Schrödinger’s Cat is a famous thought experiment which demonstrates the concept of superposition, the ability of a quantum system to exist in multiple states simultaneously. To oversimplify the experiment, when the cat is placed in a box with items that may or may not kill it, it is both alive and dead until observed. Much like Schrödinger’s experiment, quantum computers are reliant on superposition, though they are far less interesting to PETA. Quantum bits (qubits) exist in a superposition of 0 and 1 simultaneously, as opposed to a classical bit which can only be 0 or 1. The ability of a qubit to represent multiple states at once may open the door for faster computation as it allows for the evaluation of multiple possibilities concurrently.

A name presently popular amongst short sellers has reminded us of the fabled experiment. Quantum Computing Inc. (NASDAQ: QUBT) is a quantum optics and nanophotonic technology company that provides accessible solutions with real world applications. QUBT’s price and short demand have been strong, and the juxtaposition between upside and downside potential prompts the classic question, is it dead or alive?

QUBT closed above $7.00 per share on Friday March 14th, up 29% from Thursday’s $5.49 close and continued its climb on Monday, gaining another 13%. This surge in share price may be due to investors anticipating positive news from Nvidia’s upcoming Quantum Day conferences. Despite the recent appreciation in share price, the stock is still down nearly 70% from its 52-week high of $27.15. The price decline came after comments on the future of quantum computing from the Nvidia CEO in early January. Quantum Computing Inc. is also facing class action lawsuits filed in Q1 2025 claiming that the firm made misleading statements regarding its business, operations, and prospects.

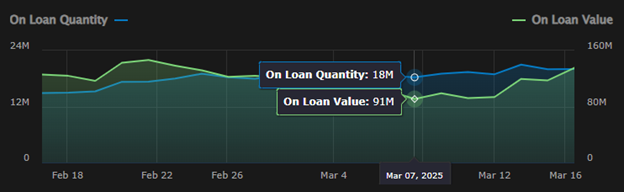

The stock has remained popular amongst short sellers in recent weeks, with Utilization in the 90’s. From March 7th, On-Loan Quantity and On-Loan Value have jumped 22% and 42% respectively. The chart below displays this relation between the quantity and the value of the shares on loan. Due to the higher share price, the added quantity of shares on loan has a greater value, which is why the green line appears to ascend more rapidly.

QUBT On-Loan Quantity vs On-Loan Value February 17th, 2025 – March 17th, 2025

Source: Interactive Brokers Securities Lending Dashboard. Data is provided by Orbisa.

The Securities Lending Dashboard can be used to analyze short sale metrics for QUBT and other stocks. Current IBKR clients can receive a free trial of the dashboard by clicking here.

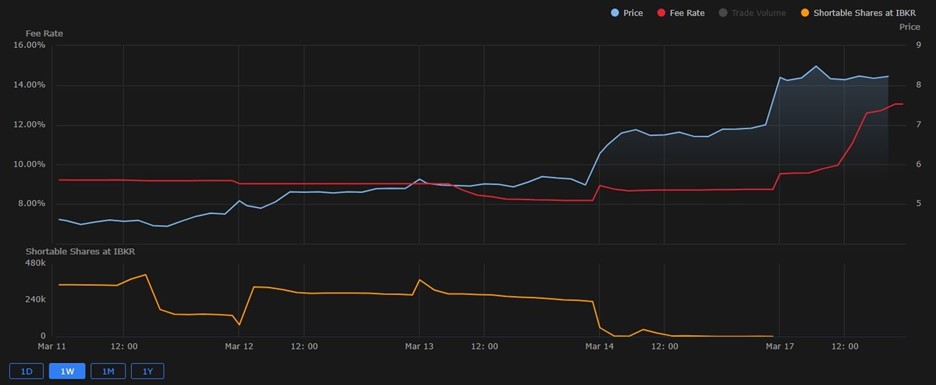

Since Thursday of last week, we’ve seen a falloff in Shortable Shares as the share price soared and the borrow fee rate followed suit. The rate is currently 13.50%. When determining Short Sale Cost, short sellers at Interactive Brokers should also consider the interest they receive on Short Sale Proceeds. Looking at the chart below from Trader Workstation’s Fundamentals Explorer Short Selling tab, we can track historical changes in the price, Fee Rate, and Shortable Shares. The light blue line represents the share price, which has been tailed by the Fee Rate illustrated by the red line. At the bottom of the chart, the orange line displays the Shortable Shares at IBKR, which decreased sharply as the share price spiked on March 14th. We are being shown inventory by two securities lending counterparties, a mutual fund issuer and a small prime broker.

QUBT Short History March 11th, 2025 – March 17th, 2025

Source: Interactive Brokers Trader Workstation – Fundamentals Explorer – Short Selling Tab

While the future of QUBT’s share price is uncertain, the options market’s estimated daily price movement range can be observed using the Rule of 16. For example, the QUBT Mar 21 2025 8 Call shows implied volatility (IV) of 280%. Since IV is an annualized figure, we can determine the implied daily percentage move by dividing IV by the square root of 256 (number of trading days per year). The result of dividing 280% by 16 is 17.50%, which is the daily up or down price movement implied by options market pricing.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Securities Lending Desk, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Securities Lending Desk and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Margin Trading

Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!