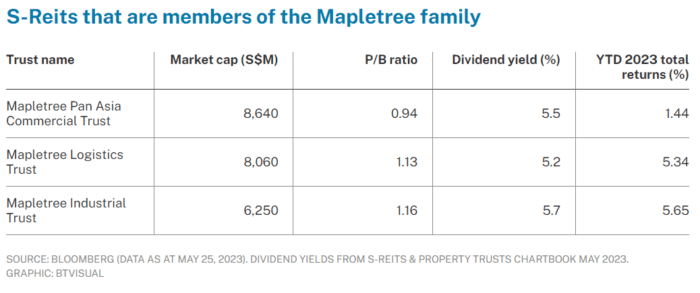

Among the constituents of the Straits Times Index, three S-Reits are members of the Mapletree family – Mapletree Pan Asia Commercial Trust, Mapletree Logistics Trust, and Mapletree Industrial Trust – and they make up a third of S-Reits’ representation in the index.

Mapletree Pan Asia Commercial Trust (MPACT) invests primarily in commercial assets for office and retail purposes across five key Asian markets, with total assets under management (AUM) of S$16.6 billion.

Mapletree Logistics Trust (MLT) invests in logistics assets across nine countries worldwide, with total AUM of S$12.8 billion.

Mapletree Industrial Trust (MIT) owns industrial and data centre assets both in Singapore and North America, with total AUM of S$8.8 billion.

All three S-Reits have reported full-year results for FY22/23 ended Mar 31, 2023 and saw stronger gross revenue and net property income (NPI) performance for the year.

MPACT reported the strongest growth in gross revenue and NPI among the three, with full year FY22/23 gross revenue and NPI rising 65.4 per cent and 62.6 per cent year on year (yoy) respectively.

According to MPACT, the growth was mainly driven by contribution from properties acquired through the merger of Mapletree Commercial Trust and Mapletree North Asia Commercial Trust, as well as higher earnings from core assets, VivoCity and Mapletree Business City, which cushioned the increase in utility and finance costs.

This led to higher distribution per unit (DPU) of 9.61 Singapore cents for the year, up 6.1 per cent yoy (excluding the release of retained cash in FY21/22).

MPACT also reported stronger operational metrics, with portfolio committed occupancy at 95.4 per cent and positive rental reversion of 0.7 per cent. In particular, VivoCity’s full year tenant sales improved 30.6 per cent yoy, exceeding S$1 billion, which set a new record and surpassed pre-Covid levels.

MLT’s FY22/23 gross revenue and NPI grew 7.7 per cent and 7.2 per cent yoy to S$731 million and S$635 million respectively. As a result, amount distributable to unitholders grew 10.8 per cent yoy to S$432.9 million, while DPU rose 2.5 per cent to 9.011 cents on an enlarged unit base. In March this year, MLT announced the acquisition of eight modern logistics assets in Japan, Australia and South Korea for S$904.4 million as well as the potential acquisition of two modern logistics assets in China for S$209.6 million.

MIT reported a double-digit gross revenue growth for FY22/23, up 12.3 per cent yoy. This led to stronger FY22/23 NPI of S$518 million, an increase of 9.7 per cent yoy.

It was mainly driven by the contribution from the acquisition of 29 data centres in the US but partially offset by higher borrowing costs.

However, DPU for the year fell by 1.7 per cent to 13.57 cents due to an enlarged unit base.

MIT recently also completed a private placement, raising over S$200 million to partially fund its latest acquisition of a newly built data centre in Osaka, Japan, which came at a purchase consideration of 52.0 billion yen (approximately S$507.9 million).

The private placement was approximately 4.5 times covered at S$2.212 per new unit. This marks MIT’s first foray into the Japanese data centre market, further diversifying its portfolio.

Post-acquisition, Japan will account for about 5.5 per cent of MIT’s portfolio by AUM, with North America and Singapore representing the remaining 47.6 per cent and 46.9 per cent respectively.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted May 29, 2023 – REIT Watch – Mapletree S-Reits see strong performance amid active acquisitions

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!