ZINGER KEY POINTS

- Nio’s CFO resigns; EV deliveries up 98.1% Y/Y in June.

- Mixed technical signals as Nio’s stock shows both bullish and bearish indicators.

Nio Inc. has had a rough year, with the stock plunging 51.54% over the past year and 46.31% year-to-date. But the story doesn’t end there. The latest shake-up at the top and mixed technical indicators have made Nio a stock to watch closely.

Leadership Change: CFO Resigns, New CFO Steps Up

Nio’s Chief Financial Officer, Steven Wei Feng, resigned for personal and family reasons, effective Friday. Stepping into the role is Stanley Yu Qu, the company’s senior vice president of Finance. This news sent Nio shares down 2.67% as investors digested the leadership change.

Impressive EV Deliveries Amid Market Volatility

Despite the leadership turmoil, Nio’s electric vehicle (EV) deliveries have been impressive.

In June 2024, Nio delivered 21,209 EVs, a 98.1% year-over-year increase. The second quarter of 2024 saw 57,373 EVs delivered, up a staggering 143.9% year-over-year. As of June 30, 2024, Nio’s cumulative deliveries reached 537,020 vehicles.

Nio Stock – Mixed Technicals Signals

Nio’s technical indicators present a mixed picture:

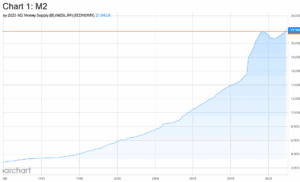

Chart created using Benzinga Pro

- Short-Term Bullish: The stock price of $4.87 is above its 8-day and 20-day simple moving averages (SMAs) of $4.48 and $4.54, respectively, signaling bullish momentum over the short-term.

- Long-Term Bearish: The 50-day SMA is also $4.87, making it a neutral signal, while the 200-day SMA is $6.34, indicating long-term bearishness.

Chart created using Benzinga Pro

- MACD Indicator: With a value of -0.11, the MACD suggests a sell.

- Relative Strength Index (RSI): At 55.47, the RSI indicates the stock is neither overbought or oversold.

- Bollinger Bands: The 25-day bands (4.3 – 5.06) and 100-day bands (4.37 – 5.65) suggest the stock is a sell.

The Bottom Line

Nio’s impressive EV delivery numbers show strong operational performance, but the leadership change and mixed technical signals add a layer of uncertainty. Investors are advised to stay cautious and watch for further developments as Nio navigates this transitional phase.

—

Originally Posted July 5, 2024 – Nio Stock Takes A Wild Ride: Leadership Shake-Up, Mixed Technical Signals

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!