient owner of equities and an avid buyer of income at these levels.

I’d add three things: 1. U.S. public debt doubled from 2013 (~$17T) to 2023 (~$34T). During that period, the real debt CAGR (i.e., net of GDP growth) was 5%. This was the worst fiscal performance of industrialized economies that have greater than 90% debt-to-GDP ratios. So, the U.S. has a debt problem that is compounded by a spending problem. 2. U.S. bond investors are concerned by what is going on with Gilts. The UK has a lower debt-to-GDP than the U.S. (97% vs 129%) and it is adding to it at a slower real rate (2% vs. 5%). Yet the rate on 10 year Gilts has blown up 100 bps since 19 Sept 2024. So, a country that is arguably managing its debt better than the U.S. is seeing the same deterioration in bond yields. This points to the critical importance of confidence. Confidence in the UK fiscal policy was shaken in 2022 and may take years to recover. Now those investors are looking at the incoming U.S. administration and asking the question: Could these guys actually make things worse? 3. U.S. equity valuations are quite high by historical standards. Further, much of this run-up has accrued to a few stocks based on expectations for future AI earnings. However, people who use packaged and custom AI tools regularly have started to recognize the chasm between the vision of future AI revenue and the realities of current AI capabilities. Putting these things together, I understand both the focus on rates and the magnified impact on equities. That doesn’t mean the market can’t rally from here, but it does mean that signs of accelerating inflation, a slowdown in the economy or reckless fiscal policy will likely be met by further equity selling.