As you might expect, a key element of my job involves discussing markets with members of the media. Don’t get me wrong – it’s a highly enjoyable privilege. But there are days (generally volatile ones) where I’m more popular than others. And almost every discussion involved some version of “why did Nvidia (NVDA) get hit so hard?” Funny, when the stock rallied about 30% in two weeks last month, adding a cool $1 trillion to its market capitalization, no one asked me why. And bear in mind that we haven’t been at these low levels since… checks notes… less than a month ago.

NVDA remains by far the most active stock on our platform, with buying activity far outpacing selling. Many investors have understandably become true believers. Frankly speaking, a lot of people have made A LOT of money in a fairly short period of time, so it makes sense. And the belief is based upon results. I can’t recall a company so consistently beating on the top and bottom lines, raising guidance, then doing it all again the next quarter. The growth has been stupendous, justifying a big rally, and thrilling many investors.

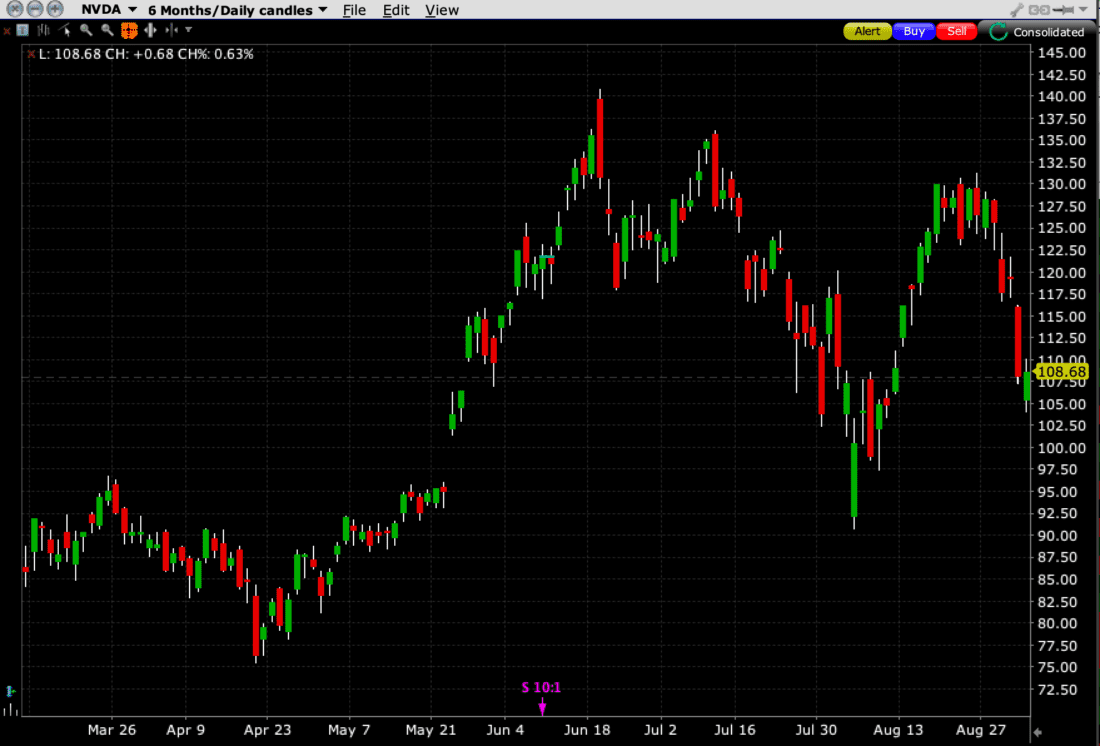

The current NVDA sell-off is a gut check for sanguine investors. But first, bear in mind that we haven’t been at these low levels since… checks notes… less than a month ago. It’s easy to forget that the stock rallied from under $100 to over $130 from August 7th -21st. I heard no complaints when the stock was shooting higher because we’ve come to expect that the stock will go up rapidly. It’s become a very volatile stock, so investors who believe in the company had better get used to the swings. Investors love volatility on the way up (aka “socially acceptable volatility”) but hate it on the way down. Unfortunately, one usually brings the other.

NVDA 6-Months, Daily Candles

Source: Interactive Brokers

(Note that the peak occurred shortly after the 10:1 split went into effect. Buy the rumor, sell the news…)

However, I think we’re at a point where individual investor enthusiasm remains sky high (it never occurred to me to attend an earnings watch party) at a time when institutional investors seem to be taking a more sober view. And, because traders react while investors consider, it is understandable why institutional investors might have waited until yesterday to make a move. Many portfolio managers take vacations and send their kids off to college in late August, rather than focus on their work. Some might attribute this to seasonality, which we noted yesterday, but there are less emotional, more sober reasons why investors may choose to protect their well-earned profits.

Last week’s earnings report reminded us that we have become quite spoiled by NVDA’s consistent ability to beat revenue and earnings estimates, raise guidance, then do it again next quarter. But the magnitude of the beats has been shrinking. As we pointed out last week, NVDA’s EPS beat consensus by 31.07% last August. The level of “beat” has declined since then to 19.64%, 11.69% and 8.51% ahead of last week’s 5.43%. NVDA’s EPS beats have gone from enormous to pedestrian. A stock with a 50 P/E needs to be more than pedestrian. At that valuation it needs to be excellent.

It’s clear that investors have not given up their well-deserved faith in NVDA yet. Only the most robust stocks could be essentially unchanged after receiving a subpoena from the Department of Justice. But the stock’s smooth upward trajectory has become quite a bit bumpier in recent weeks. Turbulence is often unsettling.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

$140.75 intraday top =- $1475/share = very expensive.

@$104 = still $1040/share = expensive.

Post-split (and they love to knock things down post split) – just look at what happened to TSLA or AMZN, which used to be $3800/share. So NVDA, making expensive chips for things have yet to demonstrate bottom line revenue/value => IMO, support ~$76.

As a coder/technologist/trader, based on the realities of how things are still being done in tech (AI included),..tech has been overblown and propped up insider dark pool trade signals and by squeezing shorts for far too long.

Then again Wall St. loves a bubble and needs something/anything to get people excited enough to place a bet. Bottom line: it’s a game show. Questions are asked and answered using money.

Regarding those dark pools signals… write some code to capture trades (aka signals) that are outside-the-spread from a dark pool real time data feed in, say TSLA, or NVDA, both at pre-market 5AM EST (that day’s “play calling”) and post market ~5-5:30 PM (“the shape of things to come”). What you find will be amazing, befuddling and will leave you scratching your head… i.e. until you reverse engineer and analyze it.

Welcome to todays’ markets.

here reason why it’s down:

– month of September

– doj letter (nothing burger)

– high growth stock

expensive is NOT by its stock history.

Follow company fundamental

8 AM EST* (not 5 AM). Use Fibonaccis to analyze the results.

I like ASML as a pick and shovel AI play. They have 90% of the photo-lithography market (they make the machines chip foundries use to manufacture ultra nano chips. They currently make the only machine capable of 2nm die size. Fair Value $990. Closed at $811 today.

NVDA IS THE MOST BOGUS & PUMPED UP STOCK ON PLANET EARTHJUST LIKE THE …….CCCCOOOOMMM BBBUUUBBBLLEEE.

IT IS HSNGING ON BORROWED TIME.

THE REST STOP ON THE WAY SOUTH STANDS AT 104.99 & THEN IT WILL GO DOWN SOUTH TO 99.72 WHERE THE NEXT REST STOP IS.

HEY NO ROLLER COASTER HAS GONE STRAIGHT DOWN & SO WILL THIS BOGUS PUMPED UP POST SPLIT STOCK WILL DO. IT WILL DRIVE PEOPLE NUTS BY GOING UP & DOWN.

THANKS.

S.D.

Ah, S.D., you’ve painted quite the doomsday scenario for NVDA, like a prophet predicting the end times from his backyard observatory. Listen, I appreciate a good thrill ride as much as the next interdimensional traveler, but let’s not confuse a roller coaster with a freefall.

You see, describing NVDA as a ‘pumped up post-split stock’ is like calling a black hole ‘a bit windy.’ It’s not just hanging on borrowed time—it’s creating its own time. Sure, the path might dip to 104.99 or even 99.72, but predicting its complete demise? That’s ignoring the gravity of its underlying strength.

Stocks, like the universe, have their ups and downs, but your certainty of a downward spiral seems more like wishful thinking through a pessimistic telescope. I’d buckle up if I were you, because if this thing swings back to the 110-115 zone, it’ll be more than just a rest stop—it’ll be a victory lap. Thanks for the cosmic entertainment, but I’m not buying that ticket to doom.

Well said!

The all CAPS in SD post told me everything I needed to know about SD.

I got in at average cost / share of ~$45 (split adjusted). I invested money I felt i could afford to lose, which is what everyone should do IMO.

Invested because as a computer scientist (almost 30 years now), I understand the technology, and understand how AI fundamentally changes the way we compute.

It’s a massive sea change in technology overall.

I looked at the fundamentals of Nvidia (and past performance), and realized I should have invested long ago.

On August 5, 2024 while everyone else was panic selling I added 100 more shares at $95/share (which only increased my average cost/share to $48)

Volatility always follows a relatively parabolic move.

The comparisons to the dot com bubble are pretty ridiculous when you consider the fundamentals of NVDA and the other MAG 7 mega caps as well as the many other names investing in AI. Just ask someone who bought NVDA at split adjusted price of 50 cents per share.

The cap ex spending of the mega caps will prove to be justified in the end.

I’m LONG NVDA.

What about KLAC?

NVDA drops not as bad as almost $200 drop in KLAC.