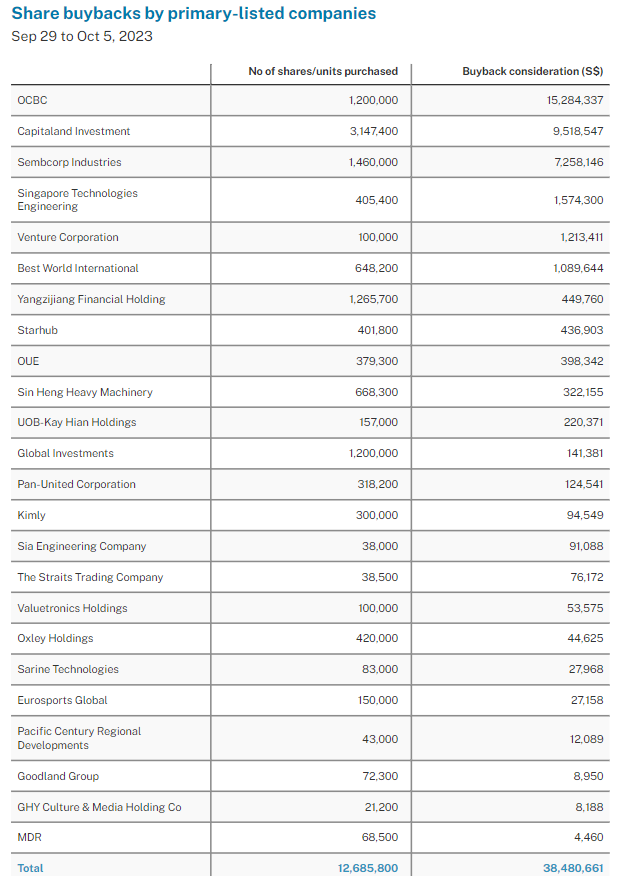

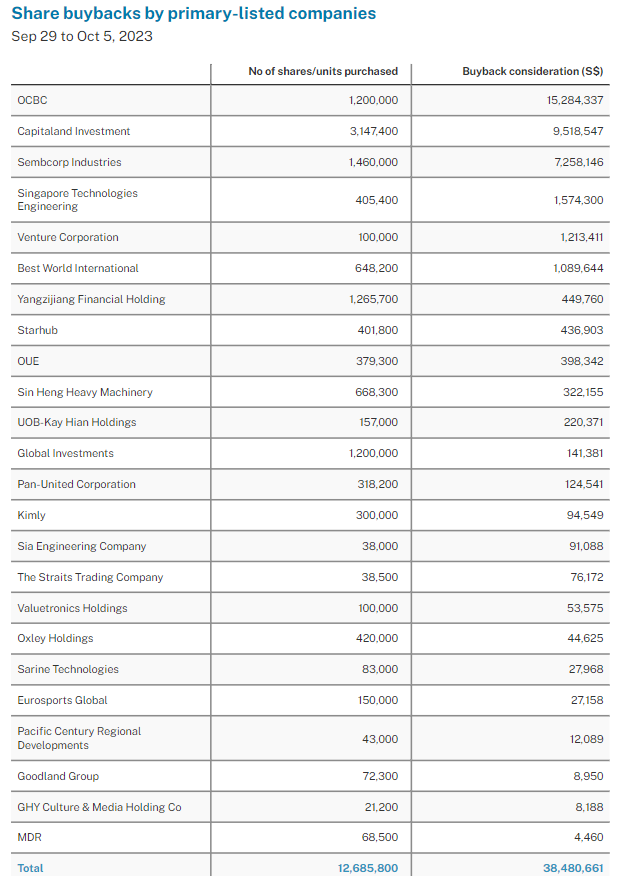

INSTITUTIONS were again net buyers of Singapore stocks over the five trading sessions through to Oct 5, with S$100 million of net institutional inflow, and 24 primary-listed companies conducting buybacks with a total consideration of S$38.5 million.

OCBC led the share buyback consideration tally, buying back another 1.2 million shares at an average price of S$12.74 per share, followed by CapitaLand Investment buying back 3,147,400 shares at an average price of S$3.02 per share. Best World International also bought back 648,200 shares at an average price of S$1.68 per share.

Leading the net institutional inflow over the five sessions were OCBC, DBS Group, UOB, CapitaLand Investment, Singapore Technologies Engineering (ST Engg), Singtel, UMS Holdings, Singapore Exchange (SGX) and ComfortDelGro Corp.

Meanwhile, Thai Beverage, Yangzijiang Shipbuilding (Holdings) (YZJ), Singapore Airlines, Venture Corp, CapitaLand Ascott Trust (Clas), Lendlease Global Commercial Reit (Lendlease Reit), Mapletree Logistics Trust, CapitaLand Integrated Commercial Trust, Keppel Corp and CapitaLand Ascendas Reit (Clar) led the net institutional outflow over the five sessions.

The five trading sessions saw 70 changes to director interests and substantial shareholdings filed for 30 primary-listed stocks. This included 14 company director acquisitions with no disposals filed, while substantial shareholders filed eight acquisitions and three disposals.

Companies that saw directors or chief executive officers acquire shares included JB Foods, Marco Polo Marine, Overseas Education, XMH Holdings and YKGI.

Stocks leading net institutional inflow

In the third quarter of 2023, Singapore stocks booked S$113 million of net institutional fund inflow, with a near even ratio of the number of stocks that booked inflow versus outflow.

Banks

From a sector perspective, Straits Times Index (STI) banks, comprised of DBS, OCBC and UOB, led the net institutional fund inflow to Singapore stocks in Q3 2023.

The combined S$596 million of net institutional fund inflow for the heavyweight trio compared to S$2.17 billion of net institutional fund outflow in the first half of 2023. The three banks also averaged 7 per cent total returns over the quarter. The higher-for-longer Fed funds rate outlook for 2024 saw banks as the next best performing sector in the global stock market after the energy sector in Q3 2023.

During Q3 2023, the trio of STI banks reported combined net interest income (NII) of S$8.26 billion in Q2 2023. This was the third consecutive quarter that their combined quarterly NII was reported above the S$8 billion mark. For context, the combined quarterly NII of the trio broke above S$5 billion in Q1 2018 and ranged between S$5 billion and S$6 billion for just over four years through to Q1 2022, before breaking above S$6 billion in Q2 2022.

Reits

On the other side of the higher-for-longer Fed funds rate outlook, the iEdge S-Reit Index declined 4 per cent in total return over the quarter. This coincided with the Singapore real estate investment trust sector booking the most net institutional fund outflow for Q3 2023.

However, Clar, with a strong focus on technology and logistics properties in developed markets, booked the seventh-highest net institutional inflows at S$56 million in Q3 2023. Clar also generated a 2 per cent total return in Q3 2023. This brought its nine-month total return to 4 per cent. Back in H1 2023, the manager of Clar completed three accretive acquisitions in Singapore with an aggregate purchase consideration of S$515 million, while also divesting KA Place, a high-specification industrial building in Singapore, for S$35 million, which was a 55 per cent premium to its market valuation. Furthermore, Clar reported 6.7 per cent growth in H1 2023 net property income from H1 2022, to S$509 million.

On Aug 17, Clar completed the acquisition of its fifth data centre in the United Kingdom for S$200 million. This latest acquisition boosts its Reits data centre investments in the United Kingdom by 54 per cent to S$570 million. Clar entered the European real estate market in March 2021. As relayed in investor presentations in Q3 2023, the manager of Clar is steering the portfolio towards asset classes that cater to the changing market and tenant requirements arising from structural trends and changing consumption patterns such as digitalisation and e-commerce.

Other STI stocks that led the net institutional fund inflow in Q3 2023 included Seatrium, ST Engg, SGX, Wilmar International and YZJ.

Non-STI

Looking beyond STI stocks, ComfortDelGro, UMS, StarHub, iFast Corp and CapitaLand India Trust booked the highest net institutional fund inflow in Q3 2023. Meanwhile, non-STI stocks that booked the highest net institutional fund outflow in Q3 2023 included Clas, Lendlease Reit, Suntec Reit, Sheng Siong Group and Nanofilm Technologies International.

ComfortDelGro saw S$71 million of net institutional fund inflow in Q3 2023, after booking S$44 million of net institutional fund outflow in H1 2023. In mid-August, ComfortDelGro managing director and group CEO Cheng Siak Kian highlighted with H1 2023 and Q2 2023 results that despite headwinds in some parts of the business, the overall performance had recovered. Cheng added that the group had also seen recovery accelerate in Q2 2023, particularly in its core business of public transport, and taxi and private hire.

He noted that that to sustain this momentum, the group is also exploring growth opportunities beyond its existing core business, particularly in the areas of electrification and autonomous vehicles. This was echoed by ComfortDelGro chairman Mark Greaves, who noted as a leader in land transport, the group is committed to new technologies and future engines of growth, while at the same time remaining focused on its existing operations to improve core performance.

In line with the group’s strategic focus, ComfortDelGro introduced a new segmental reporting framework effective H1 2023, with the business segments now public transport; taxi and private hire; other private transport; inspection and testing services; and other segments. ComfortDelGro’s dividend payout ratio policy has also been raised to at least 70 per cent of profit after tax and minority interests (Patmi) from 50 per cent previously, to better reflect actual payouts and provide more certainty to shareholders while still allowing for growth.

UMS saw S$38 million of net institutional fund inflow in Q3 2023, after booking S$3 million of net institutional fund outflow in H1 2023. UMS chairman and CEO Andy Luong noted in mid-August that while the ongoing global slowdown in semiconductor demand put pressure on the group’s top and bottom lines, its overall performance in H1 2023 benefitted from sustained demand in the front-end semiconductor sector and stronger contributions from its aerospace business.

This saw its H1 2023 semiconductor sales ease 8 per cent from H1 2022 to S$138 million, while revenue in aerospace climbed 45 per cent to S$10 million. The former was on the back of semiconductor integrated system sales growing 21 per cent to S$75 million, while component sales fell 28 per cent to S$63 million in H1 2022. Luong said that the group’s key customer expects to outperform its markets this year, and UMS had successfully renewed its integrated system contract until end 2025. Luong added that the group had also secured an in-principle agreement with its new customer for a new renewable three-year contract.

StarHub saw S$16 million of net institutional fund inflow in Q3 2023, after booking S$1 million of net institutional fund outflow in H1 2023. In early August, StarHub reported its H1 2023 attributable net profit increased 26 per cent to S$77 million from H1 2022. StarHub’s largest segment by revenue in H2 2023 was its mobile service, which contributed S$303 million of its total S$1.1 billion revenue. Its mobile service revenue for H1 FY23 was up 13 per cent from H1 FY22, due to higher postpaid and prepaid revenues.

The group also reiterated that it continues to execute on its Dare+ programme, focusing on elevating customer lifetime value through Infinity Play and the convergence of the 3Cs (connectivity, cloud and cybersecurity) for enterprise customers.

StarHub CEO Nikhil Eapen maintains that for consumers, this means an expanded menu of lifestyle, entertainment and connectivity options that they can access anytime, anywhere, on any device, while for enterprises, StarHub plans to be a trusted single platform for their cybersecurity, cloud, infocommunications technology and network connectivity needs.

Inside Insights is a weekly column on The Business Times, read the original version.

Enjoying this read?

- Subscribe now to the weekly SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

—

Originally Posted October 9, 2023 – Banks lead Q3 2023 net institutional inflow

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!