Strategies like short selling are one of the unique ways traders can potentially profit off a stock when it goes down. However, many traders believe short selling is just another way of trading options, and commonly confuse it with puts.

In reality, short selling and put options are two completely different trading strategies – both by design and how they’re priced. We’ll break down how they work, highlight their differences, and provide examples for appropriate times to consider using each one.

What is Short Selling?

Short selling is a common strategy for traders who believe a stock will decline in value. Unlike put options, in the case of short selling, you’re still technically trading shares of a stock.

The kicker is that you’re borrowing shares from someone else – usually a brokerage firm. You’re essentially trading a stock you don’t own. Your brokerage firm will lend you shares so you can sell them…but at times, there is a cost to this – and in some rare cases, the cost can be significant.

Stocks with a large supply of available shares have little to no cost to borrow them from your brokerage firm. Stocks with a smaller supply of available shares that are in demand could have a significant cost to borrow them from your brokerage firm.

Here’s one way to think about it – someone lends you 10 ounces of gold to sell. Let’s say the cost of each ounce is $2,000…but since it may be in extremely high demand, they actually charge you an extra $50. Now, you’re able to “short sell” the gold at $2000/oz, but it costs you an extra $50…so you’re theoretically selling it at $1,950. The price of gold would have to drop below $1,950 for you to make a profit if you buy it back.

What are Put Options?

With put options, you’re not buying and selling actual shares of a stock. Instead, you’re trading contracts that give you the right to sell 100 shares of said stock (per contract) if it hits a certain price (strike price) before those contracts expire.

Put options are typically used by traders as a hedging tool for protection against potential downside in the underlying asset’s price. You buy put options when you’re expecting the price of an underlying asset to decline. This allows you to potentially profit off those contracts if the underlying asset falls, prior to those contracts expiring.

A put contract will be more expensive if the underlying stock’s price is closer to – or below – the strike price. A put option typically gets cheaper if its underlying stock moves higher above the contract’s strike price.

Having said that, calculating the cost of put options isn’t that cut and dry, as there’s a number of intricate factors that determine pricing. Some of your biggest drivers include the underlying stock price, volatility in the underlying stock, along with the contract’s strike price expiration date.

I always keep an eye out for potential high-profit put plays for my free Weekly Watchlist. If you’re interested in finding out which stocks I’m following at the start of each trading week, click here to start getting my free Weekly Watchlist.

Short Selling vs Put Options

Now that we’ve respectively defined both trading methods, let’s summarize their similarities and differences.

SIMILARITIES BETWEEN SHORT SELLING AND PUT OPTIONS

Bearish Plays

In both cases, buying put options and short selling a stock allow you to potentially profit from a stock that’s expected to decline in value – ie, when traders have a bearish outlook on the underlying asset.

Risk Management

Put options offer the potential for leveraged returns due to their ability of amplifying profits if the underlying stock price declines significantly. Moreover, buying put options and short selling stocks can be used as an effective risk management tool to offset any downside risk in your portfolio.

Profit Potential

While both trading strategies offer substantially high profit potential, the amount you can theoretically make is limited. Since profits are reliant on the underlying asset going down, a stock can’t drop any lower than $0. Your potential profit range in either trading strategy is largely contingent on two main factors – the collective value of your contracts or shares, and their underlying stock price.

DIFFERENCES BETWEEN SHORT SELLING AND PUT OPTIONS

Ownership

This is a major difference between short selling a stock and buying put options. Shorting a stock involves borrowing and selling actual shares of the underlying asset – which you do not own. Buying put options gives you the right to sell that stock at a predetermined price (strike price).

Obligation

In short selling, you’re obligated to repurchase the asset, since the shares are being loaned. For put options, you have the right – but not the obligation – to sell the underlying asset if it hits or falls below a specific price (strike price) before the contracts expire.

Pricing

Pricing for both trading strategies are determined by completely different factors. Short selling involves borrowing costs, and potential margin requirements, along with the number of available shares, relative to their overall demand. Buying put options require an upfront payment for each contract prior to purchasing.

Risk Exposure

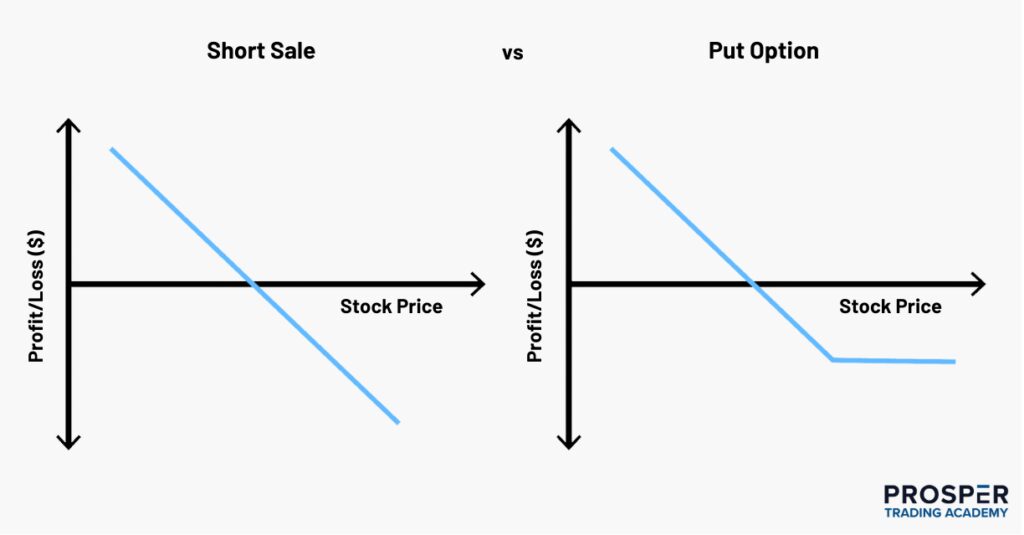

In theory, the maximum loss for short selling is unlimited, since shares of said stock can infinitely rise. As a result, if a stock you’re trying to short winds up skyrocketing, you could wind up owing the lender a much higher sum when it’s time to repay your loan. The losses for buying put options is limited to how much you paid for those contracts – meaning if the underlying asset price keeps going up, their contracts can wind up expiring worthless upon expiration.

Example: Trump Media & Technology Group (DJT)

SHORT SELLING DJT

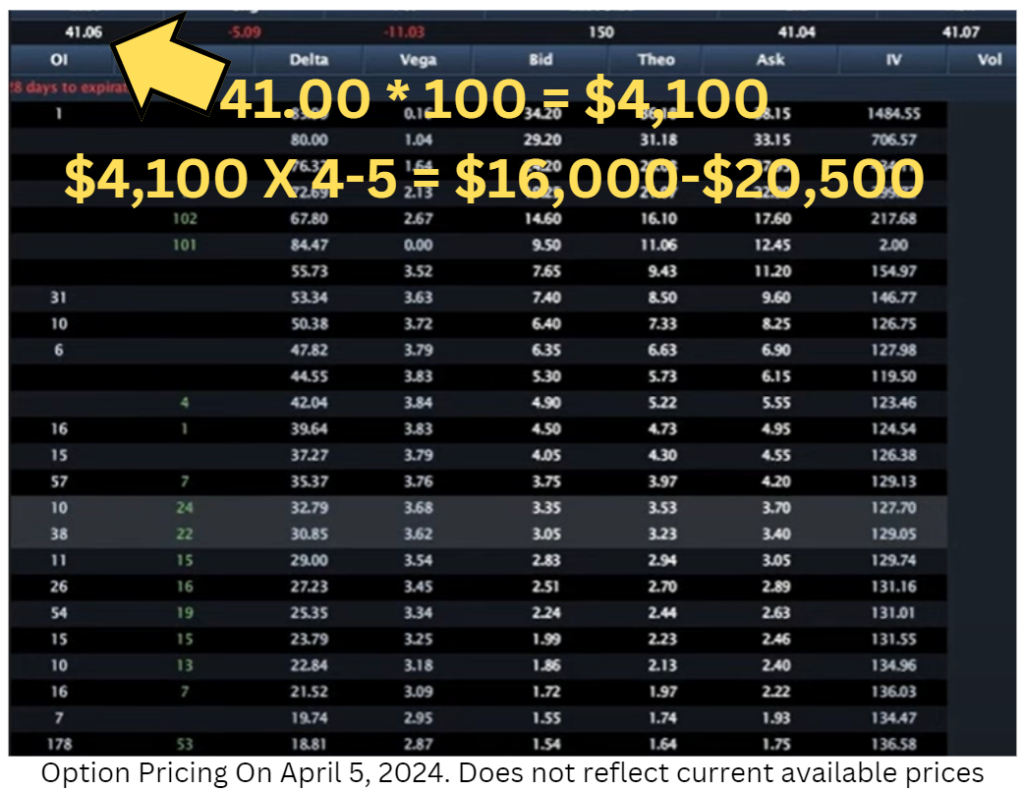

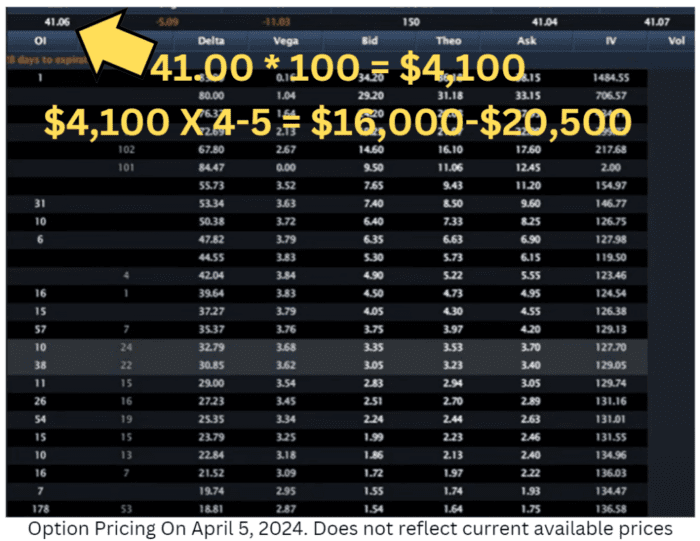

After falling over 60% in recent months, Trump Media & Technology (DJT) is a great example to highlight the practical differences between put options and short selling. On April 5, there were less than 50,000 shares of DJT available to borrow – at a time when they were in very high demand.

The cost to borrow DJT shares skyrocketed 400-500% during its recent decline. If you sold 100 shares when DJT was trading at $41, you’d collect $4,100.

Since you don’t have stock to sell, you’d have a brokerage firm lend you these shares…however, due to their short supply, you would have been charged 4-5X – meaning they’d cost over $20,000 to borrow. In order to even cover the shorting costs, DJT must decline by 1.4% daily…so even if the stock hit $0 – you’d still lose money.

TRADING PUTS IN DJT

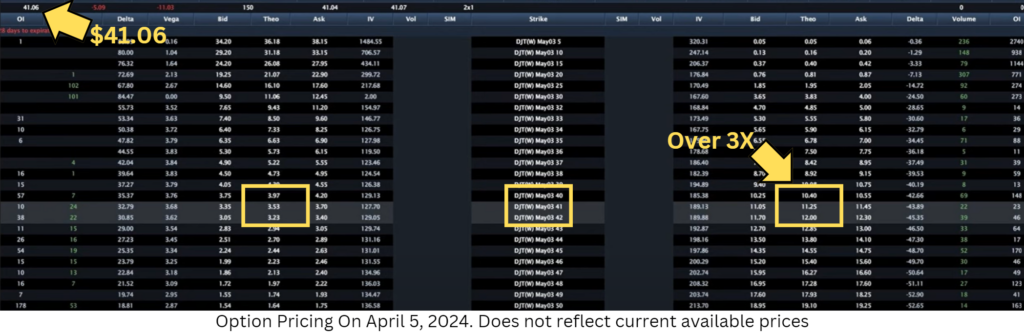

Let’s say you wanted to trade puts in DJT on April 5. Remember – the stock had a bearish outlook, and was already well in decline at this time. We’ll use options contracts with a $41 strike price and 5/3 expiration available on April 5 in this example. Although prices for both calls and puts near the stock price (at-the-money) are usually close in price, this wasn’t the case.

Calls with the aforementioned metrics were trading at $3.50 per contract, whereas puts were going for $11.25 – over 3X the amount of calls. The reason for this is because there were very little (or none whatsoever) stock shares available to borrow. Even if you bought puts at $11 flat, if you went with the $41 strike price in your put options, DJT would need daily declines of 1.4% for you to break even before those contracts expire.

I don’t know if or when trading DJT puts will be on my radar next, but if you want to check out which stocks I’ve got my eye on every week, click here to sign up for my free Weekly Watchlist.

Conclusion

Although they’re often confused, short selling and put options are distinct strategies that allow traders to potentially profit from declining stock prices. Short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose costs are influenced by availability and demand.

On the contrary, put options provide the right – but not the obligation – to sell a stock at a set (strike) price before the contract expires. Furthermore, both trading strategies are influenced by different factors when it comes to pricing, profit potential, and risk exposure.

While both trading strategies can be extremely beneficial when used in the right situations, it’s always important to research any stock you’re following, and take your risk tolerance into consideration.

—

Originally Posted June 5, 2024 – Short Selling vs. Put Options: What’s the Difference? ($DJT Example)

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Prosper Trading Academy

IMPORTANT NOTICE: Trading Stock, Stock Options, Cryptocurrencies, and their derivatives involves a substantial degree of risk and may not be suitable for all investors. Currently, cryptocurrencies are not specifically regulated by any agency of the U.S. government. Past performance is not necessarily indicative of future results. Prosper Trading Academy LLC provides only training and educational information. By visiting the website and accessing our content, you are agreeing to the terms and conditions.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Prosper Trading Academy and is being posted with its permission. The views expressed in this material are solely those of the author and/or Prosper Trading Academy and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

How about a primer on selling put options Vs callbuying

Hello, thank you for reaching out. Please check out this IBKR Campus course:

https://www.interactivebrokers.com/campus/trading-lessons/introduction-to-options-2/

It could be a great resource for you!

I like the explanation

We hope you continue to enjoy Traders’ Insight!