KEY TAKEAWAYS

- AI’s long-term impact could extend beyond the “Magnificent 7”— Apple, Microsoft, Amazon, Google (Alphabet), Meta, NVIDIA, and Tesla — to nearly all global industries.

- AI is still at the early stages of one of the most powerful technological revolutions since the internet.

- Investing in the full AI value chain — such as through an AI-focused ETF — could offer a broader approach compared to traditional tech sector investments.

AI IS JUST GETTING STARTED

Artificial Intelligence (AI) is showing up everywhere you turn, from self-driving vehicles to summarized product reviews. AI thrives on data, and we live in an increasingly digital world. In fact, AI market size is expected to reach $407 billion by 2027,1 and BlackRock believes AI could disrupt the global economy over the next decade. (Learn more about digital disruption and AI).

Although the concept of AI has been around for decades, recent trends of advancements in semiconductor breakthroughs, data proliferation, and software design have converged to bring the field to an inflection point. AI has transcended its “buzzword status,” with businesses across sectors looking to integrate the technology to grow new revenue streams or improve efficiencies.

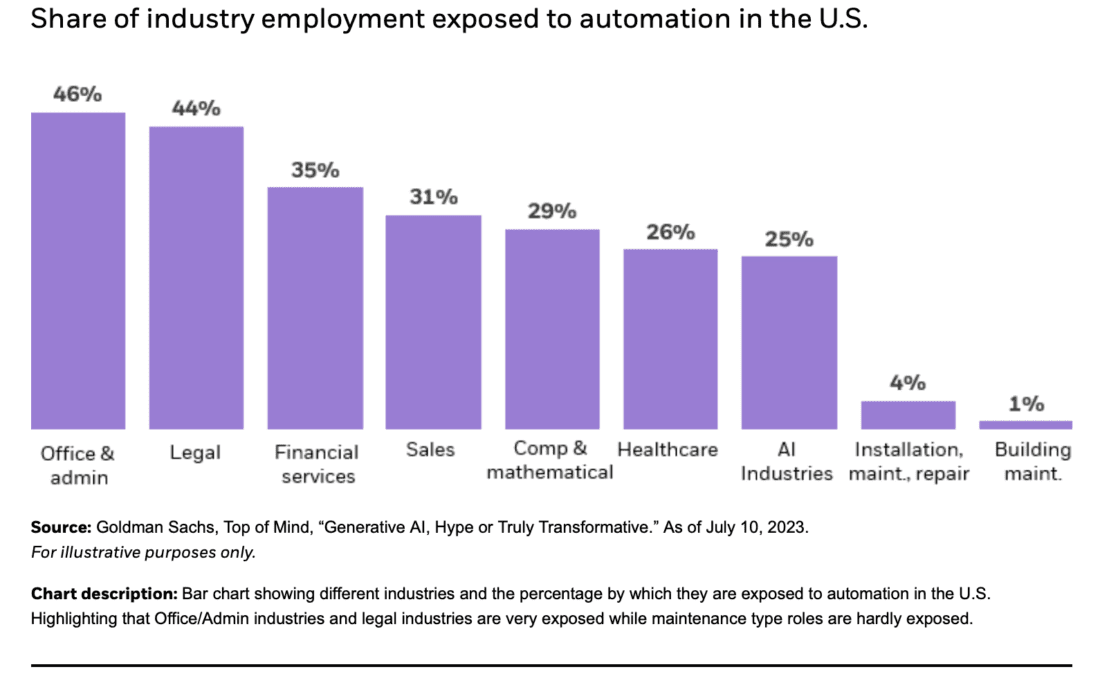

AI will bring new efficiencies and revenue opportunities to virtually all segments of the economy

Yet despite the recent attention on AI, we believe the AI theme is still in its early stages, presenting investment opportunities for long-term investors.

LOOKING BEYOND THE “MAG 7”

Certain areas of the AI space continue to attract more headline attention than others, like the select group of mega-cap tech companies known as the “Magnificent 7”.

Focusing on the Mag 7 illustrates the potential emphasis on “picking a winner now” when investing in AI. The S&P Technology Select Sector Index has exhibited notable disparities between top and bottom performers. The difference between top-decile and bottom-decile technology stocks year-to-date is about 47.4%.2 Long-term thematic AI investing is not just about investing in today’s largest tech stocks it is about identifying underappreciated areas within AI that are well-positioned for long-term growth and going beyond today’s market leaders.

HOW TO CAPTURE THE FULL AI VALUE CHAIN

The AI value chain includes companies and industries directly contributing to AI’s growth, including software, hardware, and infrastructure. A few key examples include:

GENERATIVE AI

- Core AI models designed to generate new and original content

- Specialized chips essential for training and running AI models

Did you know?

Worldwide AI chip revenue is projected to increase to $71 billion in 2024, marking a 33% increase from 2023.³

AI DATA AND INFRASTRUCTURE

- Operators of AI workloads & data centers, providing the infrastructure needed for generative AI

- Chips that support broader AI applications

- Infrastructure for data centers, crucial for storing and processing vast amounts of data

Did you know?

The U.S. data center market saw the largest pricing increase of all commercial real estate assets in 2023.⁴

AI SOFTWARE

- Databases & related software tools that facilitate data management & AI deployment

- Enterprise software enhanced with AI capabilities to improve business processes

- Consumer software integrated with AI features, enhancing user experiences and functionality

Did you know?

AI software spending is predicted to grow from $124 billion in 2022 to approximately $298 billion by 2027.⁵

AI SERVICES

- IT consulting or service firms that specialize in the implementation and management of AI technologies

Did you know?

It is estimated that over 80% of enterprises will have used generative AI by 2026, up from less than 5% in 2023 — creating demand for AI-as-a-service providers.⁶

These categories represent the diverse and evolving landscape of AI. By owning the full value chain of AI industries, investors can seek to capture a broader spectrum of companies and reduce the risk of overreliance on a few dominant players. This approach may allow for exposure to both established and emerging innovators and enablers. A thematic ETF focused on these areas can offer a streamlined approach to AI.

[…]

CONCLUSION

AI is still at the early stages of one of the potentially most powerful technological revolutions since the birth of the Internet. AI may introduce new efficiencies and revenue streams across sectors of the economy. As this technology matures, investors can turn to AI to complement the core exposure of their portfolios or to replace their traditional tech exposure. AI-focused ETFs can offer a streamlined way to tap into potential diverse opportunities with a single trade.

—

Originally Posted August 15, 2024 – Investing in AI: It’s about how, not if

© 2024 BlackRock, Inc. All rights reserved.

1 Source: Forbes, “24 Top AI Statistics and Trends in 2024.” June 15, 2024.

2 Source: Morningstar, as of 7/31/2024. Based on stocks in the S&P Technology Select Sector Index. Top decile funds are up 37.3% and bottom decile funds are down –10.1%.

3 Source: Gartner, “Gartner Forecasts Worldwide AI Chips Revenue to Grow 33% in 2024.” As of May 29, 2024. Forward-looking estimates may not come to pass.

4 Source: CBRE “North American Data Center Pricing Nears Record Highs, Driven by Strong Demand and Limited Availability”, March 7, 2024.

5 Source: Gartner “Forecast Analysis: AI Software Market by Verticl Industry, 2023–2027”, March 27, 2024. Forward-looking estimates may not come to pass.

6 Source: Gartner, Catherine Howley, “Gartner Says More Than 80% of Enterprises Will Have Used Generative AI APIs or Deployed Generative AI-Enabled Applications by 2026.” As of October 11, 2023. Forward-looking estimates may not come to pass.

[…]

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

This information must be preceded or accompanied by a current prospectus. Investors should read it carefully before investing.

Investing involves risk, including possible loss of principal.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0824U/S-3782046

Disclosure: iShares by BlackRock

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from iShares by BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or iShares by BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!