What Does the Rotation Out of Tech Mean for Tech Earnings?

Last week began with investors continuing to rotate out of tech after a massive growth year thus far, and ended with a broader sell-off. With tech earnings on deck that may change if results support the rich valuations for sported by many of those mega tech names. The Nasdaq fell ~4% last week while the S&P 500 was down over 2%. The Dow Jones Industrial Average ended just about flat after rallying more than 700 points on Tuesday, its best day in over a year.

Currently, S&P 500 Communication Services and Information Technology, two of the sectors taking the biggest hits last week (along with Consumer Discretionary), are expected to be the leaders of Q2 earnings season. Investors may be waiting to see if earnings results will justify high P/E levels. With expectations so high, these names will likely have to put up healthy beats to impress shareholders.

According to FactSet, the current consensus for S&P 500 EPS growth is for 9.7% YoY, an increase from 9.3% last week.1 Thus far 80% of companies that have reported have surpassed analyst profit estimates, while only 62% have beaten on revenues.2

CEO Uncertainty Remains High

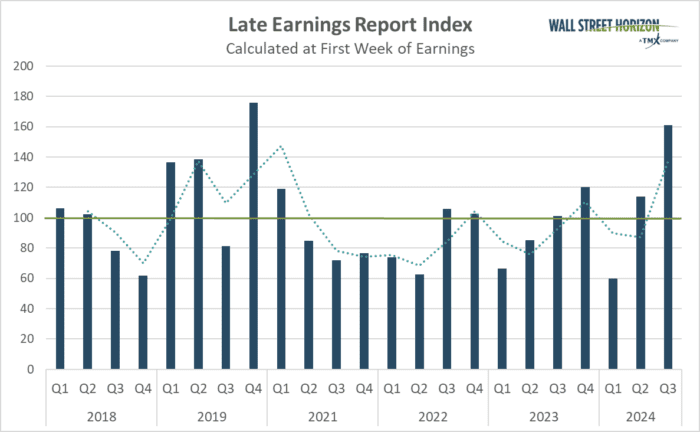

After falling to its lowest level in its nine years in the first quarter of 2024, the Late Earnings Report Index, our proprietary measure of CEO uncertainty, is back up for the second quarter in a row for Q3.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The official pre-peak season LERI reading for Q2 (data collected in Q3) stands at 161, well above the baseline reading, suggesting companies are feeling less certain about economic conditions than they were at the beginning of the year. Some of that uncertainty was evident in banking commentary made over the last couple of weeks. As of July 12, there were 66 late outliers and 37 early outliers.

Source: Wall Street Horizon

Past performance is not indicative of future results

Big Tech on Deck

This week we start to get results from several Magnificent 7 and other big tech names including: Tesla (TSLA), Alphabet (GOOGL) and IBM (IBM). This comes just as investor’s start to rotate out of these megacap winners into smaller names that they believe will benefit more greatly from interest rate cuts potentially coming as soon as next month.

Source: Wall Street Horizon

Past performance is not indicative of future results

Late Earnings Date Confirmation

When a company is late to confirm their quarterly earnings date, it could be valuable information for current or prospective inventors to know.

Released in 2022, Wall Street Horizon’s Confirmation Timing uses historical data to project an expected confirmation date and the normal range that enables the identification of:

- Companies that have not yet confirmed an earnings date and are materially late compared to their historical trends/behaviors.

- Announced earnings dates in which the Confirmation Timing is materially earlier or later than the company’s historical average of the same quarter.

Companies that tend to stall on confirming their earnings dates also tend to set later than usual earnings dates which academic research has shown highly correlates to bad news being shared on the call.3

The Walt Disney Company (DIS)

In recent years DIS has confirmed its Q2 earnings date around July 5 with a standard deviation of +/- 3.7 days. DIS ended up confirming its Q2 earnings date, August 7 BMO, on July 18 which was 14 days past the mean confirmation day. While the earnings date itself is within the historical range of expected earnings dates, the delay in confirming that date could point to a hesitant management team.

Earlier in the year Disney was embroiled in a proxy battle which ended in April as the entertainment behemoth fended off activist investor Nelson Peltz who attempted to secure board seats. Following a vote at its annual shareholder meeting, the company announced the current Disney board would remain as-is.4

Q2 Earnings Wave

This season peak weeks will fall between July 22 – August 16, with each week expected to see over 1,000 reports. Currently August 8 is predicted to be the most active day with 1,445 companies anticipated to report. Thus far only 60% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

Past performance is not indicative of future results

—

Originally posted July 22nd, 2024 – Investors Rotate Out of Tech Just Ahead of Big Tech Earnings

1 FactSet Earnings Insight, FactSet, John Butters, July 19, 2024, https://advantage.factset.com

2 FactSet Earnings Insight, FactSet, John Butters, July 19, 2024, https://advantage.factset.com

3 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

4 The Walt Disney Co., 2024 Annual Meeting of Shareholders Transcript, April 3, 2024, https://thewaltdisneycompany.com

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!