Stock splits are gaining in popularity in 2024 as some companies try to make their stocks look more appealing to retail investors. With the rise of retail investors out of the COVID-19 pandemic came the need to be more appealing to this more active batch of investors. Walmart1 and Nvidia2 made it clear when they split their stocks this year, that the purpose was to be more accessible to a wide range of investors, including employees.

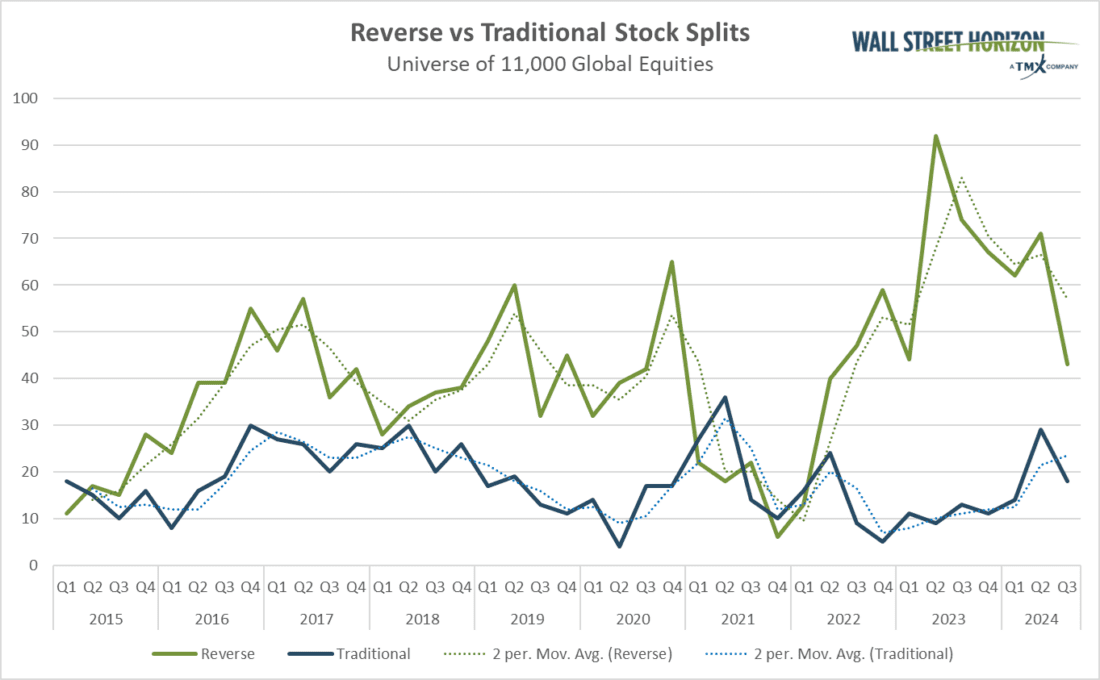

In Q2 2024 announced stock splits reached 100 (out of Wall Street Horizon’s universe of 11k global equities). This is the highest level of stock splits since Q2 2023 which reached 101. However, the first half of 2024 saw 168 split announcements, the highest for a first half in over ten years.

Traditional vs. Reverse Splits

While total stock splits are up, most of that volume is driven by reverse splits which have been outpacing traditional splits for years. A reverse split takes shares from an investor and replaces them with less shares, increasing the stock price, but the market value of the company remains the same. The motivation for this is likely to remain listed on certain exchanges by boosting the share price.

While Q3 isn’t completed yet, it’s clear from the first ten weeks of data that the splits trend continues. In July 2024 there were 30 split announcements (18 reverse, 10 traditional), that’s the most July split announcements in nine years of data. As things do, splits slowed a bit in August with 27 announcements, but that was still a high count historically speaking, with an average of 22 August split announcements for the 10 years.

Source: Wall Street Horizon

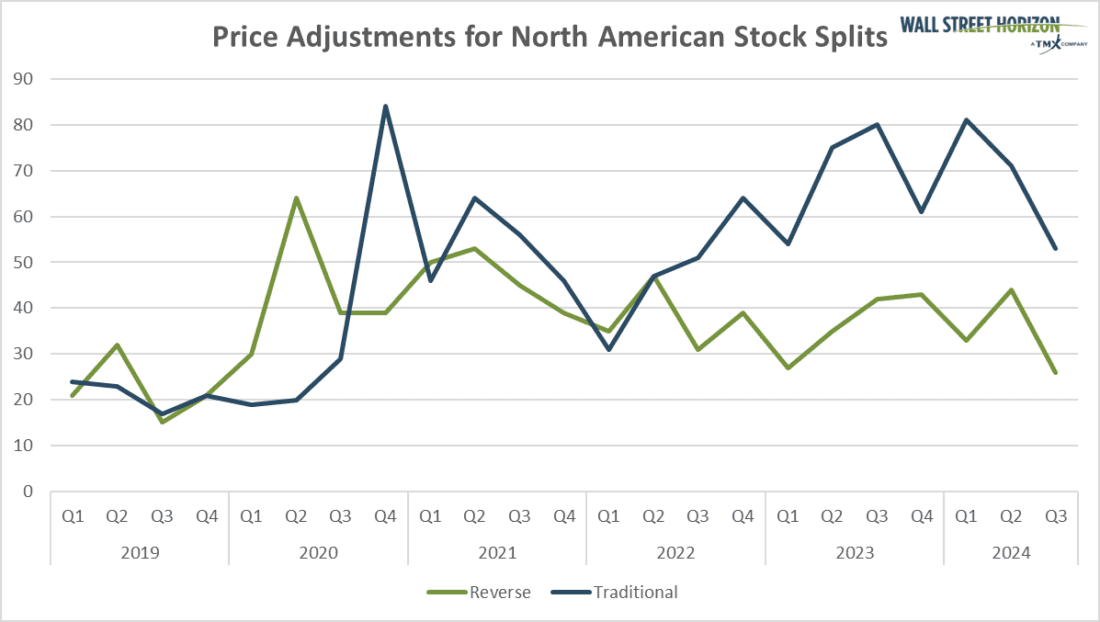

More stock splits means investment teams need to properly adjust stock prices to reflect these corporate actions properly in order to conduct time-series analysis. TMX’s Price Adjustment Curve (PAC) provides price adjustments applicable down to tick level prices or even orders, and below you can see the number of recorded adjustments for North American splits have been steadily increasing. H2 2024 recorded 229 such price adjustments, the most in five years.

Source: TMX Datalinx

Biggest Stock Split Announcements YTD

Despite reverse splits being on the rise, traditional splits tend to get the most media coverage as they are usually enacted by large caps looking to lower the price of their stock to attract new investors. Some of the more notable traditional splits in 2024 include:

Walmart (WMT), 3-for-1, distributed February 23

Nvidia (NVDA), 10-for-1, distributed June 7

Chipotle (CMG), 50-for-1, distributed June 25

Williams-Sonoma (WSM), 2-for-1, distributed July 8

Broadcom (AVGO), 10-for-1, distributed July 12

Notable reverse splits for 2024 include:

Qiagen (QGEN), 24.25-for-25, distributed January 30

Rent the Runway (RENT), 1-for-20, distributed April 2

Buzzfeed (BZFD), 1-for-4, distributed May 6

New York Community Bank (NYCB), 1-for-3, distributed July 11

SITE Centers Corp (SITC), 1-for-4, distributed August 19

The Container Store (TCS), 1-for-15, distributed September 3

AllBirds (BIRD), 1-for-20, distributed September 4

The Bottom-line

While we are only two months into Q3 the momentum in stock splits continues. As corporations attract attention by announcing splits, it may be the case that more companies are encouraged to do the same. Traditional splits tend to be bullish for a stock price, with a one-year return of 25% from the date of the split announcement according to Bank of America.3 This could encourage a broader range of companies, both in different market caps and industries, to try and utilize either the traditional or reverse flavor of this corporate action.

—

Originally Published September 11, 2024 – Stock Splits Continue Their 2024 Comeback

1 Walmart Announces 3-for-1 Stock Split, Walmart Inc., January 30, 2024, https://corporate.walmart.com

2 NVIDIA Announces Financial Results for First Quarter Fiscal 2025, NVIDIA, May 24, 2024, https://nvidianews.nvidia.com

3 Nvidia’s 10-for-1 stock split confirms ‘big tech is going bite-sized’ to lure retail investors—and it might signal more market-beating returns, BofA says, Fortune, Will Daniel, May 24, 2024, https://fortune.com

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Stock split information seem incorrect. You may want to update your article.

Nvidia = 10 for 1

Chipotle = 50 for 1

Broadcom = 10 for 1

William-Sonoma = 2 for 1

Thank you for pointing this out. This change is now reflected in the article. We appreciate your feedback!