In a twist that few saw coming, Donald Trump clinched a comeback victory, reigniting his signature style and policy focus in the White House. The markets roar, tremble, and speculate as Wall Street attempts to decode this new era of “America First” economics, a revived Trump playbook, and promises of booming industries. With the dust settling, investors are on high alert: Which stocks will thrive under Trump’s unique brand of leadership?

When Trump first took office, he made waves in sectors like defense, traditional energy, and financials; he favored industries that aligned with his pro-business, domestic-focused agenda. Now, with Trump 2.0 in the White House, we’re diving into a potential golden age for “presidential stocks”—companies primed to rise with policy shifts that could drive the market.

Betting Big on America’s Core Industries

Historically, Trump has shown clear favoritism toward industries that build, secure, and fuel America. Now, as he steps back into the Oval Office, he’s expected to double down on these industries with policies that could unleash their full potential.

ExxonMobil and Chevron have long been power players in American oil. Under Trump’s watch, these oil giants could see renewed growth, with a return to aggressive fossil fuel policies and reduced regulations. Known for supporting U.S. energy independence, Trump is expected to lift restrictions and champion drilling rights, creating a boom for energy stocks.

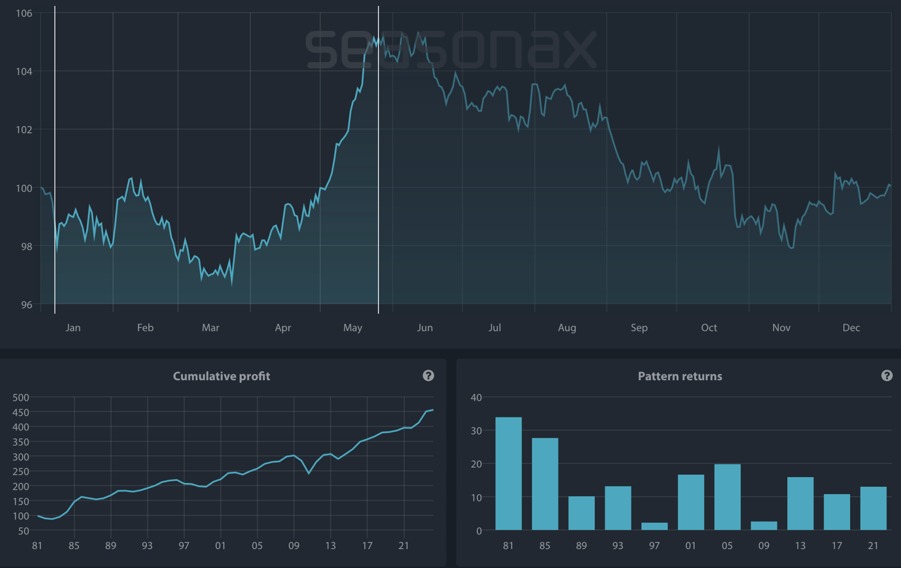

Seasonal pattern of ExxonMobil over the past 10 years

Source: Seasonax, sign up here to access further analysis, 30 days for free

Keep in mind that the seasonal chart shows the average price pattern of the stock calculated over recent years. The horizontal axis shows the time of the year, and the vertical axis shows the percentage changes in the value of the stock (indexed to 100).

Over the past decade, ExxonMobil has shown a strong seasonal trend in the first and second quarters, often delivering peak returns in the early part of the year.

Defense Powerhouses – Locking in National Security Dollars

A Trump Presidency wouldn’t be complete without heavy spending on national defense. Lockheed Martin (LMT), Northrop Grumman (NOC), and Raytheon Technologies (RTX) could be poised for lucrative government contracts as Trump signals his dedication to national security.

Lockheed Martin and Raytheon often see seasonal strength in the first half post-election as defense budgets are released and contracts flow. Historically, they also experience performance peaks when national security concerns are front and center—conditions almost guaranteed in a Trump-led era.

Lockheed Martin has shown a robust seasonal pattern in post-election years, with a strong performance from January 7 to May 26. Over this timeframe, the stock has averaged a 14.7% gain across 97 trading days. Since 1981, returns during this period have been consistently favorable in each post-election year, as highlighted in the bar chart below.

Seasonal pattern of Lockheed Martin in post-election years since 1981

Source: Seasonax, sign up here to access further analysis, 30 days for free

Tech Titans: Powering Up in a New Administration

Another sector Trump seems to favor is technology, and it’s hard to overlook the impact on major players like Microsoft, Amazon, and Alphabet (Google’s parent company). These giants are well-positioned for potential gains as Trump’s administration leans into AI initiatives and ramps up Department of Defense funding, creating prime opportunities for tech advancements.

If you’re considering a long-term investment in these sectors, understanding potential favorable entry points can be just as important as identifying the right stocks. Interestingly, each of these three stocks has historically underperformed toward the end of the year, which could present an attractive buying opportunity for investors.

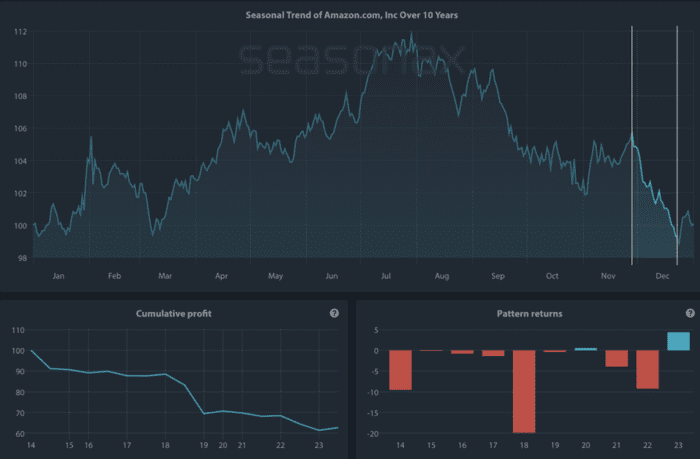

Detrended seasonal chart of Amazon over the past 10 years

Source: Seasonax, sign up here to access further analysis, 30 days for free

*Using Seasonax’s detrended charts can help investors visualize these seasonal lows and highs, stripping out long-term upward trends and revealing hidden cyclical patterns that could influence strategic timing.

From November 28 to December 23 over the past decade, Amazon has shown a consistent downward trend, delivering an average loss of over 4.3% during this period.

For long-term investors, timing entries during these seasonal dips could enhance the potential for growth over time.

But it doesn’t stop there—Tesla has also ridden a wave of success, with its stock soaring after Trump’s election victory. This surge comes in part thanks to CEO Elon Musk’s vocal support for Trump, sparking investor enthusiasm and propelling Tesla into the spotlight as a symbol of innovation in the new administration.

Decoding the Trump Seasonality Patterns

Investing in the “Trump 2.0” era isn’t just about choosing the right stocks—it’s also about timing those investments. Trump’s historical policy moves create predictable patterns, with many stocks showing seasonal strengths in key months post-election.

Seasonax provides you with insights into these seasonal trends, helping you make strategic entry and exit decisions.

It is possible to analyze more than 25.000+ instruments including stocks, (crypto)currencies, commodities, indexes by signing up to a free 30-day trial.

Remember, don’t just trade it, Seasonax it!

—

Originally Posted November 13, 2024 – “Presidential” Stocks in a Trump Comeback

Disclosure: Seasonax

Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. Seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. Seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by Seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. Seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Seasonax and is being posted with its permission. The views expressed in this material are solely those of the author and/or Seasonax and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!