- Q4 S&P 500® EPS growth expected to come in at 16.9%, the highest growth rate in three years

- Large cap outlier earnings dates this week include: ANSYS, Akamai Technologies and Trimble Inc.

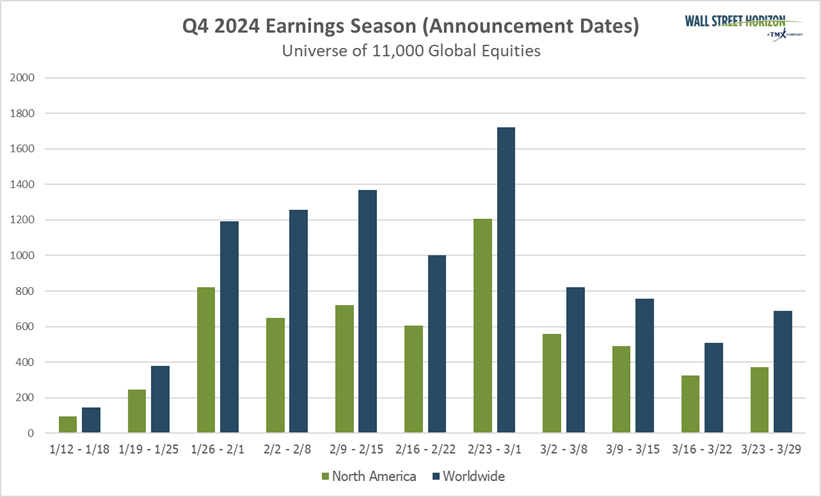

- The third week of peak season begins this week, with 1,233 companies expected to report

Despite being a packed week for earnings, it was Federal Reserve testimony, January’s CPI reading, and proposed steel tariffs that took center stage for investors last week.

Federal Reserve Chairman Jerome Powell was already giving conservative commentary regarding future rate cuts when he spoke to the Senate Banking Committee on Tuesday, reiterating the Fed was in “no rush” to ease, and commenting that inflation was “moving in the right direction.”1 That argument got flipped on its head a bit by Wednesday morning when January CPI came in hotter than expected, showing a 3% increase in YoY inflation, moving away from the Fed’s 2% target.2 Powell worked this change into his comments on Wednesday to the House Financial Services Committee. “I would say we’re close, but not there on inflation,” Powell reiterated. “You can see today’s inflation print, which says the same thing.”3

After the CPI report, the CME Group’s FedWatch tool showed the probability of a rate cut at the June FOMC meeting falling to 36.9%. On Friday, February 7, the probability of a rate cut at that meeting was 52%, and that was even after a strong January jobs report. The June meeting was anticipated to be the first time in 2025 where we would see the Fed cut rates, but now that expectation has moved into September, with a 58% probability of a cut.4 Some in the industry have gone as far to say they expect no rate cuts in 2025, including Bank of America CEO, Brian Moynihan.5

Going hand-in-hand with inflation concerns, tariff talk once again took over the headlines last week when President Trump announced a 25% tariff on steel and aluminum products that would be implemented on March 12.6 Industries ranging from auto, homebuilding, household durables and even consumer staples names such as Coca Cola reacted with how this would impact their bottom-line.7

The Q4 earnings season continued on with results from restaurants, enterprise technology companies and others. Restaurants have been a mixed bag, even within similar segments. Fast food restaurants have been duking it out for market share, as the US consumer in particular remains very value-conscious. McDonald’s was able to tap into this over the summer by bringing back their $5 value meals, but Q4 results released on Monday showed sales took a hit due to an E. coli outbreak. Yum! Brands, which reported results on February 6, showed same store sales (SSS) for its KFC brand were flat for the quarter, while Pizza Hut’s SSS fell 1% YoY. Yum! Brand’s Taco Bell was the leader in its portfolio with SSS that increased 5%. Restaurant Brands was out with results on Wednesday that showed the quick-serve names in its portfolio were also doing well in this environment, with Burger King and Popeyes posting SSS results of 1.5% and 0.1%, respectively.

With 77% of companies from the S&P 500 now having released results for Q4, growth is at 16.9%, the highest level in 3 years. Revenue growth stands at 5.2%.8

On Deck this Week

This week marks the third peak week of earnings season with 1,233 companies (in our global universe of 11k) set to report, and 78 from the S&P 500. It’s a bit of a light “peak” week due to the President’s Day holiday on Monday, February 17 during which US markets are closed. Once Americans return from their long weekend, they’ll have some consumer-centric reports to look forward to such as Etsy, Walmart and Hasbro.

Source: Wall Street Horizon

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share negative news on their upcoming call, while moving a release date earlier suggests the opposite.9

This week we get results from a number of large companies on major indexes that have pushed their Q4 2024 earnings dates outside of their historical norms. Five companies within the S&P 500 confirmed outlier earnings dates for this week, three of which are later than usual and therefore have negative DateBreaks Factors*. Those names are Akamai Technologies (AKAM), CF Industries Holdings (CF) and Trimble Inc. (TRMB). The two names with positive DateBreak Factors are ANSYS Inc (ANSS) and Insulet Corp (PODD).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Akamai Technologies

Company Confirmed Report Date: Thursday, February 20, AMC

Projected Report Date (based on historical data): Tuesday, February 11, AMC

DateBreaks Factor: -3*

Akamai Technologies is set to report their Q4 2024 results on Thursday, February 20, nine days later than expected. By releasing results on February 20 they are not only reporting the latest that they have in a decade, but pushing into the 8th week of the year (WoY), when they typically report during the 7th WoY. This will also be the first time in at least ten years that they will report on a Thursday, bucking the long-term Tuesday trend.

ANSYS

Company Confirmed Report Date: Wednesday, February 19, AMC

Projected Report Date (based on historical data): Wednesday, February 26, AMC

DateBreaks Factor: 2*

ANSYS is set to report their Q4 2024 results on Wednesday, February 19, a week earlier than expected. While this adheres to their usual Wednesday reporting trend, it would be the earliest they’ve reported in at least ten years.

Q4 Earnings Wave

We are well into peak earnings season at this point, which started on February 3 and runs until February 28. Currently, February 27 is predicted to be the most active day with 881 companies anticipated to report. Thus far, 74% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), and 39% have reported results.

Source: Wall Street Horizon

—

Originally Posted February 18, 2025 – Inflation, the Fed and Tariffs Provide a Distraction from Peak Earnings Season

1 Board of Governors of the Federal Reserve System, Semiannual Monetary Policy Report to the Congress, February 11, 2025, https://www.federalreserve.gov

2 Consumer Price Index – January 2025, February 12, 2025, https://www.bls.gov

3 US inflation jump puts Fed officials on notice as Powell testifies, Reuters, by Howard Schneider, February 12, 2025, https://www.reuters.com

4 CME Group FedWatch Tool, https://www.cmegroup.com

5 Bank of America CEO on inflation impact on U.S. economy: ‘Rates are going to stay where they are’, CNBC, by Hugh Son, February 12, 2025, https://www.cnbc.com

6 Is It Made of Metal? It Could Get More Expensive Under Trump’s Latest Tariffs., New York Times, by Lydia DePillis, February 11, 2025, https://www.nytimes.com

7 Coca-Cola says it will sell more soda in plastic bottles if aluminum tariffs take effect, CNBC, by Amelia Lucas, February 11, 2025, https://www.cnbc.com

8 Earnings Insight, FactSet, John Butters, February 14, 2025, https://advantage.factset.com

9 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!