The so-called Santa Claus rally refers to the market’s tendency to rise during the last five trading sessions of a calendar year through the first two of the new year. At this point, it might be something of a self-fulfilling prophecy, as experienced traders expecting the market to rise position for a bump. The exact reasons are murky, however, but some rationales include:

- Markets tend to go up over time, so those upward moves can be exacerbated by thin volume (aka, “don’t short a dull tape”).

- Portfolio managers have an incentive to “window dress” their holdings, meaning they want to push their holdings higher into year-end to boost their performance.

- New money flows into the market at the start of a new calendar year.

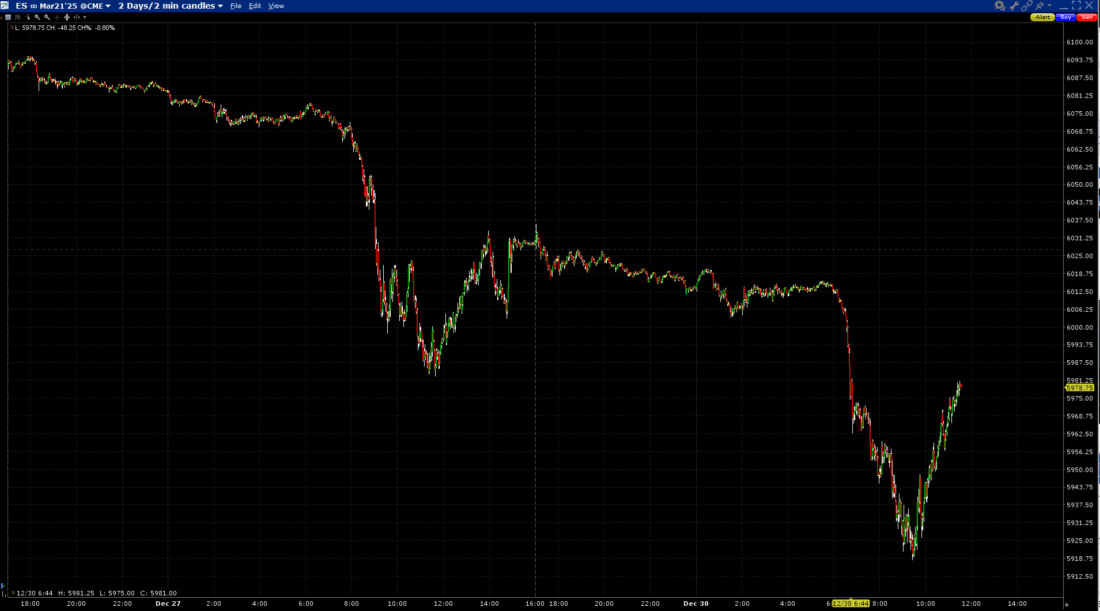

As I write this, just before midday Eastern time, the rally has evaporated. All the key market measures – the S&P 500 cap-weighted (SPX) and equal weighted (SPW), Nasdaq 100 (NDX), Russell 2000 (RTY), and Dow Jones (INDU) are all down between -0.7% and -1.5% in the 3 1/2 sessions (so far) since last Monday. That’s not the encouraging start that many had hoped for, but we are literally only halfway through the period. That is hardly an insurmountable loss – especially if my hypothesis about pension fund selling is correct.

We proposed this hypothesis on Friday, in the piece entitled There Goes Santa Claus?. I stand by the assertions made, including:

- Today [Friday] is a reminder that just because a “Santa Claus” rally is a statistical likelihood, it is far from guaranteed.

- The best I can figure out is that there are large accounts, pension funds and the like, who need to rebalance their holdings before year-end.

- Can I be certain of this? I not been able to confirm first-hand that this is the case. But it is certainly a highly logical explanation. Considering how stock and bond prices have diverged over the past quarter and past, it is highly likely that stocks have become a disproportionately high percentage of a balanced portfolio. Simply put, if a fund desires a 60/40 ratio of stocks to bonds in its portfolio, and the stock portion has risen while the bond portion has fallen, they will likely find themselves with, say, 65/35 or 70/30. Getting back into balance would require selling stocks and buying bonds.

We did acknowledge a potential flaw in the theory, noting:

- Unfortunately, there is a flaw in the “rebalancing” theory: Bond prices haven’t been the inverse of stock prices since early in the session. It is possible that the overall selling in bonds remains substantial, or that the funds are simply raising cash. We see short-term rates lower on the day, so it would make sense if the funds raised from selling stocks are being deployed in cash equivalents. Or of course, the sellers may be waiting until their sales settle on Monday.

Considering that bond yields are sharply lower this morning – about 7-8 basis points in the 2- through 10-year Treasury notes – it appears that the theorizes one-day lag was accurate as well.

One question I received was “why pension funds?” My answer: They’re not taxable. A taxable investor is incentivized to sell losers before the calendar turns and wait until after the new year to sell winners. It defers taxes. Pension funds don’t have that consideration so they can reallocate whenever they see fit without regard to year-end taxes.

Another reason for my theory comes from an early experience of mine. One of the first big trades that I remember was a huge asset allocation trade in August or September of 1987. I was new on the Salomon Brothers trading desk at the time, so I was only peripherally involved, but one of the states’ pension funds (Maryland, I think)[i] took advantage of the big rally in stocks and the plummeting bond market to reallocate across asset classes. For those too young to remember, stocks were zooming throughout 1987 even as bonds were mired in a bear market. Stocks had risen about 20% in the first nine months of that year even as 10-year yields rose from 7% to 9.5%. The fund took advantage by selling stocks and buying bonds. It proved to be a brilliant trade two months later when stocks crashed in October and yields plunged.

The anecdote above by no means is meant to presage a market crash. But it illustrates my thinking. And by the way, in the time it’s taken me to write this piece, stocks have recovered at least to Friday’s lows. It’s too early to count out Santa, even if we can’t always count on him arriving on Wall Street.

ES March Futures, 2-Days, 2-Minute Candles

Source: Interactive Brokers

—

[i] When I tried to check that assertion, I was unable to prove it conclusively. But the first graphic in this report seems like the fund managers were taking a victory lap 14 years later.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Thanks for the article. I use these trends and stats often. This time is different however, because the new government brings more doubts than any assurance. It is possible that we may see some growth for some time, but his plan is more recessive, inflationary, divisive and reckless than the other way around. I am getting ready for everything, including go short eventually.

“This time is different” the 4 most expensive words

A trend in the stock market is noteworthy, until it becomes widely recognized.

Er… beg to differ a tad… I don’t think the AIs and algos running the machines and trades I’m seeing in the real time trading trenches believe in myths, they seem to more concerned about risk mitigation and profit maximization.