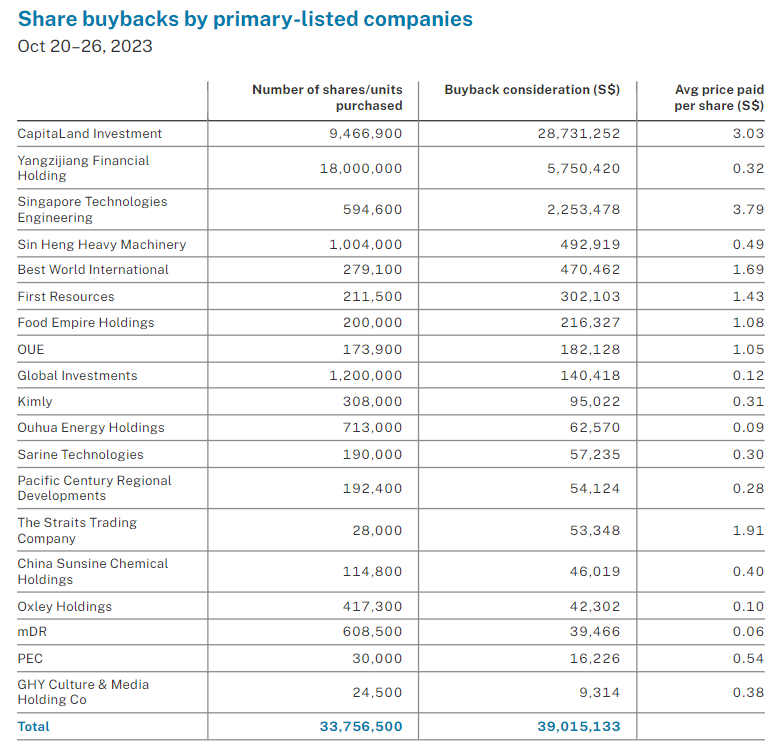

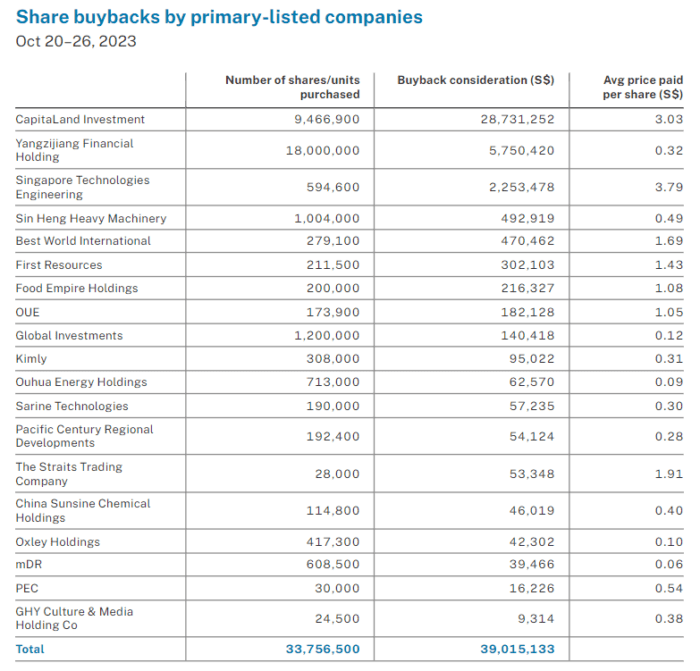

INSTITUTIONS were net sellers of Singapore stocks over the five trading sessions through to Oct 26, with S$109 million of net institutional outflow, as 19 primary-listed companies conducted buybacks with a total consideration of S$39 million.

CapitaLand Investment (CLI) led the share buyback consideration tally, buying back 9,466,900 shares at an average price of S$3.03 per share, after also leading the buyback tally for the preceding five sessions. The company is scheduled to provide a third quarter 2023 business update before the market opens on Thursday, Nov 9.

Leading the net institutional outflow over the five sessions were UOB, CapitaLand Integrated Commercial Trust, Mapletree Logistics Trust, Seatrium, CapitaLand Ascendas Reit, HongkongLand, Keppel DC Reit, UOL Group, Jardine Cycle & Carriage and Suntec Reit.

Meanwhile, DBS, OCBC, Yangzijiang Shipbuilding, ComfortDelGro Corporation, Singapore Airlines, Genting Singapore, Singtel, UMS, Sembcorp Industries and Keppel Reit led the net institutional inflow over the five sessions.

The five trading sessions saw close to 60 changes to director interests and substantial shareholdings filed for 28 primary-listed stocks. This included 13 company director acquisitions with two disposals filed, while substantial shareholders filed 11 acquisitions and two disposals.

Wing Tai Holdings

Wing Tai Holdings chairman and managing director Cheng Wai Keung has continued to build his deemed interest in the company, through his spouse Helen Chow acquiring shares.

From Oct 20 through to Oct 26, Cheng increased his deemed interest in the leading real estate developer and lifestyle retailer by 720,300 shares.

He maintains a 61.27 per cent total interest in the company. Since Sep 8, Chow has acquired 2.85 million shares.

AEM Holdings

On Oct 18, AEM Holdings substantial shareholder abrdn plc increased its deemed interest back above the 9 per cent threshold with 273,000 shares acquired at S$3.518 per share.

This followed abrdn plc’s deemed substantial shareholding falling below the 9 per cent threshold on Jul 3.

Outside of the STI constituents, AEM Holdings has been the third most traded Singapore-listed company by trading turnover in the 2023 year through to Oct 26, after ComfortDelGro Corporation and UMS Holdings.

AEM Holdings has also booked S$39.7 million of net institutional inflow over the 43 weeks.

With a global presence across Asia, Europe, and the United States, AEM Holdings provides comprehensive semiconductor and electronics test solutions.

Back in August, the group provided FY23 (ended Dec 30) revenue guidance of S$460 million to S$490 million on the back of reduced test capital equipment utilisation levels across the industry and delays in current customer device release schedules.

This compares to respective FY22, FY21, FY20 and FY19 revenues of S$870 million, S$565 million, S$519 million and S$323 million.

The group also noted that while inventory digestion is expected to continue through 2023, it believes it is well-positioned to take advantage of the semiconductor volume growth that is expected to return to the semiconductor industry in 2024.

AEM Holdings maintained in August that its Test 2.0 paradigm is at the forefront of test solutions for next-generation advanced logic devices, including high-performance compute, given the group’s unmatched capability in thermal and Device Under Test power.

In responses to questions prior to the FY22 AGM, AEM Holdings had noted that its Test 2.0 paradigm enables a device manufacturer to define test flows that break away from the limitations of the standard Test 1.0, thus delivering the required test coverage at a significantly lower cost of test.

It added that anecdotal evidence of the cost of test savings has been conservatively anywhere from 30 per cent to 50 per cent at high volume.

AEM Holdings maintained in August that customer traction for the Test 2.0 solutions continues to grow with confirmed initial orders from an additional new leading application processor customer, and an expansion of AEM’s engagement with a previously announced memory customer.

Bonvests Holdings

Between Oct 23 and 25, Bonvests Holdings executive chairman Henry Ngo acquired 272,700 shares at S$1.00 per share. The acquisitions were made through Allsland Pte Ltd, which is wholly owned by Ngo.

This increased his total interest in Bonvests Holdings from 84.60 per cent to 84.67 per cent.

Ngo has gradually increased his total interest in the group from 82.93 per cent in August 2018.

The five revenue segments of the group span rental, hotel, industrial, investment and property development.

The hotel division contributed the most to the group’s H1FY23 (ended Jun 30) revenue, at 74 per cent of the S$105.37 million total revenue, followed by the industrial division contributing 17 per cent and the rental division contributing 9 per cent.

Ngo is the founder of Bonvests and stepped down as managing director, while continuing as executive chairman in 2022.

Under his leadership, the group had developed the property arm and diversified into waste management as well as hotel development and operations overseas.

LHT Holdings

Between Oct 23 and 26, LHT Holdings managing director, Yap Mui Kee, acquired 235,900 shares at an average price of S$0.819 per share.

With a consideration of S$193,123 this took her direct interest in the homegrown pallet manufacturer from 16.08 per cent to 16.52 per cent.

Yap has gradually increased her direct interest in LHT Holdings from 14.12 per cent in August 2021.

Her preceding acquisition was back on Oct 18, 2022, with 460,700 shares bought at S$0.70 per share.

LHT Holdings is one of the largest homegrown manufacturing companies of high quality and eco-friendly wooden pallets, boxes, and crates in Singapore.

Yap had been an executive director of the company since January 1988. She was appointed acting managing director in February 2016 and re-designated chairman, managing director, and CEO in February 2017.

She oversees the sales and marketing functions of the group for more than 35 years and is responsible for exploring new markets for the company and aligning its research and development efforts for new products based on market needs.

Yap plays an active role in the group’s efficient consumer response (ECR) pallet rental business in Singapore and Malaysia; and oversees the development of the group’s radio frequency identification (RFID) ECR pallet tracking system.

Back on Aug 11, the group reported that its H1FY23 (ended Jun 30) attributable profit increased 7.9 per cent to S$2.58 million.

It noted that the sales of pallets and packaging business segment decreased by 9 per cent from H1FY22 to S$12.89 million due to saturated market conditions arising from increased competition and a reduction in market demand.

At the same time, the group was able to achieve a higher gross margin in H1FY23.

This was mainly due to intensified efforts in sourcing for cheaper raw materials and lower production cost as a result of the group’s effort to gradually relocate production facilities to Malaysia.

The group noted that going forward, apart from intensifying its marketing efforts, it will continually review and further streamline its current operations and production processes.

Tai Sin Electric

On Oct 23, the spouse of Tai Sin Electric executive director and CEO Bernard Lim Boon Hock acquired 464,000 shares of the company.

The shares were acquired by Pang Yoke Chun at S$0.40 per share which increased Lim’s total interest in the South-east Asian industrial group from 17.55 per cent to 17.65 per cent.

Lim has gradually increased his total interest in the company from 14.82 per cent at the end of 2019.

—

Originally Posted October 30, 2023 – CLI buys back S$29m in shares; abrdn’s deemed AEM interest back above 9%

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!