Use the Securities Lending Dashboard to analyze short sale metrics for these and other stocks.

IMPACT OF BANKING CRISIS ON SECURITIES LENDING WIDENS

Even as the U.S. Federal Reserve took extraordinary steps to stem the impact of Silicon Valley Bank’s collapse, including an infusion of roughly $150 billion of liquidity, the ripple of the crisis continues to spread both domestically and abroad.

Regulators and investors alike are particularly focused on First Republic Bank (FRB) of San Francisco and Credit Suisse. With FRB facing liquidity concerns and UBS announcing a takeover of Credit Suisse in the last few days, broader market sentiment remains on a knife’s edge.

CONCERNS NOT LIMITED TO U.S. DOMESTIC BANKS

After a turbulent 2022 and a stock plunge in the week following the collapse of Silicon Valley Bank, UBS announced that it would purchase Credit Suisse in a deal orchestrated by Swiss regulators to sure-up the country’s banking sector.

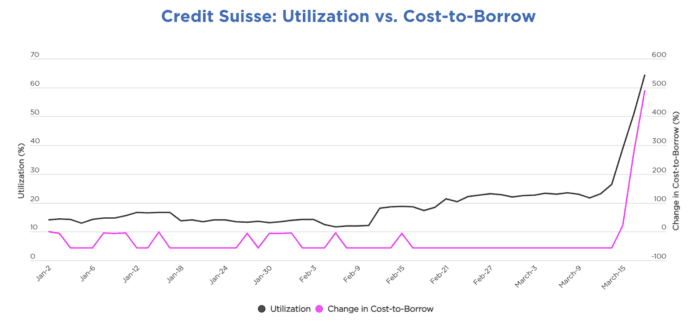

Credit Suisse has seen a strong uptick in loan activity in the last week, a broader indication that the banking crisis’ impact on securities finance would not be limited to U.S.-based institutions. The following chart shows the proportion of available Credit Suisse shares that are out on loan as well as the difference in cost to borrow relative to January 2, 2023, as captured by Orbisa.

During the week of March 13, 2023, utilization jumped from 23% to 65%, with the cost to borrow shares of the bank up 491% compared to the start of the year.

FIRST REPUBLIC STAYS AFLOAT

A consortium of banks combined to throw FRB a $30 billion lifeline amidst extreme volatility in its share price. While the infusion aims to assuage investors’ balance sheet fears, securities lending activity on First Republic shares (ticker: FRC) swelled throughout the week.

We previously highlighted shares of FRC as one of the most impacted regional banks among a Regional Banking ETF. At the time, utilization of shares available to loan had jumped from roughly 1% at the start of 2023 to 17% on March 13. As of close of trading on Friday, March 17, utilization had further ballooned to 42% of available shares. The increased demand for FRC has also continued to drive up the cost to borrow shares, which as of end-of-day March 17 had increased a massive 5,679% relative to the start of 2023.

The chart below plots the utilization rate and relative cost to borrow FRC shares since the beginning of 2023.

At Orbisa, we will continue to monitor how these still-developing events are impacting the securities lending market.

—

SVB Financial (SIVB) And The Impact On Securities Lending Part 3

Disclosure: Orbisa

ORBISA (the “Firm”) is not registered as an investment advisor or otherwise in any capacity with any securities regulatory authority. The information contained, referenced or linked to herein is proprietary and exclusive to the Firm, does not constitute investment or trading advice, is provided for general information and discussion purposes only and may not be copied or redistributed without the Firm’s prior written consent. The Firm assumes no responsibility or liability for the unauthorized use of any information contained, referenced or linked to herein. © 2023 EquiLend Holdings LLC. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Orbisa and is being posted with its permission. The views expressed in this material are solely those of the author and/or Orbisa and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!