Key News

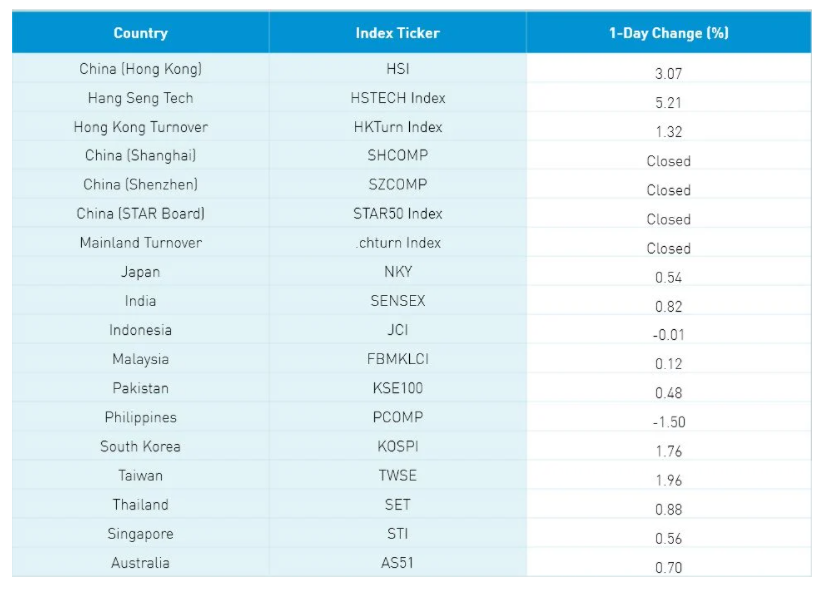

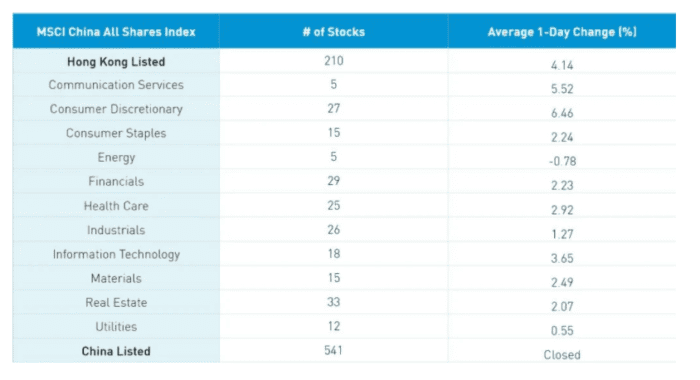

Asian equities cheered US debt ceiling progress/kicking the can and a proposed virtual call between Biden and Xi following US-China talks in Zurich. Virtually all markets were up, though Hong Kong and South Korea posted significant gains. The Hang Seng gained 3.07% while the Chinese companies listed in Hong Kong within the MSCI China All Shares (the most comprehensive definition of China comprised of Shanghai, Shenzhen, Hong Kong, and US-listed Chinese stocks) gained +4.14% and the Hang Seng Tech gained +5.23%. While Hong Kong’s volume was very light/just 61% of the 1-year average, internet stocks had a very strong day on strong volume. Remember our air pocket thesis that many active EM and global funds have moved out of the space.

Yesterday we noted Charlie Munger doubling his stake in Alibaba in Q3 and Fidelity’s CIO and China’s PM both commenting on opportunities in China tech stocks. If we can get some momentum, this money can move back into the space. Today’s price/volume action could be a sign of this occurring. Early days but fingers crossed. A Mainland media source noted Duan Yongping, a Chinese billionaire tech entrepreneur widely followed by Chinese investors, had stated he was buying Tencent in August.

Clean technology had a very strong day including EV, solar, wind, and metals, while energy stocks were hit with profit-taking. Real estate stocks had a strong day following yesterday’s announcement on developing land near Shenzhen for affordable housing. Chinese Estates gained +31.72% as the company’s founding family took the company private.

An area that the US and China should be able to find common ground on is the US providing China with much-needed coal and LNG to solve the energy shortage. China’s energy crisis could take several months to curtail despite a full-court press from policymakers. We’ve already seen China begin importing coal from Australia, despite political tensions, though US suppliers could benefit as well.

The Holding Foreign Companies Accountable Act is another area of potential collaboration. It benefits neither the US nor China to see US-listed Chinese companies delisted. Domestic travel appears to have been limited on Delta worries during the Golden Week, consumption activity appears to be strong according to JD.com and Meituan real-time data.

One overlooked economic nugget is the business activity expectation survey within the PMIs. What better way to understand what business leaders are thinking about the future than their expectations? September’s official PMIs business expectations for Manufacturing were 56.4 versus August’s 57.5, while the Non-Manufacturing PMI’s business expectations were 59.1 versus August’s 57.4.

There are 14 companies globally with a market cap of over $350B that grew revenue more than 20% year over year. Two of the fourteen are Alibaba and Tencent. The average P/E ratio of the 14 companies is 59 though Tesla’s P/E ratio of 397 skews the simple ratio. Alibaba and Tencent’s P/E ratios are 22 and 18 which are both below that of Saudi Arabia Oil Company’s (Aramco) P/E of 28.

H-Shares Update

The Hang Seng opened higher and kept going closing +3.07% though volume only increased +1.34% which is only 61% of the 1-year average. The 210 Chinese companies listed in Hong Kong gained +4.14% led by discretionary +6.45%, communication +5.52%, tech +3.64%, healthcare +2.91%, materials +2.49%, staples +2.22% and real estate +2.07% while energy was off -0.79%. Hong Kong’s most heavily traded were Tencent +5.6%, Meituan +9.71%, Alibaba HK +7.28%, Ping An +7.03%, Xiaomi +3.89%, NetEase +8.59%, JD.com HK +6.15%, Kuaishou +8.49%, HSBC +1.88% and HK Exchanges +1.61%. Southbound Stock Connect was closed today.

A-Shares Update

Shanghai, Shenzhen, STAR Board, and Northbound Stock Connect were closed today.

Last Night’s Exchange Rates, Prices, & Yields

Mainland markets were closed overnight.

—

Originally Posted on October 7, 2021 – Investors Cheer US Debt Ceiling and Diplomatic Progress

Author Positions as of 10/7/21 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!